I believe every one of us is searching for significance and satisfaction in life. My work as a financial advisor has put me in contact with a lot of different people at differing levels of wealth and poverty, and I’ve become convinced of a simple truth:

Success, satisfaction and significance aren’t born out of your account balance or income, but are achieved by the way you engage life in the present.

We are constantly making significant decisions. They don’t always look like life-changing opportunities, but they are always in front of us. They’re choices that build on one another—like the times you’re in a rush to get something done and you decide to break from your frenzied routine and tell your spouse how much the matter to you. We make little choices everyday that we don’t think about. We choose to watch show after show on Netflix instead of reaching out to a friend. We walk by friends and acquaintances asking them if they are well, decidedly content not to engage in their response. (What if we did?)

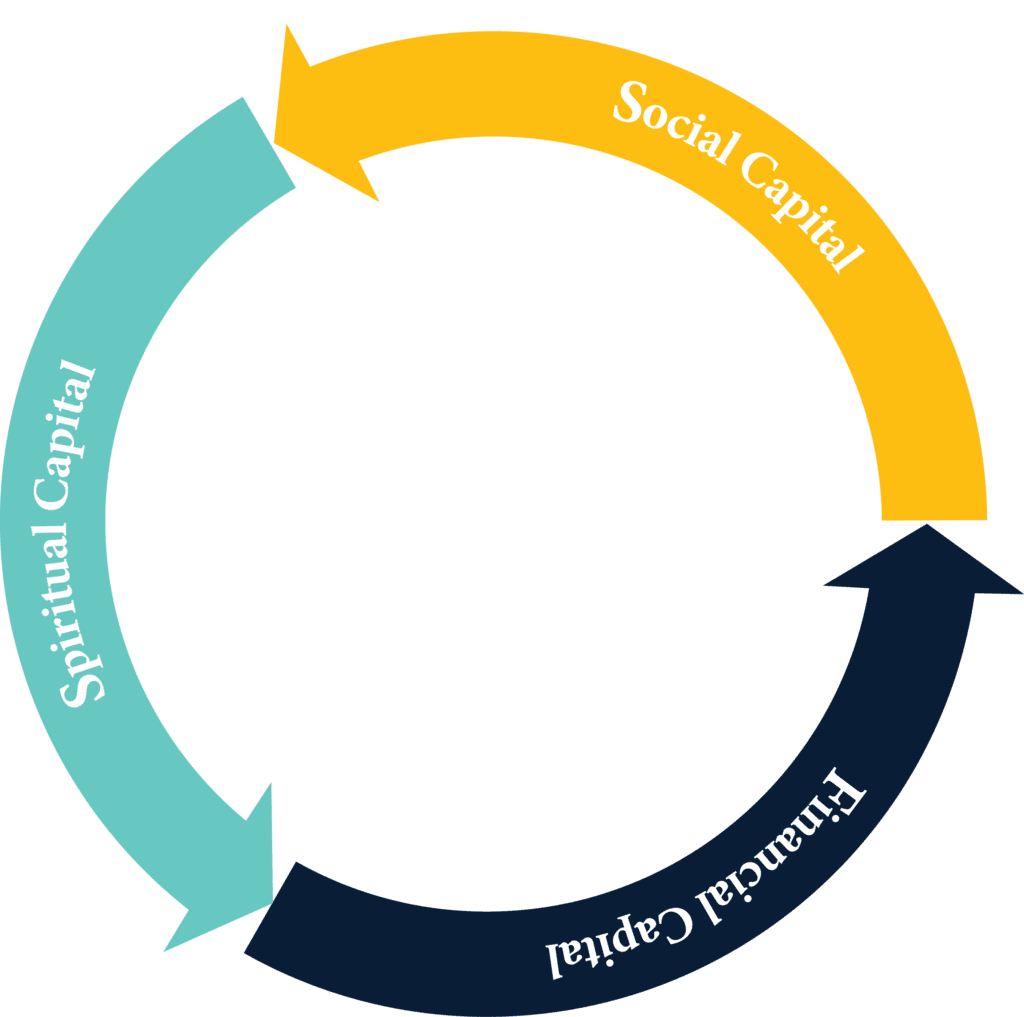

We make choices all the time. Some of them are smaller while some are larger. some of them are financial, some of them spiritual, and other are relational. As a financial advisor, I generally see people when they are thinking about financial decisions. In reality, there are a few different types of capital we need to think about spending, investing, and growing.

