In light of recent tariff and Geopolitical events, We’ve decided to begin publishing a short piece every Monday to discuss what we think we will be doing to navigate the recent crash and eventual recovery. We have a history of being both supportive and critical of any politician or perspective, so the commentary below not intended to be a comprehensive statement or endorsement any politician, candidate or platform. Please be aware that we will need to avoid publishing certain details for compliance purposes, but are happy to discuss any of the comments with you in the specific context of your account.

We manage the account on your behalf. That means that we are making adjustments, increasing/decreasing cash & cash investments, making portfolio decisions and carrying the stress of market turmoil on your behalf. We love to hear from you about your needs (and feedback), but please don’t feel the burden of managing your portfolio. Obviously, this note is for client’s of CoCreate, if you’re not a client of our firm consider reaching out to see if we can help you enhance the way your accounts are performing in this environment.

Also, publishing about the week ahead is a difficult task and some or all of the things we say may change or play out completely differently than we expect. Regardless of short-term market fluctuations, we will remain disciplined and committed to following our time-tested approach.

Yes and No. on April 8, the President paused the “reciprocal” tariffs. These “reciprocal” tariffs weren’t related to tariffs imposed upon the US, but were based on the difference between imports and exports with each country.

The 10% broad-based tariff is in place. This is effectively a back-door sales tax on US consumers (about $1300/year for every household according to the Tax Foundation). I’ve heard a number of news broadcasters express wrong information about whether or not the tariffs are in place. This is part of the Trump negotiating strategy, to create enough chaos and confusion that it is difficult for those he is negotiating with to fully understand what is happening. In is role as President, this has an affect upon the public’s understanding as well.

First Trust Economics: No America Didn't Stop Making Things

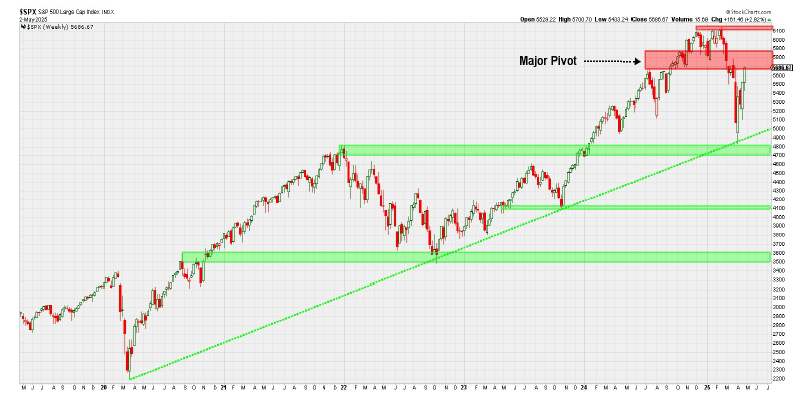

For anyone casually watching the stock market, the past two weeks have actually looked relatively good. The last 8 days showed positive returns for the S&P 500 and if there weren’t significant outstanding issues, it would look like the markets might rebound. We’ve been watching the $5800 price point on the S&P 500 as a potential turning point. All the charts and graph wizardry that investors are known for has no reason to work but sometimes it does. Right now, we’re sitting at a place where the market could go either direction. Andrew Adams from Saut Strategy put it this way:

Yet at the same time, the stock market has so far done everything that it's been asked to do since marking its lows in early April. Several resistance levels have been overcome, breadth has recovered to neutral from its washed-out lows, and the S&P 500 has now traded well into that 5500-5800 region that always felt like a logical target zone. Buying has indeed been strong. I wrote last Wednesday that breadth had been good but not as outstanding as it appeared, yet Friday's session was almost a 90% upside day and helped to improve those total breadth readings. The move off the low is certainly very reminiscent of others we've witnessed over the past few years that began larger rallies. It wouldn't exactly be shocking to see the market shake off the recent weakness, especially if all these trade deals they are supposedly working on start to get announced soon to keep waving a carrot in front of buyers.

However, it can also be argued that the real test for the stock market is only now beginning. The S&P just entered on Friday what has been a major "pivot" point over the past 10 or so months. As the chart below shows, this region has been the site of both support and resistance in that time and is a primary reason why I've used ~5800 as a key area to watch. It's also why I've said that if stocks are going to roll back over, it is likely to happen around or below this zone where heavier resistance is found. Clearing that region will be a big win for the bull case and increase the odds further that a major bottom has been made.

Right now, we’re sitting at a point where the market could go either direction… except that there are significant topics that still need to play out and the positive growth ignored what should have been headwinds. First, many corporations announced their first quarter results. Some of them adjusted their forward looking projections to account for the potential impact of tariffs, some chose more of a wait-and-see approach remaining optimistic. It was interesting to watch, and while I’ve not measured any data to confirm this, it certainly felt like those companies who chose to be realistic about the threat had share-price declines and those who did not had price increases. If that’s the case, it should bode well for us this month to rebalance our holdings because that is the opposite of what I would want to see.

Of course, the first quarter’s results don’t include the tariffs, and included quite a bit of noise from the business trying to buy ahead of the tariffs. This boosted earnings significantly. The Second Quarter results, will begin to show the damage. For companies who are riding high on Q1 optimism, Q2 will be a big adjustment.

While the future of tariffs is still very much unknown, we’ve been working hard to prepare portfolios in as many ways as possible. We are looking at the probability & potential return versus risk of loss and we’ve even implemented Artificial Intelligence tools to mine for information that could specifically impact each investment’s sensitivity to tariffs (this would include company filings and exposure to various countries). This is our first foray into using AI for anything more serious than the photo for the weekly playbook series.

Q1 Real GDP came in at -0.3% (annualized), with business and consumer spending heavily enough (presumably to purchase ahead of tariffs) to increase Core Real GDP at 3%, which is the same as Q1 last year. Real GDP is regular GDP adjusted for inflation, Core Real GDP is consumer spending, business fixed investment, and home building, and excludes the most volatile categories like government purchases, inventories, and international trade. While it is difficult to estimate accurately, tariff frontrunning may have boosted Q1 GDP by as much as 2%. This won’t be part of Q2 GDP. The technical definition of a recession is complex, but most people use two consecutive quarters of contracting GDP as shorthand. I believe we have actually been in a recession since mid-2024 when people were out of covid money and began to really feel the impact of inflation. This means that we’re now seeing that reflected in GDP (among all the other things).

It’s important to remember that looking back on Q1 or the past week is just that, looking back. In some ways it is helpful to understand the investment and business landscape, but the role of an investor is to look forward with optimism for the long-term future.

While we look forward to the long-term future, I’ll once again quote Andrew Adams:

As impressive as the rally has been, it is also still within the limits of historical bear market rallies. This inconvenient truth is why simply assuming it's straight up from here remains a risky proposition. In 2000-2003, for example, the S&P 500 lost 50% overall but there were six separate rallies of 10% or more during that time, including three of more than 20%. In 2007-2009, the S&P fell 57% but there were four rallies of 10% or more, including two greater than 20% (this is yet another reason why I think it's silly to use 20% moves to mark bull and bear markets, but I digress). So even though this rally from the lows has been strong, it wouldn't be historically atypical for it to still roll back over.

While I genuinely hope the market losses and volatility have turned around, there isn’t quite enough evidence for me to fully commit to the paradigm at this point. We will still need to focus on collecting rising dividends from strong companies who are as insulated as possible from trade risks and balance the risks with appropriate levels of cash.

This week we will continue to watch for trade negotiations. I have yet to hear any actionable news other than that of a rare earth minerals deal with Ukraine. Canada’s new prime minister will meet with Trump on Tuesday, but as expressed a willingness to be both demanding and patient.

The Federal Reserve will meet this week. We are not expecting a reduction in interest rates, and I believe this is good. On the one hand, a rate cut would stimulate capital investment a little and soften the blow of tariff price increases, It would simultaneously have the opposite affect because increased money in the system increases inflation. Managing the stock market is not part of the Fed’s duties, so they should opt to protect the purchasing power of the dollar. Powell’s position also puts pressure on the Administration to bring its tariff negotiations to a head quickly so that it is far in the past when we get to the mid-term elections.

On the policy front, we are continuing to watch for a tax bill and additional deregulation. Musk reported that DOGE eliminated at least 160 Billion in spending, and though he is stepping down, the administration will continue to hold this as a priority. Aside from the spending itself, excessive and nonsense regulation has been the biggest headwind to economic growth for quite some time. The combination of the reversal of the Chevron Doctrine last year (The Chevron Doctrine established that Federal agencies could essentially replace congress in rule-making) and efforts to reduce burdensome regulations is the only thing that has the potential to offset tariff risks.

Republicans are still working out what may or may not be in a tax bill, and there are quite a few different opinions. Here are a few key topics in debate:

The issues in discussion will demand compromise because there are not enough productivity-boosting components of the bill to allow republicans to use the budget reconciliation process and include all their tax cuts. Essentially, they won’t be able to offset the proposed tax cuts with enough future revenue to pass a bill that includes all of it with just a simple majority in the Senate. Tariffs won’t make up this lost revenue either, which was undoubtedly one of the initial hopes of the Administration. We’ll be watching to see what happens here, as the house has set a goal of getting this through by Memorial Day weekend.

