Here are two sets of charts that we feel do a great job of explaining what is happening in the stock markets over the past few weeks. The first is one that we created about a month ago that illustrates the tech bubble on July 10th. The second chart shows three different stock market averages, the Nasdaq 100 (about 60% technology), the S&P 500 (about 40% technology and heavily weighted in just a few companies), and the S&P 500 equal weight index, which gives an equal representation to each of the 500 largest companies in America. These three charts illustrate the tech bubble burst We believe the S&P 500 is a terrible representation of the overall stock market and when it is used in a portfolio as an investment (in a fund), it's actually a high-risk "momentum" investment. Because the Nasdaq 100 is even more heavily concentrated in Big Tech companies than the S&P 500 index, when we look at the two side by side it illustrates the impact the technology sector has on what most people call the stock market (the S&P 500).

People have been overly excited about the impact that publicly available AI will have on the economy and on profit margins. In short, the tech bubble is bursting, but the broad market is much healthier. The business-minded investor has a broader and longer view of the market, and resists the temptation to speculate. When you look at the S&P 500 Equal Weight, which is very closely aligned to the performance of our portfolios so far this year, you see a much different picture. For people in diversified portfolios (not an S&P 500 ETF) who are thoughtfully evaluating profit margins, business models, and dividend payouts, the story has been much more positive (blue line in second chart).

We've been skeptical of the Big Tech explosion for some time, and even made some adjustments in our client portfolios in July to account for the increased risks of the tech bubble. We believe that there will be some upside from here, but we aren't out of the woods yet. The election is coming soon and markets should be quite turbulent until then. In the mean-time, dividend-oriented businesses that fit or investment criteria are generally in a strong position and are continuing to increase dividends despite inflationary pressures and other economic challenges. These should be the strongest companies in a recovery, and have mitigated losses very well in the past weeks. We are excited to continue to collect cash from dividends to be reinvested ate better pricing.

All in all, we aren't particularly concerned for the long-term investor who is in an appropriately managed investment portfolio. It may even prove to be an exciting time with great entry-points for new cash.

A contact directory for our clients.

Matt Hudak, AAMS®, CFP®

We don’t publicly engage in much discourse that touches the political spectrum. We believe the polarization of American society is the greatest geopolitical and economic risk we face today and in order to overcome this risk we need to come together. In turn, we do our best to put our energy into listening to a diverse range of ideas and opinions. Most of our personal ideology is centered around loving people who are different than us and coming together. At times, it can be difficult to publish about important economic topics and concepts without crossing lines into politics and divisive rhetoric. Nevertheless, we will attempt to take a neutral political perspective while addressing the challenges to the strength of our economy.

There are several key concepts we feel should be relatively apolitical and have benefits for both sides of the spectrum. These concepts are primarily monetary & economic—politics-adjacent, but overshadowed by divisive rhetoric and ineffective dialogue. Before we can engage any productive solution, of course, our political leaders must learn to work together. This collaboration seems nearly impossible, but it begins with each of us.

While a lot of the headline economic reports look good, and the 7 companies that represent the “stock market” have shot up (a little sarcasm for you. Microsoft, Apple, Amazon, Meta, and Alphabet represent 31% of the S&P 500, what people mistakenly call the “stock market”). The reality of our economic environment is a little more complicated. We believe that we are currently in a ghost recession. Primarily because savings are low, people are feeling the pressure of higher costs and are thinking about how they use their money carefully. When we see positive data points, there are often divergent stories in the components it represents.

Before we suggest a few helpful ideas, we should identify the drivers behind the challenges facing our economy.