Here’s the thing about these small decisions that create this kind of eternal significance. Every moment in which we act, we take a step forward on one path or another. Even indecision, or inaction is a step forward in the timeline of our lives. We create futures with these steps, building them into a masterpiece, or we leave them weathered, worn and underdeveloped. We pursue our passions, or we let them fade.

The hard truth in this is that we make choices that don’t lead us to this kind of significance and success all the time. When our priorities are misaligned, we find ourselves on facebook instead of face-to-face with the people who are right there. At other times, we do things that insulate us, from communities and our own fears. We choose to be disengaged or to build up walls to protect us from our fears or even from self-understanding. Decisions like these are often ones of apathy because it can seem easier to continue on the path of a disengaged life.

The fantastic news is that each of these moments is new. You can live in a way that makes each moment significant, STARTING NOW. Every day, we encounter opportunities to engage life in such a way that we will make an eternal impact, creating a future for ourselves, our families, and our communities.

I encourage you to start engaging life on purpose. Though there is no set path to follow, I’ll be writing about a few simple ways get started in my next post “Engage Life – living on purpose.”

This three part series of articles was originally written by Christa Hudak in November of 2016.

Budgeting documents my financial growth. It is helpful to periodically evaluate where you are, where you have been and where you are going. If you don’t have a record, it is very hard to make this evaluation. It can be incredibly encouraging and motivating to recognize your progress. On the flip side, if your evaluation shows that you have not been making progress toward your goals it may help you realize it is time to start making some changes.

It is important to celebrate your wins and recognize what you have achieved. It fuels your motivation to keep pushing toward your goals and challenging yourself.

Budgeting allows me to live larger. When you are in control of where your money goes you can put incredible focus on the things that are important to you and accomplish more than you ever dreamed was possible. Truth be told, there a lot of areas in which I am very frugal, sometimes to a shocking degree. In other areas, we spend very freely. This practice is quite purposeful and it allows us to have a much greater impact in the things that are important to us than our income would generally allow. Are your finances a hurdle to overcome or are they propelling you toward your goals? Is money a stress and a worry, or is it a tool accomplish things of true significance? No matter your financial situation, you can begin the process of priorities-based budgeting and you will be amazed at what becomes possible.

This three part series of articles was originally written by Christa Hudak in November of 2017.

Budgeting relieves financial stress. A big source of stress is uncertainty. Simply not knowing where your money goes or what you will be able to afford is stressful. If you run a budget and track your expenses you know what is going on with your money and you have a good sense of what you can and cannot afford. This in turn will enable you to make appropriate choices in how you commit your money.

When was the last time you applied for a home loan? If you have at any point and you kept a budget at that time you were probably shocked at what the bank was willing to lend you. However, if you did not have a handle on your finances you may have said something like, “great, I didn’t know I could afford so much!” But what you can afford and what you qualify for are two very different questions.

Let me make one thing clear: It is not the bank’s job to determine how much you can reasonably afford in your situation. The bank’s job is to give you as many options as possible (as their customer) and not expose themselves to too much risk. Only you can make the determination of how much is reasonable for you to afford given your specific situation and priorities.

This is true of a lot more than mortgages. We live in a society bursting with payment plans, leases and longer and longer-term car loans. It is not wrong to utilize these tools in the appropriate circumstances, but you need to be able to evaluate them appropriately. Saying to yourself, I could probably scrounge together another $137 per month while you sign on the dotted line for your new car stereo is not really evaluating your budget. Making financial decisions in this manner will lead you down a path stress, worry and often financial hardship.