Any good news, or even just clarity on any of these fronts should be a positive for financial markets and for our client accounts. Expect markets to continue to fluctuate in the mean time with a reasonable likelihood of declining more before this is finished. When it is all said and done, American businesses will continue to have competitive advantages and will prosper. We’ll continue to own what we believe are the best of them.

I hope you have found this insightful. We will continue to publish the Weekly Playbook as long as it makes sense to do it. In order to keep from spamming you, we may not always send it by email, but will certainly post it on our website at https://cocreatefinancial.com/ and in your client portal’s newsfeed. We double down on commitment to stewarding your investments and financial plans with diligence and integrity when the economy and markets are turbulent. Thank you to all of you who have trusted us to do so on your behalf.

In light of recent tariff and Geopolitical events, We’ve decided to begin publishing a short piece every Monday to discuss what we think we will be doing to navigate the recent crash and eventual recovery. We have a history of being both supportive and critical of any politician or perspective, so the commentary below not intended to be a comprehensive statement or endorsement any politician, candidate or platform. Please be aware that we will need to avoid publishing certain details for compliance purposes, but are happy to discuss any of the comments with you in the specific context of your account.

We manage the account on your behalf. That means that we are making adjustments, increasing/decreasing cash & cash investments, making portfolio decisions and carrying the stress of market turmoil on your behalf. We love to hear from you about your needs (and feedback), but please don’t feel the burden of managing your portfolio. Obviously, this note is for client’s of CoCreate, if you’re not a client of our firm consider reaching out to see if we can help you enhance the way your accounts are performing in this environment.

Also, publishing about the week ahead is a difficult task and some or all of the things we say may change or play out completely differently than we expect. Regardless of short-term market fluctuations, we will remain disciplined and committed to following our time-tested approach.

This depends on your particular situation and a variety of factors:

What’s going on presently is, unfortunately, real. Often, our response to various events and headlines is that they are just “noise.” The issue with tariffs is that they will actually affect business profits, consumer purchasing power, and supply chains once they are implemented. These aren’t transitory phenomena. They will effect portfolio values negatively and then growth will resume. The question on both sides is: how much? The markets may have already accounted for the potential issues or they may have additional declines in the process.

Our long-term forward projections are called Capital Market Assumptions. These “CMAs” are how we estimate long-term returns. When Covid hit, we expected to see slower growth for a number of years to come because the stimulus packages were inflationary and (as stimulus always does) borrowed from future growth to enhance the present situation. The Covid economic recovery is actually still playing out and is likely still in its adolescent stages. The trade-shifts and tariffs will be another adaptation to these Capital Market Assumptions.

We have begun updating our client’s financial plans and hope to connect in detail with everyone this year for a more comprehensive update than usual. With the updated information, we’ll be able to apply changes to our long-term projections and get a good idea of how they will affect each of our clients. The good news is that unless we’ve already been telling you your withdrawals may not be sustainable, we’ve designed your plan-portfolio pairing to accommodate for situations like these. Also, by being on the front-end of the situation, small adjustments to a financial plan can lead to significant improvement over time. IF one of your goals does appear to be at risk, it can likely be addressed with a small, manageable adjustment if we don’t wait until it becomes a crisis.

Last week was relatively un-eventful compared to the previous weeks, giving us the breathing room to do much of our normal investment management work. Last weeks economic/political events included the beginnings of “productive” (“?”) trade negotiations with a number of other countries and escalation of problems with China. China’s actions included ban on a number of US imports (including the return of Boeing 737 deliveries), as well as a ban on the export of rare-earth minerals to all other countries. “rare earth minerals include everything from magnets to lithium for batteries to Uranium. China produces 60% of the world’s supply of these minerals so the ban will have a meaningful impact on global supply chains. Much of the process of bringing industry back to the US, or establishing it in a different location will take many years. Much of China’s Xi Jinping’s top priority will likely be preserving the dominance of the current political regime in China despite the intense recession they have been experiencing. Xi Jinping’s visits around Southeast Asia didn’t appear to be as fruitful as he would have hoped, hence the complete ban on rare-earth minerals (an attempt to block reallocation of supply among different trading partners such as Vietnam). We can assume that this response is positive for US negotiations as we remain the preferred destination for exports.

The other noteworthy event was Federal Reserve chair Jerome Powell made a statement that declared there would be significant “uncertainty” from the tariff policies and lack of clarity in the rollout. His statement announced that they would not be lowering interest rates until there was more certainty about what these would look like going forward. President Trump, who is not a fan of his appointee, Powell, took issue with the statement. The Economists we follow are mixed in their sentiment about this move, and several say that Powell’s Fed will have no option but to lower rates in June based on their dual mandate to manage stable currency value and low/reasonable unemployment. We haven’t been crazy about Powell around our office, particularly because the Fed didn’t really even try to mitigate the Covid-stimulus-caused inflation until it was far too late. Mostly it was because they either didn’t understand that inflation is excessive money-supply (both Democrat and Republican caused), or because they were simply dishonest with themselves and the public about their own power to manipulate the economy. That being said, I believe this was the right move for Powell. He is being cautious and cognizant of the inflationary effect of tariffs. It also applies pressure on the Administration and we are firm believers in checks and balances within government are a good thing.

Our week consisted of our monthly deep dive into the investments we own in client accounts. We can’t get too specific in a newsletter for legal/compliance reasons that would limit our ability to be flexible and adaptable in client accounts, but overall, we are quite happy with the mix of investments. We look at and discuss a number of factors in this process including price action, financials (earnings, profit, assets, etc.), changes in management and product demand, and review what a variety of research analyst are saying. We also rotate through various processes on a quarterly basis. This month we pulled a report card to measure our diversification using the “correlation coefficient” of each investment. The correlation coefficient is essentially how frequently one investment moves in the same direction as another. Our conversations also focused on potential outcomes from tariff policies. Because we engage with these investments regularly and look for weaknesses or risks, the investments in our clients accounts have been very healthy going into this season and their financials and dividends remain strong. If any of you would actually like to speak in detail about this process and your portfolio, we’re more than happy to talk through it.

I’m really grateful for the feedback from all of you who are reading this. I had been considering how long to continue a weekly market update, but since a number of you are finding this helpful, we’ll continue to do it for longer. The caveat, I would ask each of you reading this to be careful not to follow the markets too closely. It’s potentially a very dangerous activity for those of us who are long-term investors because we generally will want to move one way or the other when what we need to do is simply stand our ground. I would much rather have you ignore these emails than take that risk, so please know yourself and send these straight to your trash bin if they make you more nervous or tempt you to be overly tuned in. You pay us to carry the day-to-day burden of managing your investments for you and we’re completely ok if you want to tune-out until things turn around. (if you’re a client, please don’t unsubscribe because you’ll miss important logistical emails if you do. Just reply to this email and I’ll take you off this particular list)

This week, we’ll be continuing to watch for policy developments and to watch corporate earnings announcements. On the policy front, I expect that it will remain nearly impossible to determine what will happen next until whatever it is takes its final form. If you read Trump’s book The Art of Negotiation, his first step is to create an extreme demand, the second is to create confusion by establishing many different and complex negotiating points while rapidly shifting from one to the next. It seems that we are in this stage with international trade policy. We will continue to watch this develop and respond in real time while exercising appropriate levels of patience and diligence.

We expect Corporate earnings to be a misdirect. The first Quarter earnings won’t account for much of the trade issues we are experiencing because they were announced on April 2. We believe that markets will take some comfort in reasonably strong earnings results. We also expect significant adjustments to forward expectations as companies announce their assessment of the economic situation. Most companies have prepared at least rudimentary plans to adapt and will probably announce much more detail on their earnings calls. We expect markets to overreact to these announcements, possibly in both directions depending on whether the announcement is better or worse than consensus expectations. When this happens, the right thing will be to wait to react until the dust settles.

I hope you have found this insightful. We will continue to publish the Weekly Playbook as long as it makes sense to do it. In order to keep from spamming you, we may not always send it by email, but will certainly post it on our website at https://cocreatefinancial.com/ and in your client portal’s newsfeed. We double down on commitment to stewarding your investments and financial plans with diligence and integrity when the economy and markets are turbulent. Thank you to all of you who have trusted us to do so on your behalf.

Also, this may be the last time I try to begin writing at 4:00AM on Monday. As the news settles and there aren’t major changes happening throughout the weekend and in the first hours of the day, There may be some more room to get it out on a more reasonable schedule.

In light of recent tariff and Geopolitical events, We’ve decided to begin publishing a short piece every Monday to discuss what we think we will be doing to navigate the recent crash and eventual recovery. We have a history of being both supportive and critical of any politician or perspective, so the commentary below not intended to be a comprehensive statement or endorsement any politician, candidate or platform. Please be aware that we will need to avoid publishing certain details for compliance purposes, but are happy to discuss any of the comments with you in the specific context of your account.

We manage the account on your behalf. That means that we are making adjustments, increasing/decreasing cash & cash investments, making portfolio decisions and carrying the stress of market turmoil on your behalf. We love to hear from you about your needs (and feedback), but please don’t feel the burden of managing your portfolio. Obviously, this note is for client’s of CoCreate, if you’re not a client of our firm consider reaching out to see if we can help you enhance the way your accounts are performing in this environment.