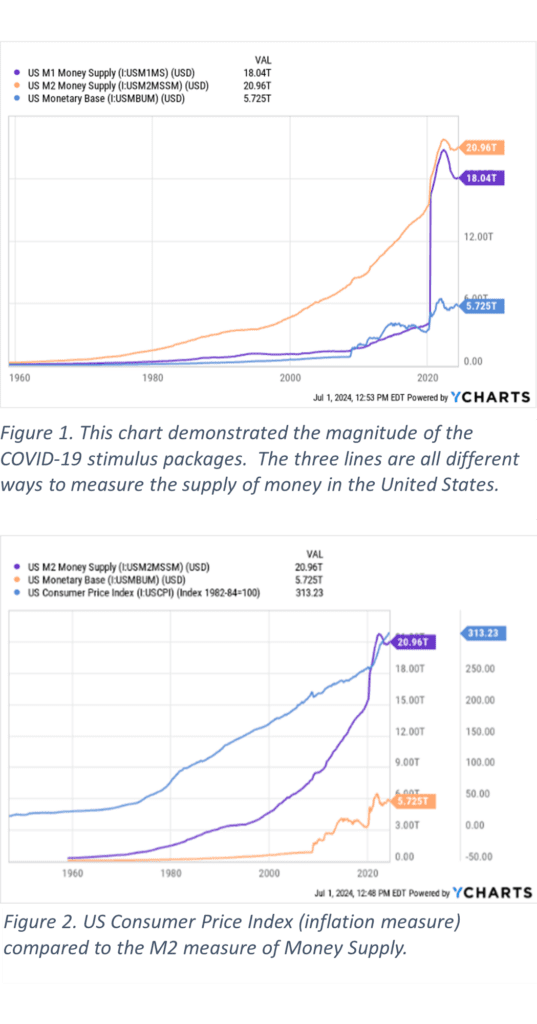

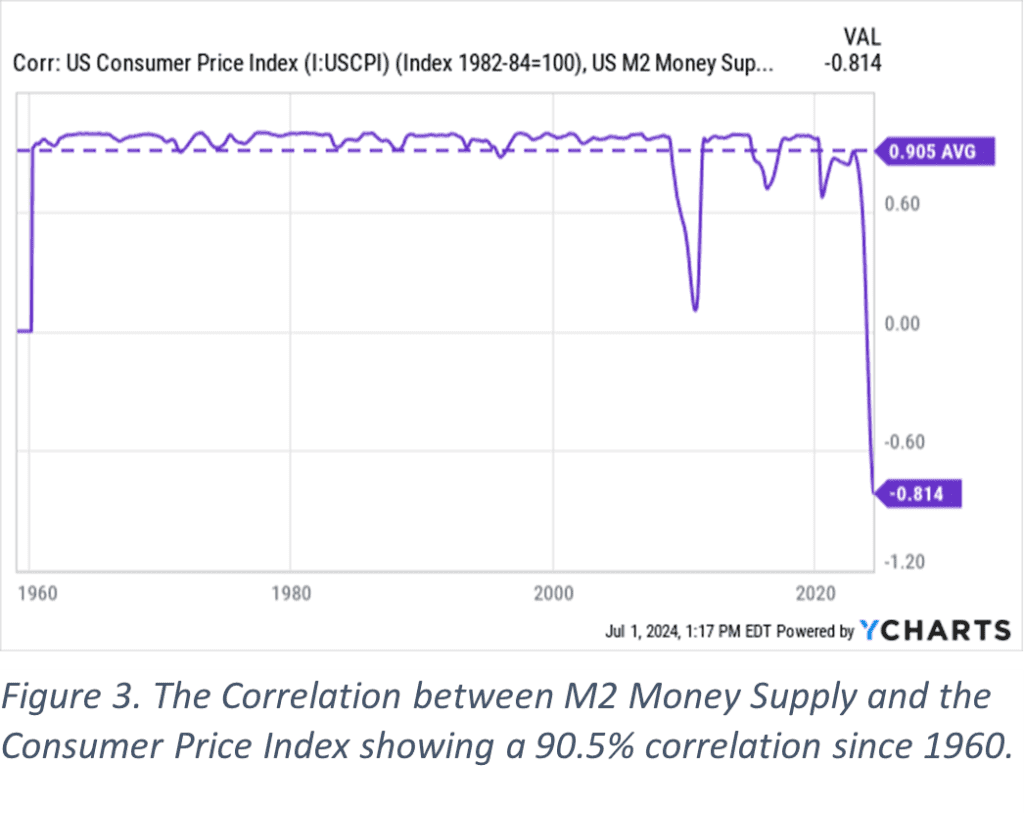

M2. If you’re an economics nerd, that’s all I should need to say. Most economists and officials are too busy trying to figure out how to turn on their flashlight to realize it’s high noon on a sunny day. Contrary to what you may perceive from the world’s obsession with central banks, inflation doesn’t have anything to do with interest rates. Interest rates can affect the speed of inflation, spreading it out over a slightly longer period of time, but no change in interest rate policy by the federal reserve can ultimately change the purchasing power of a dollar. What’s astonishing is that the obvious realities about the monetary system haven’t really been a part of the conversation at the policy level. Perhaps its because both parties are equally responsible for directly causing the current inflationary environment by more than tripling our money supply (M1) in less than 12 months. The M2 measure increased by 40% in the same timeframe (We think M2 will prove to be the predictor of inflation. To wit, prices and incomes will eventually reestablish balance with M2).