However, if you have a written budget in which you track your expenses you would easily be able to determine if there is surplus income or an area you are willing and able to cut back in so that you may buy the car stereo. If you determine that it is feasible and valuable enough you can move forward with the purchase stress free.

Budgeting shows me my priorities. You show me how you spend your money and I will tell you what your priorities are. I don’t mean your theoretical, sky high priorities, but your priorities in reality. Your functional priorities are the things on which you spend your time, energy and money. Looking at your budget can be a great opportunity to ensure that your functional and espoused priorities align as you want.

It is probably safe to say that we all prioritize a safe and stable home for ourselves and our family, which is why a large portion of most budgets are housing expenses. On the flip side, it is not accurate to say you value helping those less fortunate than yourself if you never expend any of your time or financial resources doing so.

Not only does budgeting help you see your functional priorities, it can be a tool to align your priorities with what you want them to be. If you recognize that you want to do something that you have not been, creating a place for it in your budget can make a big difference. For example, if you want to work on developing your relationships with your friends you can create a specific category for doing activities with, hosting and eating out with other people. Not only does the category give you the permission to do these things, if you are part way through the month and realize you haven’t spent that money you know it is time to pick up the phone and invest in your relationships.

Remember, your time and money are both limited resources, which means saying yes to one thing means saying no to something else. Take the time to consider if you are saying yes to the right things and you are comfortable with what you are saying no to as a result. Budgeting is not just about making sure that you spend less than you bring in, it is an opportunity to evaluate that your money is going to the things you want it to and accomplishing your goals.

This three part series of articles was originally written by Christa Hudak in November of 2017.

Truth be told, I am kind of an odd duck. I actually like to budget and I always have. There have been times when I did not like what I saw, but I have always liked to budget. However, I know this is not the case for most people. In fact, for a lot of people the idea of budgeting or reviewing your finances brings with it emotions of fear, anxiety, embarrassment and even sheer panic.

I understand that not everyone is wired to be a neurotic budgeter like myself, but I do believe it is critical for everyone align themselves with a basic budget. I want to share with you why I love budgeting.

I know that this seems backwards to so many who struggle to live by a budget or who never have, but I feel I have freedom in my finances because I budget. Sometimes I wonder if budget has become a dirty word and it may be helpful to think of it as a monthly financial plan. Frequently, people start to budget because they recognize they need to spend less and so the budget becomes about spending as little as possible in each category. Sometimes that is the reality of life, but it is a problem if you are never able to graduate from this perspective.

To help you understand how budgeting gives you freedom, I want to lay out a scenario for you. You and your spouse both work, you have decent incomes but there never seems to be enough money at the end of the month and you have fallen into the habit of carrying a balance on your credit card. Your major expenses seem reasonable but you know all the little things are adding up in a big way. Your vice (because it is a budgeting stereotype) is coffee. You grab at least one latte every day, sometimes a second if it has been a rough day or you feel like you need a pick me up. The problem is, as your finances have started to get out of control you have started to feel guilty about this habit.

If you able to actually develop a budget with your spouse you line out all your general expenses and make some categories that make sense for how you live and your priorities. All of your expenses will be allocated into one of your budget categories. One of the categories you decide is that you and your spouse each get a “Fun/Discretionary” category, which is for each of you to spend on whatever you want. After thinking about it, you decide this is where the money for your lattes comes from. By having this category, it gives you the freedom to enjoy the pleasures in life, but also a cap on what you have decided is reasonable. You may or may not be able to get a latte every day, or you might decide to skip the lattes for a week so you can go out to lunch instead. You are now able to be in control and make these choices guilt free.