Also, publishing about the week ahead is a difficult task and some or all of the things we say may change or play out completely differently than we expect. Regardless of short-term market fluctuations, we will remain disciplined and committed to following our time-tested approach.

Setting aside the individual circumstances you might have (we can discuss these personally), you should keep your cash reserves as cash reserves, continue your contributions unless you would like to change for non-market reasons, and deposit extra cash balances that are for long-term investment into your investment accounts sooner rather than later.

When you deposit funds into your investment accounts, we don’t necessarily invest it in stocks/bonds/funds (etc.) immediately (certain business models used by other advisors might require this). When you deposit funds in a situation like the present, we will most likely invest your excess cash in money-markets, CDs, Treasury’s, or other high-interest cash equivalents. We have the ability to wait for the markets to settle until the time appears right to invest. This often happens quickly, and when funds aren’t ready, we often miss the prime opportunities waiting for cash transfers to process or checks to come in the mail. You don’t need to feel the burden of timing the market, we’ll help you get invested at the most appropriate times.

Last week was fascinating for markets. In short, it was down, up, down, up, down, up and finished up some. The fluctuations were mostly driven by headlines and were so quick that there weren’t many opportunities to evaluate/make any adjustments whatsoever. In looking through the investments we hold for each of our clients, we felt very good about our positioning. It is often a good exercise to look through the list of companies trying to justify moving on from each one and finding that you actually want the investments you own going forward. There will still be more adjustments, but only time and better information will reveal what those might be.

This week has begun on a positive note. Remember, when I discuss the markets and performance, I’m generally talking about the S&P 500 in this format, your accounts with us are not the same thing and are designed much more strategically.

IF you’d like more details: Last week’s markets set a couple of records in the total daily volume of trade (number of transactions) and saw two of the largest turn arounds in history on the same days. Monday (4/7) was looking like it would be a continuation of the previous week’s selling, but then in a half-hour (9:45-10:17) the S&P changed course and shot up around 8.4%, and then had dropped 5.1% 25 minutes later. Wednesday began the morning up 3.4% overnight, but steadily declined 4.8% throughout the day. Wednesday from 1:18-1:27 the S&P jumped up 5.9% (+9.5% for the day). Thursday, at one point had given up much of Wednesday’s gains with a drop of 6.7%, but finished the week up about 5.7%.

Yes, all of this was ridiculous. All of it was relatively meaningless. None of it was normal market behavior. Most of it was driven by speculation about whatever comment came from Washington most recently. The best news of the week was a 90 day pause on the “reciprocal” tariffs (which are not reciprocal at all). The 10% baseline tariffs will remain in place. The house and senate also passed a temporary budget for the federal government and have begun to discuss upcoming tax policy. Regarding congressional activity, I do believe having a congress that is able to perform the most basic functions is good for market stability. Any of us can find a host of issues with any budget ever passed by congress, but having a House and Senate that are willing to any part of their job is good. Most of the market swings were in response to the President or his staff and it will be helpful to have all three branches begin to participate.

Regarding the tariffs, the 90-day pause is just a pause. Hopefully, there can be productive progress during that time. Other countries are willing to take the lead on imposing “retaliatory” tariffs if they are not satisfied with the progress. Markets have not priced in the 10% baseline tariff and have definitely not accommodated for a trade war if one should happen. I do expect that markets will return somewhat to a growth mode as the pause progresses, especially given the industry and company specific exemptions which have also temporarily been applied.

At the same time, expect for us to prepare for the tariffs to resume in 90 days, at which point we should have a better idea as to how those will specifically affect each of your investments. On the one hand, Republican lawmakers are growing increasingly concerned about the political ramifications of the tariffs, which are a tax hike on the consumer. If the Republican party wants to avoid major headwinds in the mid-term elections, it will need to deliver in a big way before February of next year. My assumption is that the 90-day pause will be a significant deadline at which point many republicans who have not yet been critical of the administration’s trade policies will begin to express more dissent if there has not been substantial progress in a positive direction. One of the truths we hold to be timeless at CoCreate is that politicians will always serve their next election.

Also, someone spread a rumor that Peter Navarro was going to be fired from his position in President Trump’s administration. Navarro is a strong proponent of the tariffs. Markets jumped on this news, but we have yet to find out what is really happening there.

At the end of the week, we are still waiting to see what Washington DC will implement and how each company might be specifically affected.

This week we will be watching for policy developments, though I believe it will be a little less noisy than last week with the 90-day tariff pause and other topics the news will want to cover (tax proposals, et al). We will also be reflecting on comments made during the earnings calls which will begin next week. Expect that first quarter earnings reports will show moderate or strong numbers but the forward-looking estimates will show severe declines as companies attempt to project the impact of unknown future tariffs on their profits. Their comments will be particularly important. These earnings calls may spark more broad-based selling. We intend to be careful, patient, and meticulously strategic in how we invest and will be looking to adjust our portfolios if any of the dividends appear to be at risk.

We will also look for opportunities to harvest tax losses to offset future or current gains in our client accounts. Our hope was to find more of these opportunities last week, but the wild swings in both directions would have made taking much of any action irresponsible.

Where possible, we will also be looking for opportunities to increase the cash balance in client account to achieve a target between 20-30 percent (each person is a little different what they need/should target).

We’re honored to serve you through this turbulence. We’re watching carefully and are here for you whenever you need. The best path forward is to stay the course and continue to own well-managed, profitable businesses that pay you as an owner with rising dividends. I hope you have found this insightful. We will continue to publish the Weekly Playbook as long as it makes sense to do it. In order to keep from spamming you, we may not always send it by email, but will certainly post it on our website at https://cocreatefinancial.com/ and in your client portal’s newsfeed. We double down on commitment to stewarding your investments and financial plans with diligence and integrity when the economy and markets are turbulent. Thank you to all of you who have trusted us to do so o

In light of recent tariff and geopolitical events, we’ve decided to begin publishing a short piece every Monday to discuss what we think we will be doing to navigate the recent crash and eventual recovery. In this series, we'll briefly cover key developments and how we plan to be responsive in our client's portfolios in the week ahead. We have a history of being both supportive and critical of any politician or perspective, so the commentary below not intended to be a comprehensive statement or endorsement any politician, candidate or platform. Please be aware that we will need to avoid publishing certain details for compliance purposes, but are happy to discuss any of the comments with you in the specific context of your account.

We manage the account on your behalf. That means that we are making adjustments, increasing/decreasing cash & cash investments, making portfolio decisions and carrying the stress of market turmoil on your behalf. We love to hear from you about your needs (and feedback), but please don’t feel the burden of managing your portfolio. Obviously, this note is for client’s of CoCreate, if you’re not a client of our firm consider reaching out to see if we can help you enhance the way your accounts are performing in this environment.

Also, publishing about the week ahead is a difficult task and some or all of the things we say may change or play out completely differently than we expect.

Nowhere is a president granted the authority to set arbitrary tariffs or to create sweeping tariff policy in absence of Congress. Moreover, a president must demonstrate that their actions have some form of intelligible principal when asserting the authority delegated by congress. While specific tariffs do fall within President Trump’s purview, the 10% minimum tariff for all countries certainly does not appear to meet the criteria set forth in the Act(s). The broad implementation and method of determining reciprocity make plain the President’s intent was to implement actions that belonged to Congress. Lawsuits have already been filed even by conservative groups.

Most weeks will have a shorter preamble… I hope!

With the intense amount of selling last week across all sectors, there is a growing likelihood we will see some sort of a bounce in market prices this week. Expect us to be watching for this as an opportunity to further mitigate risk exposure in each client portfolio.

I hope you have found this insightful. Many of these missives will be much shorter in the future, as we’ll have less to catch up on. We double down on commitment to stewarding your investments and financial plans with diligence and integrity when the economy and markets are turbulent. Thank you to all of you who have trusted us to do so on your behalf.

As the year comes to a close, many of us find ourselves reflecting on how we can make a meaningful impact — not just in our own lives, but in the lives of others. It’s important that we understand the options we have available to us to help us create an impact on the things we truly care about.

Charitable giving offers a unique opportunity to align your resources with your personal values, creating a legacy of generosity that resonates far beyond the holiday season. While year-end giving is often associated with tax benefits, the true reward lies in its ability to shape our hearts so that we begin to care about the things we value and believe in.

A mindful approach to charitable giving can be a powerful way to maximize your impact while creating efficiency in your financial plan. Donating appreciated stocks or property allows you to avoid capital gains taxes and support meaningful causes, while qualified charitable distributions (QCDs) offer retirees a tax-efficient way to give directly from their IRAs. Thoughtful strategies like these can help ensure that your generosity creates lasting value, both for the causes you support and for your own financial goals.

Year-end giving isn’t just about the dollars donated — it’s about leaving a meaningful mark on the communities and missions that matter to you most. Let’s talk about how you can make this season one of purpose and impact.