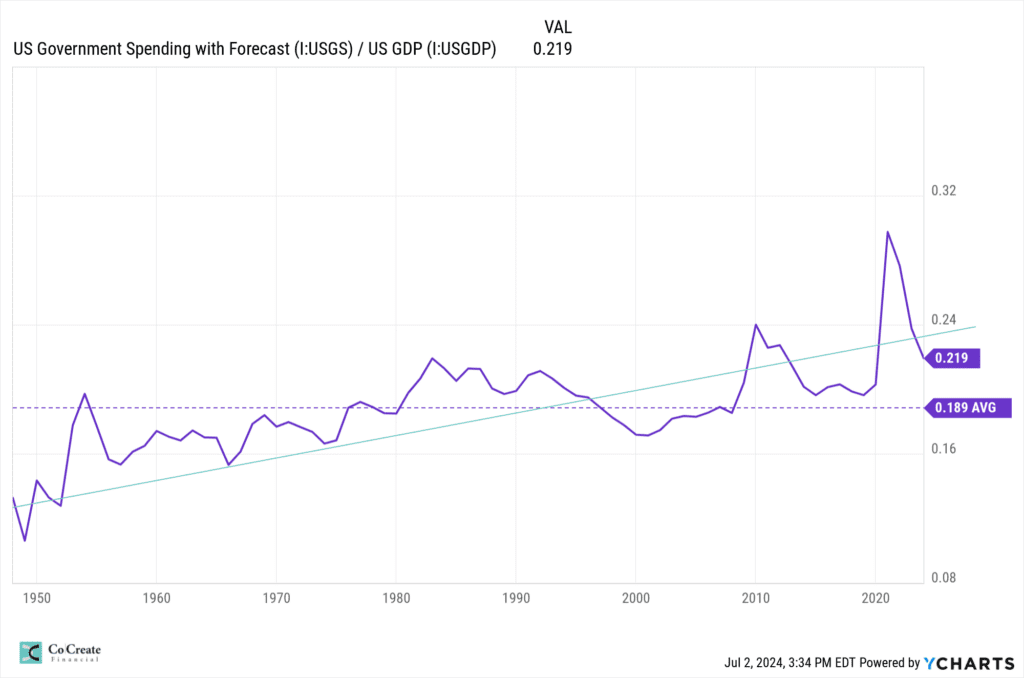

It shouldn’t go unnoticed that the M2 measure of money supply and inflation have a near perfect correlation and as seen in the chart in figure 3, until November of 2023, had never before been inverse. They move together 90.5% of the time. In fact, all of the anomalies shown in the chart are at point of major government intervention in the monetary system, and they are all followed by a rapid reversion to the normal correlation. We believe we will see the same effect in the present.

Simply put, inflation is the effect of supply and demand for the dollar. Just like the price of a carton of eggs or a used car changes depending on whether they are hard to find on a shelf or if the dealer can’t seem to move them off the lot, the dollar has more or less purchasing power if there is an abundant supply or if is scarcer in relation to goods and consumers. Policies that are effective at combating the inflationary riptide of a surging money supply will either claw back such supply, limit its future growth or distribute it among a higher number of productive citizens.

