I am excited to be restarting my career as a Financial Advisor at Co|Create Financial. After about a year and a half out of the industry, I am drawn back because of how significant money is in each of our lives and the incredible depth at which I am able to equip and empower people by helping them with their finances. In reality, money is connected to everything we do and everything we value. When we recognize that and work to ensure that our financial resources (and all our resources) are aligned with what we value and who we want to be each of us has unstoppable potential.

I have spent the last year as the First Impressions Director at Journey Church. The focus of my role was to equip volunteers to create a more inclusive and inviting culture and create a deeper sense of community. It was a very fun role and I got to help people grow in multiple dimensions as they served one another and built relationships. At first glance this may appear very different than my work as a Financial Advisor, but it is really all about equipping people for purpose and significance. This is what I have been passionate about in every professional opportunity I have engaged.

However, I find that there is something I love about getting to work with people in regard to their finances. Money is an intense source of stress for many people, but one that is frequently buried and ignored. When we engage with our financial resources instead of running from fear and stress we are able to see ourselves more clearly and put ourselves on the trajectory that we want to go. We unleash bounding potential when we stop fearing our finances and start orienting them purposefully.

When we do not choose to be purposeful about our money it is the silent force that controls our lives in all the wrong ways. We miss out on opportunities, play it safe in mundane mediocrity instead of pursuing our passions and we trade investing in living a significant and meaningful life for things the marketing people tell us we want. We live lives of financial stress that spills into all areas of our life, always left feeling wanting and realizing that we have very little for all the money that has slipped through our fingers.

I am a financial advisor because I believe in stepping into a different reality. One where we understand the significance of money but put it in its proper place in equipping us to live meaningful, significant and fulfilled lives. How you use your money is the most transparent window to your soul. If you show me what you spend your money on, I can tell you what your priorities are. I’m not talking about your lofty and idealistic priorities of who you want to be. Your money clearly communicates your functional and lived priorities.

Financial advising is about closing the gap between who you want to be and who you are so that your resources propel you forward on your life mission and purpose. I love equipping people to live lives of meaning and purpose and as a Financial Advisor I get to help people think about, manage and structure their financial resources for significance both in the present and throughout the many years and seasons of life.

When I sit down with people who are preparing for retirement, one of the most significant topics we end up wading through is their potential healthcare cost. Many have significant concerns that they will bankrupt themselves paying for their medical expenses. Even curriculum required by groups like the Certified Financial Planner Board of Standards™ have been designed to prepare us for a world in which healthcare costs could be the largest expense in retirement.

Despite the above average inflation we’ve seen affect healthcare costs and the illustrations pre-programmed into your advisor’s financial planning software, you may find that visiting your doctor is more affordable than we like to think. Let’s take a look at some actual numbers.

In 2018, the Employee Benefits Research Association published a study exploring the out-of-pocket healthcare expenses for retirees (click here to access the study). The study uses actual data reported by participants, all of whom were over 70. Interestingly, most of the conclusions we’ve drawn has used a substantial amount of hypothetical modeling as opposed to real world data.

The results are actually quite shocking. The data results essentially make a bell-curve in terms of cost. Most people spend a relatively small amount on healthcare. From age 70 until death (post age 95), the median out-of-pocket cost was a mere $27,000. That’s only about $1,000 PER YEAR! What’s more, half of the population spends less than that.

This becomes challenging because half the population spends more than $27,000. If you’re in the top 10% of people with expensive medical care, you’ll spend more than $96,000 from age 70 until you pass away sometime after your 95th birthday. Based on these numbers, healthcare probably won’t be the challenge we anticipated since 89% of us spend less than $320/month on these expenses.

The study showed that for those who are the most expensive (the top 10%) nursing care can add more than $175,000 over the course of your lifetime. While women proved to be about 28% more than men, and were much more likely to enter into nursing care, most people spent very little or no money on these services. A surprising 54% of those who passed away after age 95 never used nursing care at all.

As with most statistical studies, we need to filter out some of the noise so that we can make practical sense of these numbers. Fortunately, the EBRA did some of the work for us. When you adjust for skewness in the data-set and accounted for the participants receiving Medicaid for their assisted living costs. The average person spends about $2,000 per year on healthcare (including nursing care). If you’re in that top 10%, you’ll be spending $11,000 or more each year.Financial planning for healthcare costs should be a “prepare for the worst, but plan on the average” type of scenario. Your financial plan should prepare you for the higher costs you could encounter by maintaining flexibility in both objective and quantity of capital, but shouldn’t excessively constrain you from pursuing your passion in life. If you’re preparing for retirement, reach out to Co|Create Financial. Let’s begin creating a future together today!

Major market indices (S&P 500, Dow Jones Industrial Index, et al) have declined today, and have done so in a way that will make headlines. What do we really need to know? How should we react?