Charitable giving is more than a transaction to give yourself a tax break — it’s a reflection of your values and priorities. Whether you’re supporting local community programs, contributing to global initiatives, or funding a cause close to your heart, giving allows you to make a tangible difference in the world and fulfill your calling to care for others.

At its core, charitable giving is deeply personal. It’s about aligning your resources with your beliefs and making an impact that resonates with your sense of purpose. For many of us, having this alignment can foster a sense of fulfillment and connection, making generosity a source of joy.

Beyond the emotional rewards, charitable giving offers significant financial advantages when used strategically. For donors who itemize deductions, contributions to qualifying charities above the standard deduction can reduce taxable income, easing the overall tax burden. Strategies like donating appreciated stocks or making qualified charitable distributions (QCDs) can amplify these benefits, helping you achieve more with the resources you already have.

While the financial perks are valuable, they shouldn’t overshadow the importance of meaningful giving. The most impactful contributions come from the heart, driven by a desire to create change rather than simply reduce taxes. Balancing financial strategy and emotional intent helps to ensure that your giving is both purposeful and impactful.

By incorporating charitable giving in your overall financial plan, you can make a difference in ways that resonate with your values and bring lasting rewards to both you and the causes you support.

When we think of charitable giving, cash donations are often the first thing that comes to mind. While giving cash is a simple and effective way to support causes, it may not always be the most efficient option. By leveraging the right giving strategies, you can deepen your impact and reap the financial advantages.

These approaches not only make the most of your generosity but also work in tandem with your overarching financial goals.

One of the most tax-efficient ways to give is by donating appreciated assets, like stocks or real estate. When you donate assets that have increased in value since you purchased them, you avoid paying capital gains tax on the appreciation.

On top of this, if you itemize deductions, you can claim the asset’s full fair market value as a charitable contribution. This makes it much more efficient than giving cash and is almost like receiving a double tax deduction.

For example, say you purchased stocks for $5,000, and they have become worth $50,000. You want to make a donation of $50,000 to your favorite charity, so you decide to donate the shares of stock. By donating the shares of stock, you get to deduct the full $50,000, instead of owing capital gains tax on the $45,000 profit. The charity will then get to sell the stock with no tax.

Donating stocks that have grown significantly in value allows you to support your valued causes without reducing your portfolio or donation’s overall value because of the tax implications of selling the investment. This method is particularly effective for those with diversified portfolios who want to rebalance their investments while giving back.

Examples of assets you can donate include Stocks, Bonds, ETFs, Real Estate (full properties and fractional interests), business interests, mineral rights, and even crypto-currencies.

You can donate stocks by providing your financial advisor with the organization’s account number and the DTC number of their investment firm. Be sure to let them know to expect your donation so they can provide you with the appropriate gift receipts. For other types of assets, reach out to the charity ahead of time to discuss your gift to make sure they can accept the gift.

If you’re 70 ½ or older, qualified charitable distributions (QCDs) can be a great way to give directly from an IRA or an Inherited IRA. A QCD allows you to transfer funds from your IRA to a qualifying charity, satisfying your required minimum distribution (RMD) without adding to your taxable income. Since QCDs do not hit your income, you essentially receive the benefit of a charitable deduction even if you do not itemize and the donation does not count for income for purposes of determining your medicare premiums.

This approach is especially useful for retirees who want to support charities while managing their tax obligations. By using QCDs, you can reduce your taxable income and help your chosen organization, all while fulfilling your RMD requirements.

Donor-advised funds (DAFs) can also provide flexibility for those looking to make a long-term charitable impact. DAFs allow you to contribute assets, receive an immediate tax deduction, and distribute funds to charities over time. This strategy may be worth exploring with your trusted financial advisor if you’re looking for a structured approach to giving.

There are many advantages to donating to a Donor Advised Fund here are just a few of them:

Charitable giving often comes with questions about financial security and whether you can afford to give without jeopardizing your long-term goals. It’s natural to feel cautious, especially when balancing current needs with your future objectives. However, with thoughtful planning, you can move past these fears and experience the fulfillment that comes from making a meaningful impact.

Many people hesitate to give because they worry about all of the “what if” scenarios — unexpected expenses, market downturns, or changes in income. While these concerns are valid, they often lead to holding onto resources far beyond what’s necessary for your financial security. Working with the right financial advisor can help you identify how much you can safely give, allowing you the clarity and confidence to contribute without compromising your stability.

Charitable giving is not about depleting your resources; it’s about using them intentionally to create positive change in the world. Take a moment to think about the financial flexibility you already have. Are there areas where you’ve saved more than enough? Could reallocating some of those funds toward causes you care about bring greater purpose to your financial plan?

We are all called to use our resources to help others and make a difference in the world. By reframing your surplus as an opportunity to give, rather than something to hoard, you can change your greater approach to managing your assets. Giving becomes less about obligation and more about empowerment.

If you’re worried about whether charitable giving is the right strategy for you, ask yourself:

Charitable giving becomes powerful when it reflects who you are and directs your heart to what you care about most. By making sure that your contributions align with your values and passions, you can create a deeper connection to the causes you support, while ensuring your generosity can have the greatest possible impact.

Everyone’s values are different, and your giving should reflect what resonates most with you. Maybe you’re passionate about supporting education programs, protecting the environment, or empowering traditionally underserved communities. Whatever your priorities, you want to take the time to identify causes and organizations that coincide with your vision for a better world.

Don’t let your connection with a charity begin or end with writing a check. Ongoing involvement in the charity’s work will connect you deeply with the organization, provide important non-financial support and encouragement to the organization, amplify the power of your gift, and inform future giving decisions.

Reach out to the organization directly to learn about its mission, goals, and specific needs to determine if those align with your charitable intent. The development staff for the organization can share impact reports, budget goals, future strategic initiatives, and information about how they would steward your donation.

Consider how you can volunteer on the front end of the organization’s work, in the background, or engage with the organization’s leadership. If you are supporting a local organization, you may even consider serving on the board or assisting in fundraising.

Charitable giving can also be an opportunity to involve your family. Discuss the causes you care about with loved ones and consider making these decisions together. This not only deepens your impact but also fosters meaningful conversations about values, priorities, and legacy, which can be an incredible relationship-building tool.

Even young kids and grandkids can be brought into the giving conversation. Consider asking them where they would like to give, discussing the challenges children in your community and around the world face, and exploring the organizations that provide hope. You may be surprised and encouraged by their youthful thoughts, perspectives, and engagement.

When your financial plan incorporates your charitable goals, it helps ensure your giving remains intentional and sustainable. By working with a CoCreate financial advisor to structure your contributions to align with both your values and your broader financial goals, you can make sure that you are making the most of every single dollar.

Charitable giving isn’t just about the actual act of giving, it’s about doing so in a way that aligns with your unique financial situation. Working closely with your financial planner can help you maximize the impact of your contributions while ensuring they fit seamlessly into your financial plan.

Your charitable contributions should complement your long-term financial goals, not compete with them. By incorporating giving into your financial strategy, you can:

A skilled financial advisor can help you understand your giving capacity and design a strategy that reflects your values while maintaining your confidence in your future.

As December 31 approaches, it’s important to take proactive steps that ensure your charitable giving is both impactful and efficient. Start by discussing your plan with your financial planning team to identify the best opportunities for your strategic giving. Beginning the process early is crucial, especially for non-cash contributions like stock or real estate transfers, which may require additional time to process.

The end of the year is also a great time for setting clear goals for your giving, like deciding which causes or organizations to prioritize and how much to contribute. Just remember to keep thorough documentation, including receipts, appraisals, and transfer records, to remain compliant and optimized for all potential tax benefits.

Even with the best intentions, there are common mistakes that can undermine the impact of your charitable giving if you’re not aware of them.

Waiting until the last minute to execute your giving strategy can lead to rushed decisions, missed opportunities, and logistical challenges. Non-cash contributions, such as donating stocks or property, often require additional time to process, and rushing could result in failing to meet the December 31 deadline for tax benefits. Starting earlier in the year can help you make thoughtful and seamless contributions.

Not all charities qualify for tax-deductible donations, so you must verify that the organizations you support are eligible. By that same token, strategies like qualified charitable distributions (QCDs) come with specific rules, like age and contribution limits. Understanding and adhering to these requirements will help you avoid unintentional errors and make the most of your giving’s financial benefits.

Charitable giving is one of the most meaningful ways you can use your wealth to engage your personal values. By using strategies like donating appreciated assets and leveraging qualified charitable distributions, you can maximize the impact of your contributions while optimizing your financial plan.

As you reflect on your goals and priorities, remember that giving is about making a lasting difference for the causes and communities you care about. Whether you’re supporting local initiatives, global efforts, or personal passions, your generosity can ripple outward to create a lasting change, no matter how small or inconsequential it may seem.

This year, we urge you to take the time to plan your giving intentionally. Work with your trusted financial planners to develop a strategy that aligns with your values and ensures your resources are used effectively to serve your greater purpose.

This article is about the stock market decline on December 18, 2024. It is made up of notes and thoughts on December 19th at about 8:00AM. Stocks opened higher today, but there may be more to come.