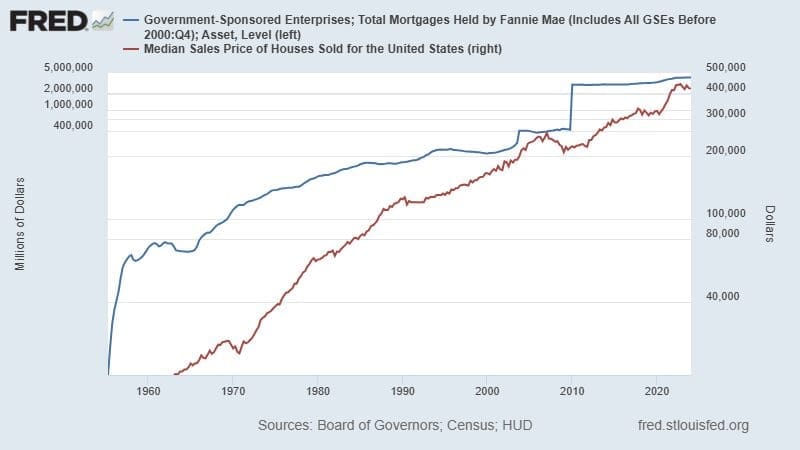

Government spending as a percentage of GDP isn’t as much through the roof as it might seem when we compare it to historical norms, but it's too high for a healthy and growing economy. This is especially true with the current level of debt. Republicans and Democrats alike stand on platforms to expand spending. Regardless of what each of us deems worthy of government funding, those funds need to be in balance with the overall productivity of our country. GDP is the total value of goods and services the US produces (consumer spending, government spending, investment, and net exports). If we imagine a scenario in which Government spending accounted for 100% of GDP, where would they get their revenue? In this hyperbole, there are no businesses or personal revenues to tax (taxable revenues begin with business investment and consumers spending on their product)

The key in a realistic solution is in finding a balance between government spending and non-government productivity. I would suggest that a healthy level of government spending (in the system we have in place today) should not exceed the 18% average (since 1947), but is probably better averaging 14%-15%. If it exceeds that rate, any additional revenue it needs has to come from non-tax policy that stimulates productivity growth in the non-government components of GDP.

This is not a “border wall conversation,” and it is a particularly difficult conversation to have given the contention surrounding the topic of illegal immigration.

The process for allowing a person who lawfully applies to leave their country to enter the United States, is painfully slow—bureaucracy for the bureaucracy’s sake. It would be easy to expedite this process for productive, low-risk people who want to come to the US to work, pay taxes and spend money. The median processing time of an application for an immediate family member of a US citizen is 11.3 months and an application for an alien entrepreneur (I-526) is 53 months. A green card takes 13.6 months. Half these applications take longer and are probably just sitting on a desk.[1]

Immigration is inherently disinflationary. When we discuss inflation in functional terms, it really must be done hand in hand with population growth. Inflation and disinflation are the impact of supply imbalance between the dollars available in the system and the goods & services available. The goods and services are, at least in our present circumstances, relatively static (except, of course, when supply chains are temporarily disrupted). Because those are static, more money means higher prices. They are directly correlated as we discussed above. Adding more people into the equation, however, dilutes the money supply. Ultimately as the end consumer, we choose where we direct the funds we possess. If I don’t have as many dollars, I am more careful about how I spend them. I’m also more inclined to be more productive so that I can earn more.

GDP growth in the US is negatively impacted by a less productive population. This is both due to an aging population (i.e. retiring baby boomers and increasing life expectancy) and an economy that is highly developed. Immigrants have proven to be highly productive and innovative because they are motivated by the opportunities of their new situation. Immigrants also tend to be younger and have larger families than those born in the US. By expediting the application process for entry into the United States, we can effectively boost GDP Growth while curbing inflation.

Imagine you’re selling your home and you have two buyers. Both of the buyers can afford to pay $7,000 toward their monthly mortgage payment and have saved $40,000 for a down payment. The first buyer has a bank that will lend 80% of the purchase price. That means they can afford to make an offer for up to $200,000 ($40k/[100%-80%]). The second buyer is working with a bank that has an investor who can take a higher level of risk and so they are willing to finance up to 95% of the purchase price. This second buyer can afford to make an offer for up to $800,000 ($40k/[100%-5%]). Sellers naturally sell to the highest bidder. Assuming there is enough demand, the maximum price is limited to the amount of capital available to the consumer. If you’re considering your options, and everyone is buyer 1, then your sale price can only be $200,000. If your market has buyer number 2, you’ll naturally try to sell to them for $800,000… just because you can.

This is exactly the scenario that led to the 2008 housing crisis. Before the Government Sponsored Enterprises (Fannie Mae, Freddie Mac, et al) began packaging loans and reselling them (CMOs) in the early 90s, the banks lent money from their own portfolios. This meant that they had to be more careful because they were responsible for the loan until it was completely paid off. Banks typically required 20% down because it meant that their borrower had demonstrated capacity to make payments and manage their funds for an extended period of time. Now, this may seem exclusionary to many, but changing this percentage doesn’t change how much a person can/needs to put down.