The chart at the top of the page illustrates the price movements of the S&P 500 over the last 12 months. Most people are referencing this index when they are talking about "The Market." It's actually a geometric average of the 500 largest publicly traded, American companies weighted by the total size. This means that the biggest companies make up most of the S&P 500 (As of September 30, Microsoft, Apple & Amazon were just over 11% of the index). Given these weightings, we know that most of "The Market" returns come from just a few companies. The S&P 500 is really more of a focused portfolio than it is a representation of the stock market.

None the less, the headlines, and an overwhelming amount of public opinion stems from it's movement, so we would be remiss to ignore it entirely. The first headline you'll hear about will probably be looking what the chart is doing. Gleaning information from the charts is a discipline called "technical Analysis." It's focus is to look at patterns of buying and selling behavior to predict upcoming price movements. Technical analysis isn't particularly useful except for short-term speculation, but many people think it is the only way to invest. While we should rarely make investment decisions based on technical analysis, knowing how it works can give us some short-term insight.

In the chart, you'll see that the S&P 500 has dropped below the Orange line (the moving average of the last 50 days), and also a flat red line. According to Technical Analysis, this was a support level, and the act of dropping below it means that the market should be looking to find the next level of support. The pink line is the moving average of the last 200 days. It's a significant point of support. The red lines that sit close to it provide some reinforcement too. "The market" is almost at that point, and we can expect (according to technical analysis) people to stop selling and start buying again.

In good times and in turbulent ones, portfolio construction is important. Different risks impact different businesses differently, so investment in each of those companies needs to be made on a one-on-one basis. Concepts such as passive index investing have worked in the past decade in which almost all of the largest companies have seen steady or rapid growth in share price, but in a more turbulent environment, it can actually amplify declines in a portfolio. We need to go back to the foundations of our investment theory and consider each investment as an individual part of the whole and also look deeper than that mathematical shortcuts we begun to rely on (i.e. alpha, beta, CAPM) and evaluate our diversification on that same basis.

As I write this part, I'm realizing that I need to write an article translating that into plain English. I'll do that soon. What's important, is that your advisor is carefully constructing your portfolio so that your exposure to risk is as minimal as possible rather than exposing you to every risk knowing only some of them will hurt you.

If you're a current client of mine, your portfolio is already designed like this. It's created for situations like we're seeing today. If you're not a client yet, book an appointment on my website or give me a call.

More than anything, this is just a frustrating headline in terms of the stock markets. Whether or not Trump should be impeached is a question to be handled in a different forum, and is really quite distinct from our economic conditions.

Remember the Clinton Era? I remember learning about impeachment. It isn't removal from office. It's really just a black mark on the president's record. Sure, congress could decide to pursue a removal afterward, but that's a very unlikely scenario, largely due to the time left on Trump's term.

If Trump is impeached, he still has all of the same powers of office and he still has similar challenges in uniting Washington D.C. (and the country) behind him. The largest impact will be on the next election, which is the reason Democrats are pursuing impeachment with such vigor. That isn't to slight those on the left; if we're really honest with ourselves, election is what drives both sides in Washington.

The President is captaining our trade negotiations and has some impact on fiscal policy and legislation, but he isn't a primary driver of the US economy. Aside from massive actions, like engaging our troops in war (which requires congress after 90 days, by the way), the President is more of an economic cheerleader — a figurehead for the rest of the system. Impeachment of Trump has a net effect on the economy of very little, but it makes for a very loud headline.

I've been working to address this issue at length for a long time. The issue is really short and sweet. We've been in an economic cold war with China since before the end of the Cold War. China made some very aggressive moves during President Obama's administration. As an example, Consider their One Road One Belt initiative that was designed to open trade for China across Eurasia. The program, financed by China, is poised to create insurmountable indebtedness for these new trade partners. China's program is about more than opening trade routes. It gives them the economic leverage they need to command trade supremacy over half the globe.

For the Unites States, our risks in a trade conflict with China remain small. If we stop buying steel from China, or if it becomes overpriced due to tariffs, Another country will be excited to fill the gap. That country's economy will grow, and we can hope their political ties to the U.S. will do the same. The short term effect: a small slowing of GDP growth for the long term benefits of increased global economic and political stability. There are a number of ways we can misstep, but at this point, we should be losing any sleep.

Nestled quietly on page 5 of whatever newspaper you read, you'll read about the economic data released for September. You'll read about slow-downs in share buy-backs, and some other miscellaneous data-points. These are the most important things we should be watching to see if the continues to slow down.

