Hi everyone! This is my first time sending out an annual market review, and I am excited to share it with you all. As we leave 2025 and enter 2026, we all at CoCreate are feeling energized and hopeful for what’s to come.

Financial markets do not move in straight lines, and 2025 was no exception. While the year had its ups and downs, it also offered valuable lessons about patience and long-term thinking. In this review, we will take a closer look at the key events and major themes of the year, and what we believe matters most moving forward.

As we move into 2026, our focus remains on being thoughtful stewards of your investments. In a year shaped by uncertainty and change, we believe careful decision-making matters more than quick reactions. Markets will always react to headlines, but long-term success comes from staying grounded, patient, and intentional.

Rather than chasing trends, we emphasize diversifying your investments among businesses that are well run, have highly profitable goods and services that people want, and that pay you cash in return for your investment. This approach helps protect portfolios during periods of fluctuation while positioning them to grow over time.

At the end of the day, markets will continue to evolve, headlines will come and go, and uncertainty will always be part of investing. Our role is to help you stay grounded through it all by making thoughtful decisions, staying flexible when needed, and keeping your long-term goals in the center stage. By focusing on what we can control and being wary of what we cannot, we can look forward to the next year with clarity and confidence.

I have gone into more detail below and would be happy to answer any questions you may have.

I hope you have all had a wonderful close to your 2025, and I’m looking forward to meeting with you and having a great 2026 together.

- Emma Shaw

Macroeconomic Conditions

Inflation Trends: Uneven Change

Inflation stayed in the spotlight throughout 2025 as investors and policymakers tried to figure out if rising prices were truly beginning to come under control. The most common way to track how quickly prices are increasing is by looking at the Consumer Price Index (CPI), which measures the cost of everyday items like food, gas, housing, and medical care. When CPI goes up, it means things are getting more expensive, and when CPI goes down, it means price increases are starting to slow.

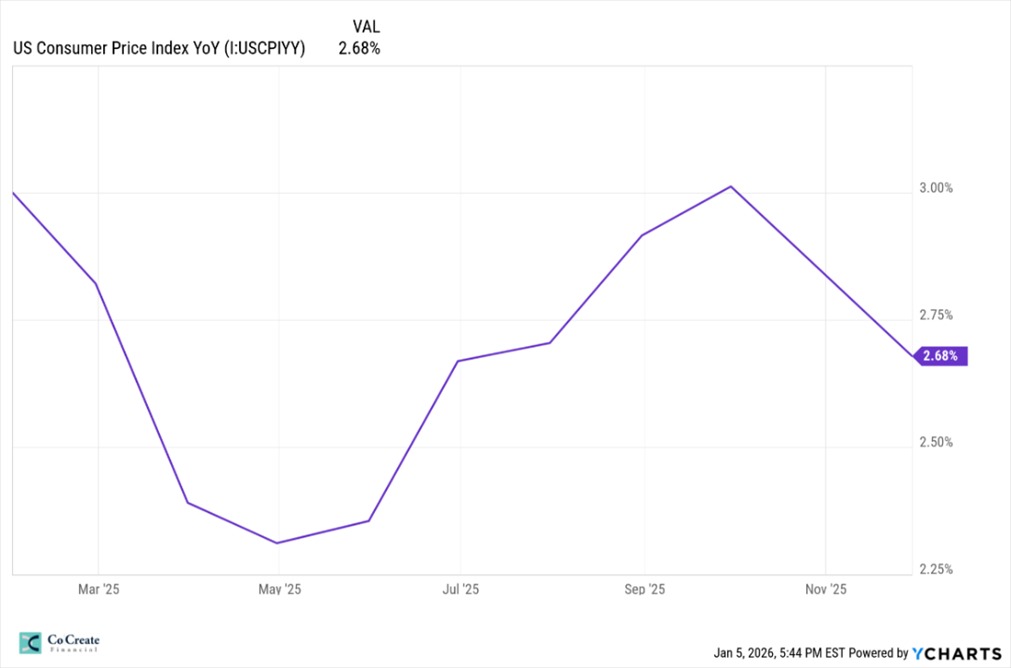

At the start of 2025, CPI inflation was around 3%, which is higher than the Federal Reserve’s long-term goal of 2%. By the end of the first quarter, inflation cooled to around 2.4%, which was a positive sign that pricing pressures were starting to let up. However, progress was not linear, and CPI moved back up to roughly 2.7% by mid-year and hovered close to 3% again by early fall before going back down below 2.7%.

The graph above tracks CPI inflation over the course of the year. The line moving down means inflation is slowing, while the line moving up means inflation is picking back up. This back-and-forth pattern we can see explains why inflation continued to feel frustratingly “sticky,” even when some areas of the economy improved.