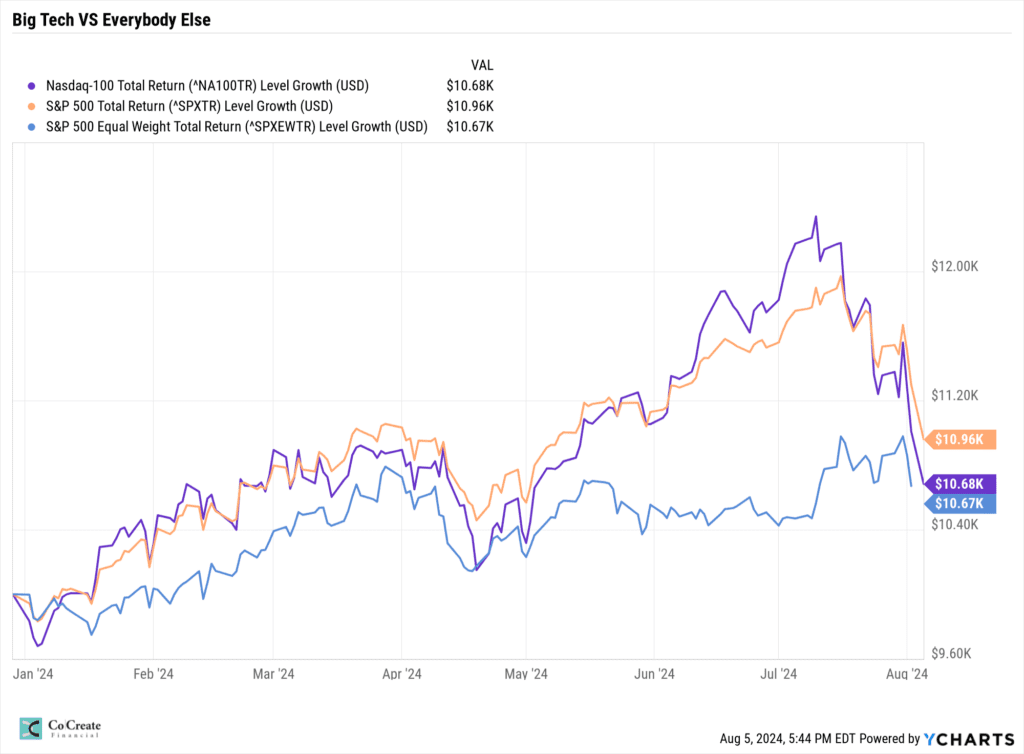

Yesterday, the “markets” declined rather precipitously, with the S&P 500 ending down 2.97%. Of course, nobody actually owns the index itself, so everyone’s experience was a little bit different. If you’ve taken a business-minded approach, you probably faired significantly better. Fortunately, our portfolios have naturally avoided many of the investments that have become overinflated and crashed multiple times this year. When these market events happen, however, they tend to impact everything for the short term. Yesterday was what we call a a 90% downside day, the first since August 5th (>90% of NYSE operating stocks declined and at least 90% of the volume and points traded were in declining stocks). There are actually a number of these each year, and they aren’t cause for alarm unless you’re a short-term trader or haven’t adequately planned for your immediate cash needs. In fact, we generally have several corrections each year (1-2 that drop about 5% and 1 that drops about 10%).

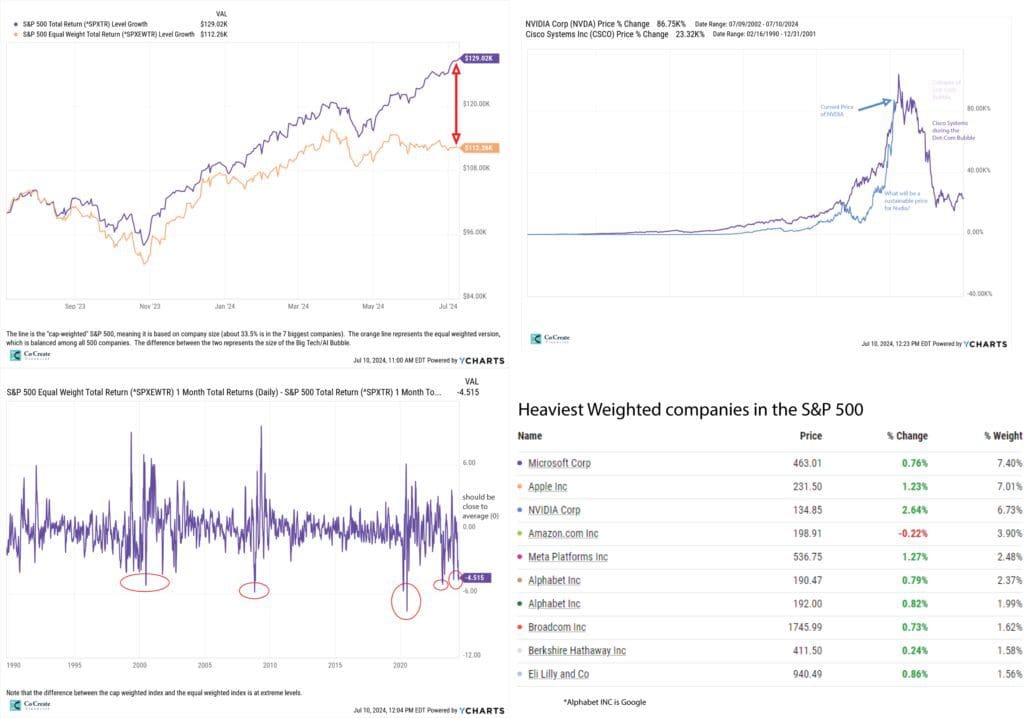

Over the past couple of weeks, we’ve been experiencing a relatively quiet version of one of these corrections. Most companies have been consistently declining for about 10 days, but they have been buoyed by the excitement about AI stocks. Because the S&P 500 and other cap-weighted indices are so heavily concentrated on the biggest companies they don’t always reflect what is happening broadly. Yesterday’s action brings us into the territory of a meaningful correction of the 10% variety. It is possible it could accelerate, but 90% downside days tend to happen a the beginning or end of these corrections and we think this one is already a little bit extended. Moreover, the events that seem to have led to yesterday’s drop were neither surprising nor particularly significant. We’ll discuss a few key issues that are relevant to what’s happening in the markets. Keep in mind that the best thing to do is often the hardest: be patient and disciplined. If we manage your investments, we’ve designed them specifically to perform well in difficult conditions, and you own businesses we believe are extremely resilient and meet our rigorous financial requirements.

“Oops I did it again, I played with your heart, Got lost in the game…”

Oh Baby, Baby, who knew back in the 1990s that Brittany Spears was actually singing about Jerome Powell and the federal reserve.

The Federal Reserve announced yesterday that they were proceeding as planned with a .25% interest rate cut. They also left their official statement unchanged from their previous press conference, in which they explained that they would take a more thoughtful approach to future rate cuts. When Powell was asked to clarify that statement, he indicated that it meant that rate cuts would slow down in the new year. There are a few really key considerations here:

Overall, the Federal Reserves less dovish stance should be a good sign for the markets in the weeks ahead.

Can we all agree that the threat of a government shutdown is now a holiday tradition? If it is, I’ll take it. It would be great if the Government was good at using its resources to make our country better, but when it can’t seem to balance a budget, keep its spending within a healthy proportion to GDP (less than about 19%), and our politicians’ main goal with the budget process is to implement non-budgetary legislation and increase their own salaries, it doesn’t feel like a budget should just be forced through.

Interestingly enough, the reduction in government spending that comes from a shutdown (if it does happen), is actually a good thing for the economy. This is especially true when our money supply is still out of control and inflation is still a problem. We can take solace knowing that the markets haven’t crashed because of a shutdown (going back as far as the year 2000).

The threat of a government shutdown may sound scary, but in reality, the Government isn’t a producer in the economy. They don’t sell a product, invent things, or make money providing services. The money they spend MUST come from productive segments of the American economy (taxing its citizens who profit from business activity). If this is out of balance its extremely harmful for economic growth. A temporary shutdown of non-essential government services, is actually helpful rather than harmful. IF the end result is a better compromise and can ultimately reduce spending and other negative partisan activity, then it can be very good.

On December 13th, Microsoft made a statement that it doesn’t need more chips for its AI projects. Nvidia dropped a significant amount on the news (it is speculated that Microsoft is 13% of their sales). Other AI Stocks spiked and subsequently retreated, but the effect of Nvidia’s drop was felt more broadly because its exorbitant return, along with other AI stocks have played such a significant role in the S&P 500’s positive growth this year. When AI prices drop, the index funds drop in price as well (especially when there are other sectors correcting)… when people sell the index fund because its price is declining, it causes further decline in AI and every other company in the index. That means that everyone’s stocks decline a little bit in their prices.

This isn’t a surprise if you’ve been thinking about the sequence of how AI needs to be implemented. It did need a groundswell in chip manufacturing at the beginning, but that levels off, both as the major data processing centers become equipped with their basic needs and as the focus shifts to other supply challenges. Microsoft identified power in their specific comments about chip needs. The bottleneck has moved to something else. What’s more is that the AI craze is not because AI is a brand new invention, but because it is much more widely available to the public. Business services have used AI for years, so many of the major consumers of AI were already spending resources to use it before Chat GPT. We have been skeptical of the long-term legs to the craze for these reasons. AI will certainly have major implications on the economy and stock market, but these will take a few more years to play out. Nvidia’s value should have increased significantly because of their coincidental ability to be ahead of the spike in demand, but nowhere near as much as it did.