First of all, let me direct your attention to the CFP Board of Standards, for the best generic summary of what to look for in a financial planner. [click here to read it]

Second. These articles about what you should look for in a financial advisor often leave much to be desired. Almost every one of them is written by someone with a significant conflict of interest. I have one too: I want you to do business with me. Right? I’m obviously going to say you should look for traits I possess so that when you call up to interview me, I’ll check all the boxes. (by the way, if you want to contact me about your financial needs, my direct line is 406-206-7571). For the record, if in any business transaction, someone tries to explain that they are “the one” who is solely looking out for your best interest… run away.

On to the Article…

I don’t want to rewrite the “what to look for” article for the 20,000th time. I have noticed, however, that there are some very important things that are missing from all of these I’ve read as well as a few factual errors that frequently show up as misdirects. I’m going to highlight these here.

Ask them: “Tell me about your finances?”

I believe that every person giving advice should be following their advice. I think Financial Advisors should have their financial lives in order. One of the great things about the investment industry is also to its detriment: the “Financial Advice” Industry was built as one of opportunity for the tenacious (think of the Will Smith movie Pursuit of Happiness). It’s great that people can change their circumstances and many who find success selling investment products actually master their own finances, but many don’t. It’s fine to do business with someone who is great at the stock market, but doesn’t have a clue how to manage expenses. You should know who you’re signing on with and how they do or do not fit your needs.

I could go on into a dozen examples, but I’ll simply note that success in retirement has more to do with how you manage your spending and your risks than it does the amount of money you earn the hot stocks.

You don’t need to get a detailed balance sheet from a prospective advisor. What you need to know is how they are on the right track themselves. If you were to ask me, I would tell you how my wife, Christa, and I learned to balance a budget when we were living on $9.50/hr and avoid the use of short-term debt. I would talk about how we worked to pay down our non-mortgage debt, and how we eventually paid it off. I would talk about how we’re saving for retirement, how we have capital for our present needs, and how we strive to grow in our generosity each year.

We have an articulated plan. We follow it. We talk about it. Whomever you are interviewing to help you be successful in your financial life should be do the same. They may be in an entirely different point in their financial life than I am (for being 30 I’ve learned a lot, sometimes the hard way, but I expect to grow and get better at living for at least another 60 years), but they should be able to talk about their financial story past, present and future.

Do you serve a diverse group of clients?

One of the questions most of these articles suggest is this “describe your typical client.” The reason for the question is because you should know your advisor can handle a situation like yours. I think it’s a good question, but I always hated when it was asked. After a number of years contemplating the question, I realized why. I may or may not have clients with the exact situation you do. You may be one of two clients with the same exact financial details. An advisor could primarily serve retirees who have an median asset value of $750,000. The advisor may have a number of clients with less, and clients with a lot more. If you’re in the $2,500,000+ club, you’re a fraction of a percent of the US population, so odds are, most advisors only have a couple of you.

I think there is a better way to gauge the advisor’s relevance. The one question should really be three.

How are you living in a way that recognizes the world is bigger than yourself?

Because generosity is an important financial discipline, your financial planner should have eyes for something other than his/her pocketbook. I know many advisors that are wonderful people who are working hard to make their communities better, to bless their neighbors, and make a difference around the globe. I can write out a long list of advisors who are doing things like foster care, global relief work, volunteering with at risk youth, helping people with disabilities, and more. In my travels I’ve talked to hundreds of other advisors with different perspectives and lifestyles when it comes to service, but I can say that I have yet to meet one who is passionate about serving and giving to others that has given me a reason to question their professional character or the quality of their advice.

The “fee-only” Myth

This one is flagrant. Fee-only is different… not better.

It seems like it’s plastered on every blog, “make sure your work with an advisor who is only compensated on a fee basis because commissions make advisors do too much trading and buy the investments that pay them bigger commissions,”. It’s asinine and a bold-faced lie told by a growing number of people in the financial industry. Asset-based fees and commissions are different, but none is universally superior. If an advisor doesn’t grasp this, they simply lack experience and are buying into a widely circulated misconception. (sorry to my fee-only friends, my intent is not to insult.)