When CMOs came along, the banks no longer needed to lend from their own portfolios but could be paid to originate the loan and sell it to a third-party investor through the Government (not technically, but the GSEs are essentially the government). There was so much demand from the GSEs to buy the loan that banks could hardly justify making loans the old way, and so the GSEs gained control over the markets. To increase homeownership levels, they began lowering down payment requirements all the way down to 3% and a borrower could use up to 45% of their income to purchase. Now, if you’re the lender, and you don’t offer the 3% down option when all the other banks do, you simply lose the revenue from making the loan. Banks, who had figured out how to structure loans that were safe for both lender and consumer, could no longer compete if they didn’t conform to the GSE’s structures. This created buyer number two (along with all the other ethical problems of consumer fraud and predatory lending). Remember, you’ll sell for the highest price just because you can. Buyer number 2 had 4 times as much capital, so the home price quadruples to match the money supply.

There have been several points in history when the Government has infused a substantial amount of capital into the housing and education markets. The effect has been dramatically increased costs.

Sallie Mae is the GSE for student loans. The same principle applies to student loans as housing. If students have limited funds for their education, the universities will work within those constraints and charge less. When student loans are nearly unlimited universities would be stupid not to maximize their income. In fact, they are forced to increase student costs in order to stay competitive. If a bank were to lend to students from their own portfolio, they would want to make sure the student can pay the loan in the future. The bank would consider the cost of the education program, the income potential for the student upon graduation, and the students commitment to graduating with a degree. All three are major problems that have presented in the current crisis.

These are the fundamental economic roots of the housing affordability crisis and the student loan crisis. We could make significant headway in both areas and dramatically reduce inflation more broadly if we placed significant limits upon the GSEs or dissolved them entirely. Additionally, Student loan forgiveness would be much more palatable if there were a long-term solution to the problem. Sallie Mae could be dismantled and unwound in conjunction with some sort of student loan forgiveness program or benefit for those who have been victims of this Government Sponsored Entity.

Recently the Tax Foundation published a lengthy research report (available here) discussing reform of the non-profit sector, noting that the net income from business-like sources would raise nearly $40 billion in tax revenues. I’ve been very involved in charitable work and was quite perturbed at the idea until giving it full consideration.

Most of the not-for-profit sector are made up of organizations like credit unions, insurance companies, athletic associations (i.e. NCAA), consulting firms, insurance companies, and golf clubs. Most businesses can adopt the form of a non-profit organization, it just means identifying how it serves the public/its members and it can’t pay its profits to owners (it can, however just convert the dividend to “reasonable salary”). What if we narrowed the definition of what a charity is, and the non-profit businesses could pay tax on their net profits just like any other corporation would (excluding income from charitable donations). This would level the playing field for competition and broaden the tax base by approximately 10% of GDP. IF the non-profit business uses its revenues to cover its expenses, those would not be taxed just like businesses deduct their expenses. The Government could use the $40 Billion of excess revenue to help resolve its budget deficit and pay down the insane amount of debt it has amassed in recent years.

People have been discussing the future solvency of the Social Security programs for a long time now. We have our thoughts and positions (essentially that no politician wants to alienate their voter base over an issue that won’t be critical until they have retired themselves), but have a couple of obvious observations. When Social Security was created, the average lifespan of someone taking benefits was around 3 years. It's much longer now, and we need people to retire later. Congress is obviously divided on this issue and whether we should or how we go about forcing it. At the same time, there are policies in place that disincentivize people who want to continue working. Instead of forcing a new retirement age, Congress could begin by simply removing the disincentives for staying employed and push some of their costs back into the private sector (which would in turn create more taxable profits).

The first change to address would be the social security benefit itself. Your Social Security based on your benefit at your FRA (full retirement age). For most people going forward, that is 67. If you take it early, you receive reduced benefits. If you wait to take it until age 70, you receive an 8% annual increase to your benefit over those three years. After you're age 70, there is no reason by which you could justify waiting longer. Why couldn’t we create some mechanism by which someone could continue to benefit from deferring past age 70?

Amplifying the effect, if you continue to work after you start drawing Social Security, after certain thresholds, your benefits are both partially taxable and are reduced relative to your earnings. If your goal is to continue to work into your 70’s or 80’s (more common than you would expect), then your decision causes you to lose much of your social security benefit while still paying into the system for others. The system causes a meaningful imbalance for those that could be reducing the burden on the system. We should simplify the system by increasing the ability to defer indefinitely with some incentive, and remove the benefit penalties for earned income.