What does this mean for non-AI stocks? It means that we will see a redistribution of capital from companies like Nvidia to other sectors of the market. Some will reallocate to invest in power, others to financials, foods, or wherever they see the opportunity to invest and make money. Sector rotation and balance is very healthy for the market and is a natural part of the business cycle. For those not invested heavily in AI, this is a tailwind.

All of that sounds very optimistic. We have a lot of economic challenge ahead of us in the coming years. national debt is still through the roof, we are still struggling with shortages in the workforce and personal savings is down while consumer debt has risen significantly. Except for consumer financial health, these are long-term problems that our leadership will need to make difficult decisions to solve. Whatever is left, will be up to the creativity of businesses to fix. These are not issues that show up as short-term market fluctuations like we saw yesterday, but in slower economic growth.

We have been watching these headwinds for quite some time and have positioned our portfolios in investments that we believe will perform well in these conditions for the long-term. If you have questions about your investment, please feel free to contact us anytime.

Here are two sets of charts that we feel do a great job of explaining what is happening in the stock markets over the past few weeks. The first is one that we created about a month ago that illustrates the tech bubble on July 10th. The second chart shows three different stock market averages, the Nasdaq 100 (about 60% technology), the S&P 500 (about 40% technology and heavily weighted in just a few companies), and the S&P 500 equal weight index, which gives an equal representation to each of the 500 largest companies in America. These three charts illustrate the tech bubble burst We believe the S&P 500 is a terrible representation of the overall stock market and when it is used in a portfolio as an investment (in a fund), it's actually a high-risk "momentum" investment. Because the Nasdaq 100 is even more heavily concentrated in Big Tech companies than the S&P 500 index, when we look at the two side by side it illustrates the impact the technology sector has on what most people call the stock market (the S&P 500).

People have been overly excited about the impact that publicly available AI will have on the economy and on profit margins. In short, the tech bubble is bursting, but the broad market is much healthier. The business-minded investor has a broader and longer view of the market, and resists the temptation to speculate. When you look at the S&P 500 Equal Weight, which is very closely aligned to the performance of our portfolios so far this year, you see a much different picture. For people in diversified portfolios (not an S&P 500 ETF) who are thoughtfully evaluating profit margins, business models, and dividend payouts, the story has been much more positive (blue line in second chart).

We've been skeptical of the Big Tech explosion for some time, and even made some adjustments in our client portfolios in July to account for the increased risks of the tech bubble. We believe that there will be some upside from here, but we aren't out of the woods yet. The election is coming soon and markets should be quite turbulent until then. In the mean-time, dividend-oriented businesses that fit or investment criteria are generally in a strong position and are continuing to increase dividends despite inflationary pressures and other economic challenges. These should be the strongest companies in a recovery, and have mitigated losses very well in the past weeks. We are excited to continue to collect cash from dividends to be reinvested ate better pricing.

All in all, we aren't particularly concerned for the long-term investor who is in an appropriately managed investment portfolio. It may even prove to be an exciting time with great entry-points for new cash.

A contact directory for our clients.

Matt Hudak, AAMS®, CFP®

We don’t publicly engage in much discourse that touches the political spectrum. We believe the polarization of American society is the greatest geopolitical and economic risk we face today and in order to overcome this risk we need to come together. In turn, we do our best to put our energy into listening to a diverse range of ideas and opinions. Most of our personal ideology is centered around loving people who are different than us and coming together. At times, it can be difficult to publish about important economic topics and concepts without crossing lines into politics and divisive rhetoric. Nevertheless, we will attempt to take a neutral political perspective while addressing the challenges to the strength of our economy.

There are several key concepts we feel should be relatively apolitical and have benefits for both sides of the spectrum. These concepts are primarily monetary & economic—politics-adjacent, but overshadowed by divisive rhetoric and ineffective dialogue. Before we can engage any productive solution, of course, our political leaders must learn to work together. This collaboration seems nearly impossible, but it begins with each of us.

While a lot of the headline economic reports look good, and the 7 companies that represent the “stock market” have shot up (a little sarcasm for you. Microsoft, Apple, Amazon, Meta, and Alphabet represent 31% of the S&P 500, what people mistakenly call the “stock market”). The reality of our economic environment is a little more complicated. We believe that we are currently in a ghost recession. Primarily because savings are low, people are feeling the pressure of higher costs and are thinking about how they use their money carefully. When we see positive data points, there are often divergent stories in the components it represents.

Before we suggest a few helpful ideas, we should identify the drivers behind the challenges facing our economy.

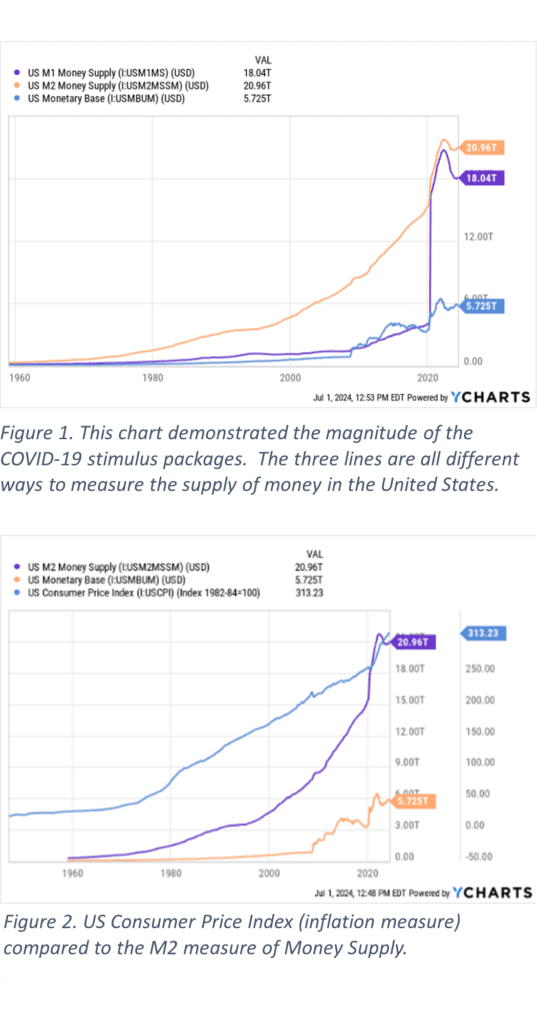

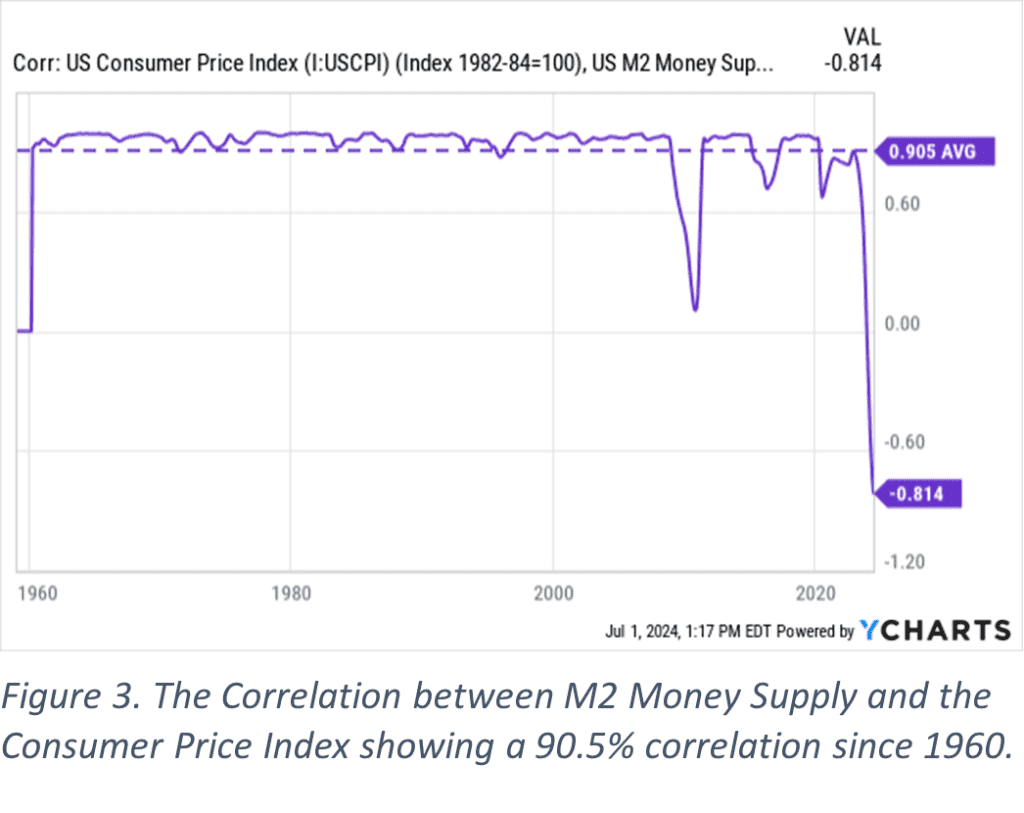

M2. If you’re an economics nerd, that’s all I should need to say. Most economists and officials are too busy trying to figure out how to turn on their flashlight to realize it’s high noon on a sunny day. Contrary to what you may perceive from the world’s obsession with central banks, inflation doesn’t have anything to do with interest rates. Interest rates can affect the speed of inflation, spreading it out over a slightly longer period of time, but no change in interest rate policy by the federal reserve can ultimately change the purchasing power of a dollar. What’s astonishing is that the obvious realities about the monetary system haven’t really been a part of the conversation at the policy level. Perhaps its because both parties are equally responsible for directly causing the current inflationary environment by more than tripling our money supply (M1) in less than 12 months. The M2 measure increased by 40% in the same timeframe (We think M2 will prove to be the predictor of inflation. To wit, prices and incomes will eventually reestablish balance with M2).