But the uneven path of inflation in 2025 is not a complete surprise, inflation rarely dissipates quickly, and expecting a smooth decline is not totally realistic. It’s normal for progress to stall or even reverse temporarily, especially when wages and housing costs remain elevated.

For investors, this backs up the importance of remaining patient and not overreacting to shorter-term data. The stabilization process is complex, made up of many various interlocking elements that move at different paces.

This graph depicts the U.S. inflation rate over the past three years. The broader trend still points towards gradual improvement, and we can navigate the uncertainty by remaining diversified, focusing on fundamentals, and avoiding emotional decisions based on fleeting headlines.

Central Bank Policy: A Cautious and Data-Driven Approach

Throughout 2025, central banks, led by the Federal Reserve, took a cautious approach to interest rate decisions. After raising interest rates aggressively in prior years to fight inflation, policymakers shifted towards a slower, more thoughtful strategy.

Interest rates deal with the cost of borrowing money. When rates go up, loans become more expensive and spending tends to slow. When rates go down, loans become cheaper and spending increases. One of the Federal Reserve’s duties is to adjust rates to help keep inflation under control while also supporting economic growth.

Since inflation moved up and down during the year, expectations surrounding possible rate cuts were inconsistent. At times, investors expected rates to fall sooner, but when inflation readings came in higher, the Fed signaled it was willing to wait to make a move until they had a more complete picture.

Federal Reserve Chair Jerome Powell repeatedly emphasized that decisions would depend on clear progress in the data, not on what markets hoped would happen. The Fed needed tangible proof that inflation was improving.

On December 10, the Fed lowered interest rates by 25 basis points, which equals 0.25%. This was the third rate cut of the year. These small cuts suggest growing confidence that inflation is moving in the right direction, but again, these things take time and rate cuts do not bring change overnight.

Impact on Borrowing Costs and Mortgage Rates

Even as inflation started to cool, borrowing money remained expensive throughout much of 2025. Mortgage rates remained high, adding to the slower activity in the housing market and affecting affordability for buyers and refinancers. Higher monthly payments made homes less affordable, and fewer people chose to refinance their existing mortgages. This kept many buyers on the sidelines and reduced overall housing demand.

The chart above tracks the 30-year fixed mortgage rate, which is the most common home loan in the U.S. The line shows how mortgage rates moved throughout the year. When the line goes down, borrowing becomes slightly cheaper. When it stays high, monthly payments remain a challenge for buyers.

Although mortgage rates declined some towards the end of the year, they remained well above the low levels we’ve seen in other years, finishing around 6.15%. While this drop offered some relief, rates were still high enough to limit affordability for many households.

Higher interest rates also affected businesses. Companies faced higher financing costs, which made them more cautious about expanding, hiring, and investing in new projects. For consumers, borrowing became more expensive across credit cards, auto loans, and personal loans, making everyday purchases harder to finance and encouraging households to be more selective with spending.

Mortgage rates will take longer to come down, even if the Federal Reserve continues to cut interest rates. While rate cuts help lower short-term borrowing costs, mortgage rates are influenced by more than just Fed policy. Meaningful relief for homebuyers will require steady improvement in inflation and economic stability over time.

Effects on Investment Returns

Interest rate movements had a broad impact on markets in 2025. Bond prices moved as rate expectations shifted. When interest rates stay high, existing bonds lose value, but new bonds offer higher yields, meaning better income potential going forward.

Stocks also experienced periods of volatility throughout the year. Higher interest rates make borrowing more expensive for companies and reduce the value of their future earnings, which can put pressure on stock prices. As investors adjusted to these conditions, markets reacted more sharply to economic data and rate expectations.

Despite short term swings, the higher-rate environment reinforced the importance of diversification. Balanced portfolios tended to perform more steadily, as income-generating assets played a larger role and helped offset equity volatility.

Economic Growth and the Labor Market

Gross Domestic Product (GDP) Growth: Slower, But More Resilient Than Expected

Economic growth in 2025 was more resilient than many early forecasts suggested. While higher interest rates were expected to significantly slow down activity, overall GDP growth remained positive, though more moderate than in prior years. GDP is a simple way to measure the health of the economy. It represents the total value of all goods and services produced in a country over a certain period. On the one hand, the U.S. economy continued to expand at a steady pace rather than experiencing any sharp contractions, showing its ability to adapt to tighter financial conditions. On the other hand, AI investment was responsible for approximately 92% of GDP growth in 2025 and tariffs appear to be costing about 1% of GDP.

As we can see in the graph above, which measures U.S. GDP throughout 2025, the slower pace of growth suggests the economy is settling into a healthier balance. Instead of growing too fast or slowing down too much, businesses and consumers adjusted their spending and investment decisions at a more sustainable pace.