This morning, the Federal Reserve stated their confidence in the US economy's strength. Frankly, I agree with the sentiment, and believe we can look at history to see that one or two months of lackluster economic data doesn't indicate we will begin a recession. It's certainly true that every recession starts with declining economic data (it's required by the definition of recession), but there are many months in which these numbers are less than ideal in the midst of robust economic growth. This morning, Brian Wesbury, Chief Economist of First Trust Advisors, wrote a fantastic article looking at the ISM Manufacturing data making this point [Read it].

The conversation about share buybacks could get a bit of attention as many will say that the companies themselves don't believe in their own value. I see it differently for now. In order to adapt to changing trade situations, large companies need their cash, and shouldn't be willing to part with it in exchange for company stock until some of the trade tensions play out. Additionally, companies have engaged in record-setting buybacks and mergers for a number of years now, using capital they set on the sidelines during and after the Great Recession. To me, this feels more like a return to normal than the beginning of crisis.

Like going to the doctor for your regular check-ups, it's important to keep your finger on the pulse of your financial plan. Usually this happens in conversations with your Financial Advisor, but occasionally you'll want to do a thorough review.

Refinancing your home or purchasing a new piece of property is the perfect time for an in-depth financial consultation.

July is the season when economists and investment advisors reflect upon the first half of the year and give ink to their thoughts about the year to come. These are some of my mid-year musings, which will guide portfolios, investment decisions, and conversations over the coming months.

Overall, it’s been a year in which the economy experienced moderately good performance, despite a few challenges stemming from Washington D.C. and from our social media accounts. This is truly a testament to the strength of the U.S. economy at this point in time. Find out what you need to know about the past six months and what the rest of the year has in store.

Understanding your mutual fund costs begins with understanding the underlying mechanics of your investment. In almost all circumstances, you own individual companies, loans (bonds) made to individuals, business and governments, and sometimes a few alternative securities types such as an option or commodity. These investments compensate you for your ownership (indirectly through the fund) and can increase or decrease in value over time. For discussion’s sake, let’s assume these investments increased 10% over the last year.

When you own a mutual fund, you don’t own these investments directly. Instead, you indirectly share in the ownership of these investments, mutually, with many other people. Your mutual fund manager decides when to buy and sell these investments and is responsible for ensuring there is enough liquidity available to provide cash to people who need to sell shares. The Fund also reports its taxable gains and losses to you as the fund’s owner (a potential impact of about 1.1% according to Morningstar[1]). Let’s take a deeper look.

Let’s say you own the fictitious Basic Blue-Chip Fund. The fund’s manager is responsible for the selection of the investments you own vicariously through the fund. The manager and staff need to feed their families, so they charge an annual fee to each person who owns the fund: the expense ratio. The expense ratio is an annual fee disclosed clearly in the prospectus and appears on most materials presenting the fund. Several academic studies have been published in recent years finding the average expense ratio is between 0.90% and 1.19%.[2] Let’s call it an even 1% for ease of conversation. The fund company also clearly discloses distribution fees, called 12b-1 fees, which generally range between 0.00% and 0.75%. If you’re paying a 0% 12b-1 fee, most of the time, you make up for the discounted cost in another method, such as a fee-based account, a retirement plan advisory fee, or in transaction fees if you DIY.

The manager must now run the business of investing the money you entrusted to the fund, the costs of which don’t show up in your expense ratio. The management team calls upon their colleagues around the industry for help. They ask the financial firm “Bond Co.” to research the government bonds they should use in the fund. In return, they pay Bond Co. a commission when they purchase the bonds. In many cases, they also ask Bond Co. to house the bonds for them at their firm using what is called an omnibus account, a service for which they will pay an additional fee. These are disclosed (generally in dollar values) in a document called the Statement of Additional Information which is available on request from the fund. Funds also experience a phenomenon called “price impact” when they engage in these transactions (which is a little more technical than we want to get in this article). These costs average approximately 1.44%.[3]

SO if you have the basket of investments that earned 10%, and you own them in the form of a mutual fund,

The assets earn 10% in the fund

The Fund pays its management team about 1%

The fund pays its distributors .75%

The Fund experiences 1.44% of internal costs relating to the acquisition and

disposition of the assets

So in total, you actually experience a cost of 3.19%. You don’t see this on a bill, but instead it shows up as a reduction in the Mutual Fund’s return so you would see a return on your statement of 6.81% instead of the original 10%.

We don’t believe that these fees and costs are necessarily a

bad thing; In fact, recent data published by George Mason University suggests

that, on average, a 0.02% increase in expense ratio provides an average

increase in performance of 0.13%.[4] But we do think it’s important to understand

your fee structure so you can make the most informed decisions possible.

[1] http://news.morningstar.com/articlenet/article.aspx?id=373782. More recent studies by Morningstar show that fees have declined on average since the 2011 study, showing an arithmetic average of 1.10%. The decline of geometric average is primarily attributed to the increased popularity of passive mutual funds which generally have expense ratios of about 20bps.