It shouldn’t go unnoticed that the M2 measure of money supply and inflation have a near perfect correlation and as seen in the chart in figure 3, until November of 2023, had never before been inverse. They move together 90.5% of the time. In fact, all of the anomalies shown in the chart are at point of major government intervention in the monetary system, and they are all followed by a rapid reversion to the normal correlation. We believe we will see the same effect in the present.

Simply put, inflation is the effect of supply and demand for the dollar. Just like the price of a carton of eggs or a used car changes depending on whether they are hard to find on a shelf or if the dealer can’t seem to move them off the lot, the dollar has more or less purchasing power if there is an abundant supply or if is scarcer in relation to goods and consumers. Policies that are effective at combating the inflationary riptide of a surging money supply will either claw back such supply, limit its future growth or distribute it among a higher number of productive citizens.

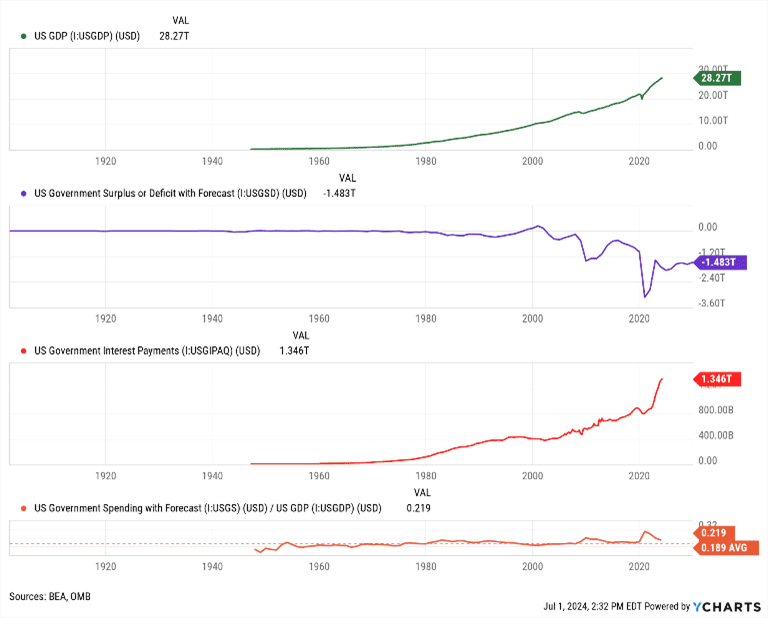

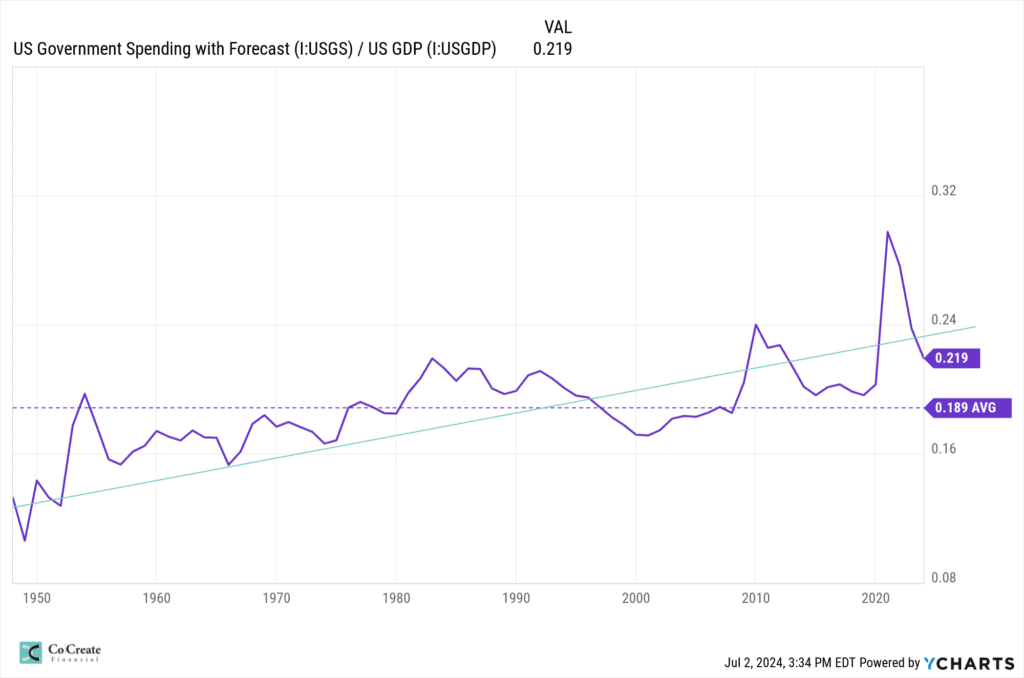

Government spending as a percentage of GDP isn’t as much through the roof as it might seem when we compare it to historical norms, but it's too high for a healthy and growing economy. This is especially true with the current level of debt. Republicans and Democrats alike stand on platforms to expand spending. Regardless of what each of us deems worthy of government funding, those funds need to be in balance with the overall productivity of our country. GDP is the total value of goods and services the US produces (consumer spending, government spending, investment, and net exports). If we imagine a scenario in which Government spending accounted for 100% of GDP, where would they get their revenue? In this hyperbole, there are no businesses or personal revenues to tax (taxable revenues begin with business investment and consumers spending on their product)

The key in a realistic solution is in finding a balance between government spending and non-government productivity. I would suggest that a healthy level of government spending (in the system we have in place today) should not exceed the 18% average (since 1947), but is probably better averaging 14%-15%. If it exceeds that rate, any additional revenue it needs has to come from non-tax policy that stimulates productivity growth in the non-government components of GDP.

This is not a “border wall conversation,” and it is a particularly difficult conversation to have given the contention surrounding the topic of illegal immigration.

The process for allowing a person who lawfully applies to leave their country to enter the United States, is painfully slow—bureaucracy for the bureaucracy’s sake. It would be easy to expedite this process for productive, low-risk people who want to come to the US to work, pay taxes and spend money. The median processing time of an application for an immediate family member of a US citizen is 11.3 months and an application for an alien entrepreneur (I-526) is 53 months. A green card takes 13.6 months. Half these applications take longer and are probably just sitting on a desk.[1]

Immigration is inherently disinflationary. When we discuss inflation in functional terms, it really must be done hand in hand with population growth. Inflation and disinflation are the impact of supply imbalance between the dollars available in the system and the goods & services available. The goods and services are, at least in our present circumstances, relatively static (except, of course, when supply chains are temporarily disrupted). Because those are static, more money means higher prices. They are directly correlated as we discussed above. Adding more people into the equation, however, dilutes the money supply. Ultimately as the end consumer, we choose where we direct the funds we possess. If I don’t have as many dollars, I am more careful about how I spend them. I’m also more inclined to be more productive so that I can earn more.

GDP growth in the US is negatively impacted by a less productive population. This is both due to an aging population (i.e. retiring baby boomers and increasing life expectancy) and an economy that is highly developed. Immigrants have proven to be highly productive and innovative because they are motivated by the opportunities of their new situation. Immigrants also tend to be younger and have larger families than those born in the US. By expediting the application process for entry into the United States, we can effectively boost GDP Growth while curbing inflation.