The truth is, the best interest of a client is best served by the most cost-effective solution balanced with the most ideal result. Sometimes this is best accomplished on a fee basis, but it is sometimes most effective to charge a commission. (Please note that I am presently a fee-only advisor. I just don’t like dishonesty in marketing.) As a fee-only advisor, I have conflicts of interest too, even if I’m a charging the same fee across all products. Those things don’t force me to do what’s in your best interest, it just changes the way our relationship looks.

Sure, I’ve seen a lot of circumstances in which someone came to me after another advisor had charged them a commission for an unsuitable product or engaged in what were perhaps abuses of the commission-based system. But what about the advisor that charges a recurring fee that produces a high profit margin and does nothing for the client? There are a lot of responses someone might toss back at me, for example, most fee-only advisors are only “Investment Advisors” under the Investment Advisors Act of 1940 (or their representatives) and are thereby fiduciaries. First off, Fiduciary status isn’t the result of fee structure. There are commission-based advisors who are fiduciaries. Second, “Fiduciary” is usually a legal term, and it’s always a technical one, and it doesn’t always mean the same thing. When you hear the term Fiduciary, you need to know what kind of fiduciary, and what standards they need to follow. There are ERISA (retirement plan) Fiduciaries, Fiduciaries under the Investment Advisors Act, and fiduciary standards for various credentials like the CFP®. The short answer is this: everyone in business has a conflict, and no fee structure can eliminate that.

Sorry about the rant. Here’s the question you should ask:

“how do you evaluate your recommendations and compensation that minimizes your conflicts of interest and is fair for the products/services you are providing?” If they dazzle you with a bunch of technical information to avoid the question, give you a non-answer such as “that’s just the price for access to the markets,” then ask the question again. As financial professionals we should all have a satisfactory response to this question.

The most important part of choosing a Financial Advisor is finding someone you trust, who has the ability to help you with your financial needs for the long term. If you have questions about the process of finding the right advisor for you, reach out to Co|Create for help.

One of our core philosophies is somewhat unorthodox, but it makes sense.

Money has no value on its own. It’s paper, with some special ink, and cotton. In today’s financial world, it might only be a number on a hard drive somewhere recording your account balance. If I have two pieces of paper, one being a one-hundred-dollar bill, and the other a blank sheet of paper upon which I hand-scrawled “$100,” the former has value and the other does not. What makes the difference between two materially similar items so dramatically different?

Some people would say its faith in the currency system, but it’s actually much more than that. Money is exactly as valuable as what it is used to accomplish. We might say that a bank account with $5000, has a nominal value, but $5000 that is used for something—to buy a boat, pay for a grandchild’s college, or drill a well in Africa, has functional value. Financial planning is the practice of connecting the functional value of your assets with their nominal value and then maximizing both.

As a result, one of the first steps in creating your financial plan is to identify the “functions” that are significant to you. These break down into two categories: quality of life and world impact. The quality of life are the self-oriented needs and desires you have. These are the basic questions that every financial planner would learn to ask in business school. “What are your basic monthly expenses?” “Do you plan to travel?” “Do you foresee any major expenses like starting a business or remodeling your home?” I call these self-oriented, but they are not selfish or un-important. These are the reasons most people have built up their assets, and a good financial plan will help you accomplish these and it will integrate them with your world impact.

The term “world impact,” isn’t necessarily as extreme as it sounds. People are fundamentally human, and we exist in the context of community. We cannot escape it, and we aren’t fully complete as people unless we participate in it. Our community is made up of our families, our neighborhoods, our towns, states, our country, and the global community. World impact, means impacting one or more of these areas. Each of us has a world impact, whether or not we choose it. When talking about your impact, it’s important to note that it is yours. Some of the things people do with their impact: help a grandchild pay for college, volunteer as a big brother or sister, sponsor a child with Compassion International, provide clean water to a remote village, start a business, teach a young person a trade, spend time with you kid so they know they are loved. These are all parts of significant world impact, and we all have unique parts to play.