Employment

The job market remained relatively stable throughout the year, though hiring slowed compared to the rapid pace seen in recent years. According to the Bureau of Labor Statistics (BLS), total employment continued to grow, particularly in areas like health care and service-related jobs. The unemployment rate, which measures the number of people actively looking for work but unable to find it, edged slightly higher but remained near normal historical levels. This leads to a cooling job market rather than a major slowdown. As I’ve mentioned before, employers just became more selective with hiring as interest rates stayed high and economic growth softened. One notable change was a 9.2% decline in federal government employment, as hiring slowed and some government roles were reduced. This contributed to the overall deceleration of job growth.

Consumer Spending

Consumer spending in 2025 remained stronger than expected, despite the higher interest rates and prices that continued to impact people’s budgets. Solid employment and steady wage growth allowed many households to keep spending, especially on everyday needs, which helped support overall economic growth. However, when it came to discretionary purchases, consumers were much more cautious.

This U.S. Retail Gas Price graph highlights a positive for consumers, and a possible factor as to why people were able to keep spending. Gas prices fluctuated during the year but declined towards the end of 2025, finishing just under $3 per gallon. These lower gas prices could have helped free up budgets and allow for more spending elsewhere.

However, this long-term chart tracking egg prices tells a different story. While prices naturally rise over time due to inflation, the sharp increases in recent years stand out compared to historical trends. Eggs are a basic household staple, so rising prices here highlight how higher everyday costs have become more noticeable for consumers (if you’re spending $311 on eggs, you must be buying the Costco-size package).

Consumer spending in 2025 was less about excess and more about adaptation, which we’ve seen is a common theme in the overall market. Instead of cutting spending dramatically and abruptly, people adjusted how and where they spent their money. Lower fuel prices helped offset higher costs elsewhere but persistent increases in everyday items, like groceries, kept consumers cautious. From the start of the year, people felt a lot of hesitation as the economy sent mixed signals and pulled sentiment in different directions. Despite the concerns, the economy proved to be more resilient than many initially had expected.

Major Market Events and Themes

2025 was a year of adjustment and adaptation. Market reactions were shaped by big policy shifts, political headlines, and changing expectations surrounding inflation and interest rates. While there were times of volatility, investors spent much of the year dealing with uncertainty and navigating the complex economic environment. Several key events and themes stood out and played a vital role in shaping market behavior.

“Liberation Day” and Broad Tariff Implementation

In early April, on a day coined “Liberation Day”, the President announced broad tariffs on imported goods. The announcement triggered sharp and immediate market reactions, stocks fell quickly as investors tried to assess the potential impacts on inflation, global trade, and corporate profits.

As the year progressed, markets stabilized as people received more clarity about how the tariffs would be implemented and which industries would be most affected. While uncertainty remained during periods of negotiation, the initial shock faded as expectations adjusted.

Ongoing global trade tensions and the influx of new tariff policies added another layer of unpredictability. Rising trade barriers and high-profile negotiations influenced expectations for economic growth and international investment.

At times, discussions about scaling back harsher policies helped restore market sentiment, but renewed tensions would harm confidence once again. The shifting dynamics made long-term planning more difficult for businesses and investors.

Inflation Slows but Prices Still High

Inflation continued to cool compared to prior years, but pricing pressures remained a central concern for investors, policymakers, and the everyday American. Even as progress was made, inflation did not drop quickly or smoothly.

Market reactions were often influenced more by headlines and policy signals than by long-term fundamentals, however this is not surprising nor rare. Short-term swings are natural, but the constant changes in policies emphasized the influence of these swings.

Market Reaction to AI Industry Dynamics

The rapid rise of artificial intelligence became a defining theme of 2025. Companies connected to AI saw massive increases in valuation as investors rushed to gain exposure to next “best” thing. Much of the AI investment came from the AI industry itself. We’ve discussed AI in previous articles and will be continuing to unpack the risks and opportunities.

But concerns about an “AI bubble” emerged, as people began to grow wary of the super high stock prices that did not seem to be in line with AI companies’ financial situation, leading to even more volatility within the industry. Moreover, there is an abundance of evidence that those implementing AI are NOT yet seeing a return on their investment.[1] We have been careful to limit our exposure to the risks of the AI industry throughout the year.

“The One Big, Beautiful Bill,” Fiscal Policy, and Government Shutdown Concerns

Fiscal policy remained a key theme in 2025, including changes to tax policy and ongoing debates over government spending.

New legislation extended and modified tax provisions for businesses and individuals, but the effects of “The One, Big, Beautiful Bill” were uneven across industries, with some sectors benefiting more than others.

The 43-day government shutdown that began in October 2025 and finally ended mid-November added to the ambiguity. While the shutdown was resolved, it brought even more short-term volatility and disrupted government services and personnel.

[1] https://mlq.ai/media/quarterly_decks/v0.1_State_of_AI_in_Business_2025_Report.pdf;

CFO Outlook for 2026: Tariffs, Hiring, Prices, and AI Impact | Richmond Fed