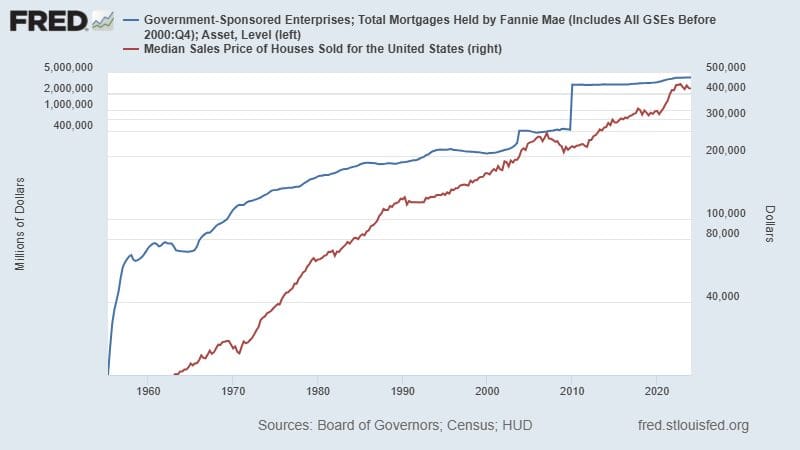

Imagine you’re selling your home and you have two buyers. Both of the buyers can afford to pay $7,000 toward their monthly mortgage payment and have saved $40,000 for a down payment. The first buyer has a bank that will lend 80% of the purchase price. That means they can afford to make an offer for up to $200,000 ($40k/[100%-80%]). The second buyer is working with a bank that has an investor who can take a higher level of risk and so they are willing to finance up to 95% of the purchase price. This second buyer can afford to make an offer for up to $800,000 ($40k/[100%-5%]). Sellers naturally sell to the highest bidder. Assuming there is enough demand, the maximum price is limited to the amount of capital available to the consumer. If you’re considering your options, and everyone is buyer 1, then your sale price can only be $200,000. If your market has buyer number 2, you’ll naturally try to sell to them for $800,000… just because you can.

This is exactly the scenario that led to the 2008 housing crisis. Before the Government Sponsored Enterprises (Fannie Mae, Freddie Mac, et al) began packaging loans and reselling them (CMOs) in the early 90s, the banks lent money from their own portfolios. This meant that they had to be more careful because they were responsible for the loan until it was completely paid off. Banks typically required 20% down because it meant that their borrower had demonstrated capacity to make payments and manage their funds for an extended period of time. Now, this may seem exclusionary to many, but changing this percentage doesn’t change how much a person can/needs to put down.

When CMOs came along, the banks no longer needed to lend from their own portfolios but could be paid to originate the loan and sell it to a third-party investor through the Government (not technically, but the GSEs are essentially the government). There was so much demand from the GSEs to buy the loan that banks could hardly justify making loans the old way, and so the GSEs gained control over the markets. To increase homeownership levels, they began lowering down payment requirements all the way down to 3% and a borrower could use up to 45% of their income to purchase. Now, if you’re the lender, and you don’t offer the 3% down option when all the other banks do, you simply lose the revenue from making the loan. Banks, who had figured out how to structure loans that were safe for both lender and consumer, could no longer compete if they didn’t conform to the GSE’s structures. This created buyer number two (along with all the other ethical problems of consumer fraud and predatory lending). Remember, you’ll sell for the highest price just because you can. Buyer number 2 had 4 times as much capital, so the home price quadruples to match the money supply.

There have been several points in history when the Government has infused a substantial amount of capital into the housing and education markets. The effect has been dramatically increased costs.

Sallie Mae is the GSE for student loans. The same principle applies to student loans as housing. If students have limited funds for their education, the universities will work within those constraints and charge less. When student loans are nearly unlimited universities would be stupid not to maximize their income. In fact, they are forced to increase student costs in order to stay competitive. If a bank were to lend to students from their own portfolio, they would want to make sure the student can pay the loan in the future. The bank would consider the cost of the education program, the income potential for the student upon graduation, and the students commitment to graduating with a degree. All three are major problems that have presented in the current crisis.

These are the fundamental economic roots of the housing affordability crisis and the student loan crisis. We could make significant headway in both areas and dramatically reduce inflation more broadly if we placed significant limits upon the GSEs or dissolved them entirely. Additionally, Student loan forgiveness would be much more palatable if there were a long-term solution to the problem. Sallie Mae could be dismantled and unwound in conjunction with some sort of student loan forgiveness program or benefit for those who have been victims of this Government Sponsored Entity.

Recently the Tax Foundation published a lengthy research report (available here) discussing reform of the non-profit sector, noting that the net income from business-like sources would raise nearly $40 billion in tax revenues. I’ve been very involved in charitable work and was quite perturbed at the idea until giving it full consideration.

Most of the not-for-profit sector are made up of organizations like credit unions, insurance companies, athletic associations (i.e. NCAA), consulting firms, insurance companies, and golf clubs. Most businesses can adopt the form of a non-profit organization, it just means identifying how it serves the public/its members and it can’t pay its profits to owners (it can, however just convert the dividend to “reasonable salary”). What if we narrowed the definition of what a charity is, and the non-profit businesses could pay tax on their net profits just like any other corporation would (excluding income from charitable donations). This would level the playing field for competition and broaden the tax base by approximately 10% of GDP. IF the non-profit business uses its revenues to cover its expenses, those would not be taxed just like businesses deduct their expenses. The Government could use the $40 Billion of excess revenue to help resolve its budget deficit and pay down the insane amount of debt it has amassed in recent years.

People have been discussing the future solvency of the Social Security programs for a long time now. We have our thoughts and positions (essentially that no politician wants to alienate their voter base over an issue that won’t be critical until they have retired themselves), but have a couple of obvious observations. When Social Security was created, the average lifespan of someone taking benefits was around 3 years. It's much longer now, and we need people to retire later. Congress is obviously divided on this issue and whether we should or how we go about forcing it. At the same time, there are policies in place that disincentivize people who want to continue working. Instead of forcing a new retirement age, Congress could begin by simply removing the disincentives for staying employed and push some of their costs back into the private sector (which would in turn create more taxable profits).

The first change to address would be the social security benefit itself. Your Social Security based on your benefit at your FRA (full retirement age). For most people going forward, that is 67. If you take it early, you receive reduced benefits. If you wait to take it until age 70, you receive an 8% annual increase to your benefit over those three years. After you're age 70, there is no reason by which you could justify waiting longer. Why couldn’t we create some mechanism by which someone could continue to benefit from deferring past age 70?

Amplifying the effect, if you continue to work after you start drawing Social Security, after certain thresholds, your benefits are both partially taxable and are reduced relative to your earnings. If your goal is to continue to work into your 70’s or 80’s (more common than you would expect), then your decision causes you to lose much of your social security benefit while still paying into the system for others. The system causes a meaningful imbalance for those that could be reducing the burden on the system. We should simplify the system by increasing the ability to defer indefinitely with some incentive, and remove the benefit penalties for earned income.

The second issue to resolve is to establish a system for individuals to continue without Medicare beyond age 65. If you don’t file form Medicare at 65, you incur substantial penalties when you do file. There are exceptions to this if you properly apply, but these should be the rule of thumb. If you have adequate health coverage by another means, the Medicare program should be glad not to have to pay for your health coverage. With the broad scope of the Medicare program, this shouldn’t impact their ability to underwrite their costs. There is even a possibility it could cause a net reduction in the cost of healthcare across the board. Medicare also has significant premium penalties for those who pass certain income thresholds. If the end goal is to have more employed people contributing, this penalty needs to exclude earned income.

The current tax code allows for a property owner to sell their property in a like kind exchange. For many, they have been able to save for retirement by owning rental properties. While there is a lot of power in the ability to use debt to finance a rental or two, the structure is often less ideal when transitioning into retirement. Income is not truly passive, it isn’t from diversified sources and liquidity is a major obstacle if there aren’t significant savings in other categories. Many who have built their nest egg on a few rental properties feel trapped because of the massive tax burden they can become subject to in a sale (up to 100% of the price could be taxable). The IRS should allow, at least for a time, owners of these properties to defer taxes by depositing the proceeds into an IRA or 401(k). This allowance would allow owners flexibility to position themselves most efficiently, increase the housing supply for entry-level buyers, and would cause a net increase in tax revenue for the IRS over the long term (ordinary income vs capital gains / inherited IRA rules vs step up in basis).

If you don’t have a retirement plan from your employer, it is much harder to save in tax deferred accounts. Your annual contributions to your IRA and Roth are limited to $7,000. IF you have a plan through your workplace, you can defer much more (23000 in a 401(k)). There are other options between and some that allow for even more. It would make sense to increase the limits of each plan to the 401(k) limits creating a fair structure for individuals and small businesses. If many people increase their contributions accordingly, it would slow the pace of inflation by removing those dollars from circulation until the account holder begins their retirement. Coming full circle, the amount of money available directly correlates to the price of goods and services. Creative solutions that remove this capital from the playing field, even temporarily, are more effective than parlor tricks with interest rates.

[1] Historic Processing Times (uscis.gov)

We're really excited to announce our cocreate financial client portal and app. In the first few days of July, each of our clients will receive a link and instructions to set up a new portal account. We've been working very hard to include a lot of useful features and have complete control over how your reports appear. You'll be able to schedule appointments and engage with us right through the app.

We're confident this is a HUGE upgrade and will help us serve you more effectively!

You can download the new app on your app store by searching for CoCreateFinance or clicking here

Our Developers have created an instruction manual for us to provide to you. download it here.

We get a lot of questions about how to teach kids about money, and for good reason! Every parent wants their kids to develop the skills to be successful and live a meaningful and impactful life and we all know that money management plays an important role. When considering engaging your children (or any young person in your life) about money, here are some principles to remember:

Tell us what you have done with your kids to teach them about money! Please take a moment to write us a note (some of our best ideas come from our clients). We would love to share your great ideas with other parents in the CoCreate Community.