Our financial plan either helps us accomplish these things, or hinders our ability to engage the world around us. A good financial planner will help reconcile the two so you are better equipped to live the life you were meant to live and will help you recognize the functional value of your assets. If the plan focuses on just one, then you’ll end up either living a lonely, lavish life, or playing catch-up because you weren’t prepared to fund your basic needs.

The Co|Create way is to create a future in which you can make the most of your quality of life and your world impact…together.

It can be hard to figure out the best investment options for your retirement plan. In many cases the target date funds, the general default for most 401(k) plans, are less than ideal. If you have a workplace retirement plan, whether it’s a 401(k), a 403(b), or some other type of plan, a Co|Create advisor will gladly help you determine the best allocation using the same evidence-based, data driven processes we use for the investments managed in-house. 401(k) consultation is billed at a flat fee of $100 for the first plan and $75 for each additional plan. It is important that you evaluate your portfolio’s allocation at least annually. If we manage your other assets, this service is included at no cost.

As a business owner, it’s hard to carve out time to work on your personal financial plan, and to-do list items like setting up employee benefits and creating ways to make an effective succession plan remain on the back burner until they are either imminent or it’s too late.

Some of the services we provide to businesses and their owners are:

Your

ability to live the life you want rests squarely on your shoulders.

This is true in the present and in the future. Understanding this is key

to leading a successful life, financially and otherwise. The short-form

of a financial plan for someone who is in what we call the Accumulation

Stage of life, is “save as much as you can as early as you can.” Given

the power of compounding, it makes sense for a long term plan. There

are, of course, many factors that complicate the simplicity of saving

this way. It also doesn’t make sense to save rapidly without a plan,

because you could end up sacrificing the life you want to live now for

resources you may not entirely need later on. CoCreate strategies seek

balance, so you can pursue your passion now and in the future. CoCreate

strategies for savers include a broad scope of consultation, coaching,

and management activities. Some of the most common are:

•Helping you determine what you are saving for.

•Helping you determine your capacity to save for your future, and discovering ways to increase your savings.

•Helping you to identify ways you can maximize your resources to live in the present.

•Creating a plan to continually measure your progress in attaining your goals.

•Managing investments for retirement AND pre-retirement goals.

•Helping you evaluate real estate and business investment opportunities.

Retirement means something slightly different to everyone. Traditionally, it means wrapping up your career and enjoying “the golden years”—riding off into the sunset. More and more, people have a new definition of retirement. They want to find fulfillment in a second career, or explore the world (whether by RV, plane, or fishing boat). Others want to give their time to their communities and their grand-children. You could be one of these types or a blend of all of them. In any case, you are unique in your purpose and desires.

One thing each definition of retirement has in common is what we call Financial Freedom. You’re no longer a slave to your career for the sake of paying the bills. It means you have significant choice in what you do because you have arrived at a place, financially, that can sustain you in a variety of different options. Our job is to facilitate this financial freedom. Some of the services we provide to accomplish this are

•Cashflow Management – from Social Security benefits, to investment income, to rental proceeds.

•Asset

Management – managing your investment assets to generate the income you

need as safely as possible, so you can focus on living.

•Risk

Management – this obviously includes managing investment risks, but goes

further to helping you consider other risks you face, like over/under

spending.

•Goal Prioritization – It’s easy to spend your resources

on the unimportant thing immediately in front of you instead of what you

really care about. We’ll regularly review your financial priorities to

help you keep them in focus.

•Tools for the Next Generation – You’ve

stewarded your resources to this point, and you’ll need to be asking

the question about who the next steward will be. The most overlooked

component in estate planning is preparing them for the task. Our job is

to equip you to do so and provide whatever assistance you need along the

way.