The second issue to resolve is to establish a system for individuals to continue without Medicare beyond age 65. If you don’t file form Medicare at 65, you incur substantial penalties when you do file. There are exceptions to this if you properly apply, but these should be the rule of thumb. If you have adequate health coverage by another means, the Medicare program should be glad not to have to pay for your health coverage. With the broad scope of the Medicare program, this shouldn’t impact their ability to underwrite their costs. There is even a possibility it could cause a net reduction in the cost of healthcare across the board. Medicare also has significant premium penalties for those who pass certain income thresholds. If the end goal is to have more employed people contributing, this penalty needs to exclude earned income.

The current tax code allows for a property owner to sell their property in a like kind exchange. For many, they have been able to save for retirement by owning rental properties. While there is a lot of power in the ability to use debt to finance a rental or two, the structure is often less ideal when transitioning into retirement. Income is not truly passive, it isn’t from diversified sources and liquidity is a major obstacle if there aren’t significant savings in other categories. Many who have built their nest egg on a few rental properties feel trapped because of the massive tax burden they can become subject to in a sale (up to 100% of the price could be taxable). The IRS should allow, at least for a time, owners of these properties to defer taxes by depositing the proceeds into an IRA or 401(k). This allowance would allow owners flexibility to position themselves most efficiently, increase the housing supply for entry-level buyers, and would cause a net increase in tax revenue for the IRS over the long term (ordinary income vs capital gains / inherited IRA rules vs step up in basis).

If you don’t have a retirement plan from your employer, it is much harder to save in tax deferred accounts. Your annual contributions to your IRA and Roth are limited to $7,000. IF you have a plan through your workplace, you can defer much more (23000 in a 401(k)). There are other options between and some that allow for even more. It would make sense to increase the limits of each plan to the 401(k) limits creating a fair structure for individuals and small businesses. If many people increase their contributions accordingly, it would slow the pace of inflation by removing those dollars from circulation until the account holder begins their retirement. Coming full circle, the amount of money available directly correlates to the price of goods and services. Creative solutions that remove this capital from the playing field, even temporarily, are more effective than parlor tricks with interest rates.

[1] Historic Processing Times (uscis.gov)

We're really excited to announce our cocreate financial client portal and app. In the first few days of July, each of our clients will receive a link and instructions to set up a new portal account. We've been working very hard to include a lot of useful features and have complete control over how your reports appear. You'll be able to schedule appointments and engage with us right through the app.

We're confident this is a HUGE upgrade and will help us serve you more effectively!

You can download the new app on your app store by searching for CoCreateFinance or clicking here

Our Developers have created an instruction manual for us to provide to you. download it here.

We get a lot of questions about how to teach kids about money, and for good reason! Every parent wants their kids to develop the skills to be successful and live a meaningful and impactful life and we all know that money management plays an important role. When considering engaging your children (or any young person in your life) about money, here are some principles to remember:

Tell us what you have done with your kids to teach them about money! Please take a moment to write us a note (some of our best ideas come from our clients). We would love to share your great ideas with other parents in the CoCreate Community.

Welcome to CoCreate Financial! Embrace the excitement as we unveil our brand new client portal feed. This test blog post aims to enhance your experience and keep you informed about the latest developments. At CoCreate Financial, we believe in fostering a co-creative mindset, where our team collaborates with you to achieve your financial goals. With our personalized approach and expert insights, we offer a wide range of products and services designed to empower your financial journey. Schedule an appointment online or give us a call at (406) 206-7571 to embark on this transformative experience. Visit our office at 1805 W Dickerson St, Building 2, Suite 3, Bozeman, MT 59715, and for any correspondence, kindly mail to PO Box 4785, Bozeman, MT 59772. We prioritize transparency and are registered as an Investment Adviser in the state of Montana. While we provide factual and up-to-date information, please consult with a professional adviser before making any investment decisions. We strive to empower you with the necessary knowledge, and for your convenience, we provide hyperlinks on our website. However, we do not endorse any third-party websites. Our services are specifically tailored for U.S. residents. Remember, past performance may not predict future results, and all investments carry risks. Rest assured, our dedicated team is committed to working with you in creating a profitable and secure investment portfolio. Thank you for choosing CoCreate Financial!

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]Thinking about the future of your business? At CoCreate Financial, we work with business owners at all stages so that your business gives you the most opportunities to live the life you want. Whether you're just starting your business, making plans for strategic growth, or preparing for your next adventure, CoCreate Financial Advisors integrate business planning and advanced exit planning services with comprehensive financial planning and wealth management.

Where are you in your journey?

[et_pb_section fb_built="1" theme_builder_area="post_content" _builder_version="4.18.0" _module_preset="default"][et_pb_row _builder_version="4.18.0" _module_preset="default" theme_builder_area="post_content"][et_pb_column _builder_version="4.18.0" _module_preset="default" type="4_4" theme_builder_area="post_content"][et_pb_text _builder_version="4.18.0" _module_preset="default" theme_builder_area="post_content" hover_enabled="0" sticky_enabled="0"]News about Silicon Valley Bank’s failure has been somewhat of a nerve racking moment for those who remember the Lehman Brothers collapse before the crash in 2008. It’s an especially unnerving moment considering the economic challenges involved in unwinding the covid stimulus passed out over the past several years. We’ll continue to see turbulence for some time from these events in the coming months, but we’ve been well prepared for economic growth to slow under the pressures of inflation since 2020 and for a period rapidly rising interest rates long before that. So when we look at a bank failure in the context of our economy, and more specifically considering the specific businesses our clients own in their portfolios, we need to do so carefully and methodically. While there are a few similarities between the SBV and the Lehman Brothers collapses, the differences are far more striking and SVB’s failure will not do substantive damage to the economy and financial markets on its own.

Bank failures are actually quite common. According to the FDIC, there have been 73 failures in the past 10 years. These can happen for a variety of reasons, but the overwhelming majority are isolated problems that are the result of the failed bank’s business practices. Silicon Valley Bank’s failure is a perfect example of such and isolated, run-of-the-mill failure. Failures from systemic problems, like the Lehman Brothers collapse, are quite rare.

Most people struggle to understand the “bad loans” that caused the 2008 crisis. When congress established Fannie Mae and Freddie Mac to buy packaged loans from banks, they altered the mortgage industry forever. Instead of Banks making loans from their own capital, they had an instant investor—the Government. To stay competitive, banks had to adjust their business models so that they could originate loans and sell them according to Fannie or Freddie’s standards. These standards dramatically lowered standard requirements for a borrower. No longer on the hook for the a long-term, banks began to make loans and move on. This legislative action affected all banks, so it was systemic rather than isolated.

Fannie and Freddie package these loans together to be sold to private investors in investment vehicles called CMOs. Lehman Brothers was heavily invested in these complex investments. The problem was, congress had established a rule that forced the CMOs to be valued in a way that did not reflect the quality of the mortgages in each CMO. Because of these “mark-to-market” accounting requirements, investors had to way to understand the real value (or lack thereof) of what they owned. As a wave of foreclosures began, banks that were significantly tied to these CMOs struggled greatly. Lehman Brothers and others collapsed as a result.

Silicone Valley Bank is a different case. Sure, it’s a larger bank than most that fail and rapidly rising interest rates have affected it to a degree, but real reason for its failure has to do with its own business practices. Most banks diversify their products, loans, investments, and customers across a wide range of businesses and individuals. They also tend to be relatively conservative with their capital investments. SVB focused much of its business on venture capital and small publicly traded companies. These are both very high risk categories that have faced significant struggles post-covid, and SVB did not appropriately staff its risk management department, operating for nearly 8 months without a Chief Risk Officer. These are problems few banks face, and when they are well managed and diversified they will not have problems.

Rising interest rates have affected the banking industry, but we believe that most of the financial sector is quite healthy looking out a year or two. Think of how much more profit a bank can make on an 8% interest loan vs a 3% interest loan. The challenge, in the short term, is that depositors are expecting more interest when the bank’s loan portfolio is still producing at lower rates. For a simplified example, the bank made a loan to a customer last year at 7% at that time, they were paying interest on to customers CDs at 2%. That CD gave them the capital to make the loan, and the bank profited 5%. Now, the bank needs to pay 5% on their CDs to customers, but the loan was locked in at 7%, so the bank’s profit margin is only 2%. Soon, they will make a new loan at 10%, and be able to achieve their previous level of profit, or their variable rate loans will adjust and mitigate some of the impact of rising rates. Banks also have many other ways to generate income. Rising rates have been inevitable for some time now, and we’ve had confidence in banks with diverse revenue sources, substantial variable rate loans, and a strong deposit base.

All that to say, the banking system is in-tact. At the same time, its an important reminder to make sure if you have substantial assets at a particular bank, that you are fully covered by FDIC insurance. They will cover up to $250,000 per account category at each institution. Your accounts we manage at TD Ameritrade or Schwab have spread the cash balance among multiple banks so that you have sufficient coverage for cash. If you’re unsure about your situation, feel free to reach out to us at any time and we can help you evaluate your FDIC Insurance coverage.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]Matt and Rebeka were both discharged from the hospital yesterday afternoon and are recovering well. Matt will have his follow up visit on Wednesday, March 8th and we will be flying home on March 9th!

Matt is recovering well and has mostly been sleeping so far. If you want to send Matt a card you can go to ecards.upmc.com and they will print your card and bring it to him. Here is the information you will need:

Hospital: UPMC Montefiore

Room Number: N1175

Hospital Service/Unit: 11 North

Both Rebeka and Matt are doing great! Rebeka was finally out of surgery at 9:40pm. The new liver started working right away and she is already looking healthier. Thank you everyone for all your prayers and going on this journey with us!

Matt is out of surgery and everything went as planned. He is in recovery now an will be transferred to his room soon. Rebeka's surgery is also progressing as planned and will take about another 5 hours. Thank you everyone for all your prayers and support!

Both Matt and Rebeka's surgeries are progressing as planned, though they started later than we expected. Matt's surgery started around 10:00 and at 1:00 they were about to remove the portion of the liver. At the same time they were about ready to remove Rebeka's liver. All is going well.

[et_pb_section fb_built="1" _builder_version="4.16" global_colors_info="{}"][et_pb_row _builder_version="4.16" background_size="initial" background_position="top_left" background_repeat="repeat" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.16" custom_padding="|||" global_colors_info="{}" custom_padding__hover="|||"][et_pb_text _builder_version="4.18.0" background_size="initial" background_position="top_left" background_repeat="repeat" hover_enabled="0" global_colors_info="{}" sticky_enabled="0"]Both Matt and Rebeka have started their surgeries, and everything is looking good.

Once they are in recovery, you can send an e-card to Matt or Rebeka that will be printed out and brought to them. To send a card, go to ecards.upmc.com and the Hospital we are at is UPMC Montefiore.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built="1" theme_builder_area="post_content" _builder_version="4.18.0" _module_preset="default"][et_pb_row _builder_version="4.18.0" _module_preset="default" theme_builder_area="post_content"][et_pb_column _builder_version="4.18.0" _module_preset="default" type="4_4" theme_builder_area="post_content"][et_pb_image src="https://www.cocreatefinancial.com/wp-content/uploads/2023/02/PreSurgery-Matt-and-Rebeka-scaled.jpg" _builder_version="4.18.0" _module_preset="default" theme_builder_area="post_content" title_text="PreSurgery Matt and Rebeka" hover_enabled="0" sticky_enabled="0"][/et_pb_image][et_pb_image src="https://www.cocreatefinancial.com/wp-content/uploads/2023/02/PreSurgery-Matt-and-Christa-scaled.jpg" _builder_version="4.18.0" _module_preset="default" theme_builder_area="post_content" title_text="PreSurgery Matt and Christa" hover_enabled="0" sticky_enabled="0"][/et_pb_image][/et_pb_column][/et_pb_row][/et_pb_section] [et_pb_section fb_built="1" theme_builder_area="post_content" _builder_version="4.18.0" _module_preset="default"][et_pb_row _builder_version="4.18.0" _module_preset="default" theme_builder_area="post_content"][et_pb_column _builder_version="4.18.0" _module_preset="default" type="4_4" theme_builder_area="post_content"][et_pb_text _builder_version="4.18.0" _module_preset="default" theme_builder_area="post_content" hover_enabled="0" sticky_enabled="0"]Hi Friends!

First of all, thank you for all the encouragement, support and prayers! Tomorrow is surgery day. We will all be heading to the hospital at 5:00am (Eastern time) and surgeries will start around 7:10am. Rebeka will start first with an internal check to make sure everything is looking good for her to receive the liver before they start Matt’s surgery. Matt’s surgery should take about 5 hours and Rebeka’s will take 12 hours. I will try to post some updates throughout the day. Thank you so much for all your love, support and most of all your prayers!

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]