[2] Cf. Kinnel, Russel. "Mutual Fund Expense Ratios See Biggest Spike Since 2000." 19 April 2010. Morningstar Advisor. 31 January 2011.; Edelen, Rodger, Evans, Richard, Kadelec, Gregory. “Shedding Light on “Invisible” Costs: Trading Costs and Mutual Fund Performance” Financial Analysts Journal Vol 69 No. 1. ©2013.

[3] Edelen, Rodger, Evans, Richard, Kadelec, Gregory. “Shedding Light on “Invisible” Costs: Trading Costs and Mutual Fund Performance” Financial Analysts Journal Vol 69 No. 1. ©2013.

[4] Horan, Stephen M and D. Bruce Johnsen. "Does Soft Dollar Brokerage Benefit Portfolio Investors: Agency Problem or Solution?" George Mason University School of Law (2004): 4

I believe every one of us is searching for significance and satisfaction in life. My work as a financial advisor has put me in contact with a lot of different people at differing levels of wealth and poverty, and I’ve become convinced of a simple truth:

Success, satisfaction and significance aren’t born out of your account balance or income, but are achieved by the way you engage life in the present

In the first part of this series, we discussed talked conceptually about engaging life. This article is about practical ways to begin more effectively engaging each moment. I would encourage you to choose one or two habits to start practicing and then come back when you begin to see how these are changing your life.

People are really important. Though the statement should be somewhat ubiquitous, we live in a lightning-fast, “connected,” culture that demands immediate responsiveness and determines personal worth based upon output. To preserve our position in society, the pressure is on each of us to do more, stay in our lanes, and give into the constant barrage of push-notifications, texts, emails, and tweets, all-the-while staying in our own lane just to keep up with social and professional expectations.

While we can’t completely eschew cultural or professional standards, we can choose to embrace our inner-contrarian and foster relationships with others instead of our Facebook addictions (I realize the irony of posting this article on Facebook… and yes, I would love for you to share it). Here are three easy things you can put into practice here.

When you do these things, you’re fostering real relationship instead of fostering your technology and productivity addictions. You’ll also find that everyone around you will begin to see that they matter to you. Your relationships will deepen, your impact will grow, and you’ll become more satisfied in the way you’re engaging life.

It’s not always easy to see everything we’re called to do or be, but it’s usually easy to identify things that are counterproductive. If you identify something that gets in the way of engaging life the way you should be, make a change. Write down the activity or distraction you would like to eliminate from your life, create a plan for how you are going to avoid the old habit and replace it with something better. If you’re really ambitious, try doing making this a monthly practice.

You’ll need to take some time to be mindful in order to accomplish this. I like to take regular pauses during my day just 2 or 3 minutes every couple of hours to ponder. Others like to journal, or take ten or fifteen minutes to visualize their day and then time to reflect in the evening. Try some different things. You might want to set a reminder on your phone to remind you to be introspective.

I believe gratitude begins to grow as we begin to serve others. That’s another post for another day, but if you really want to grow your gratitude, there are three key things you need to do giving and serving being the most important. VOLUNTEER and DONATE!

There’s a third habit that is simply learning to express your gratitude over and above complaining. If you’re anything like me, you’ve probably found that complaining is the easiest form of communication. It’s taken me years of practicing gratitude only to find that I have a lot more to do. To be successful at being a grateful person, you need to respond to frustration with thanks. When you catch yourself wanting to grip about something ask yourself, “how might I be blessed and not realize it?” Enlist your spouse and your friends to help with this by encouraging them to respond to you when you complain with questions that will help you search for blessings in the midst of your frustration.

When you do these things, you’ll have better relationships, connect with your purpose, and you’ll begin to find that some of the dreams, goals, and plans you’ve had were really distractions from engaging life in a way that will bring you true satisfaction. At the same time, I believe you will be able to pursue your passion and create the best future you didn’t even know you wanted!

I believe every one of us is searching for significance and satisfaction in life. My work as a financial advisor has put me in contact with a lot of different people at differing levels of wealth and poverty, and I’ve become convinced of a simple truth:

Success, satisfaction and significance aren’t born out of your account balance or income, but are achieved by the way you engage life in the present.

We are constantly making significant decisions. They don’t always look like life-changing opportunities, but they are always in front of us. They’re choices that build on one another—like the times you’re in a rush to get something done and you decide to break from your frenzied routine and tell your spouse how much the matter to you. We make little choices everyday that we don’t think about. We choose to watch show after show on Netflix instead of reaching out to a friend. We walk by friends and acquaintances asking them if they are well, decidedly content not to engage in their response. (What if we did?)

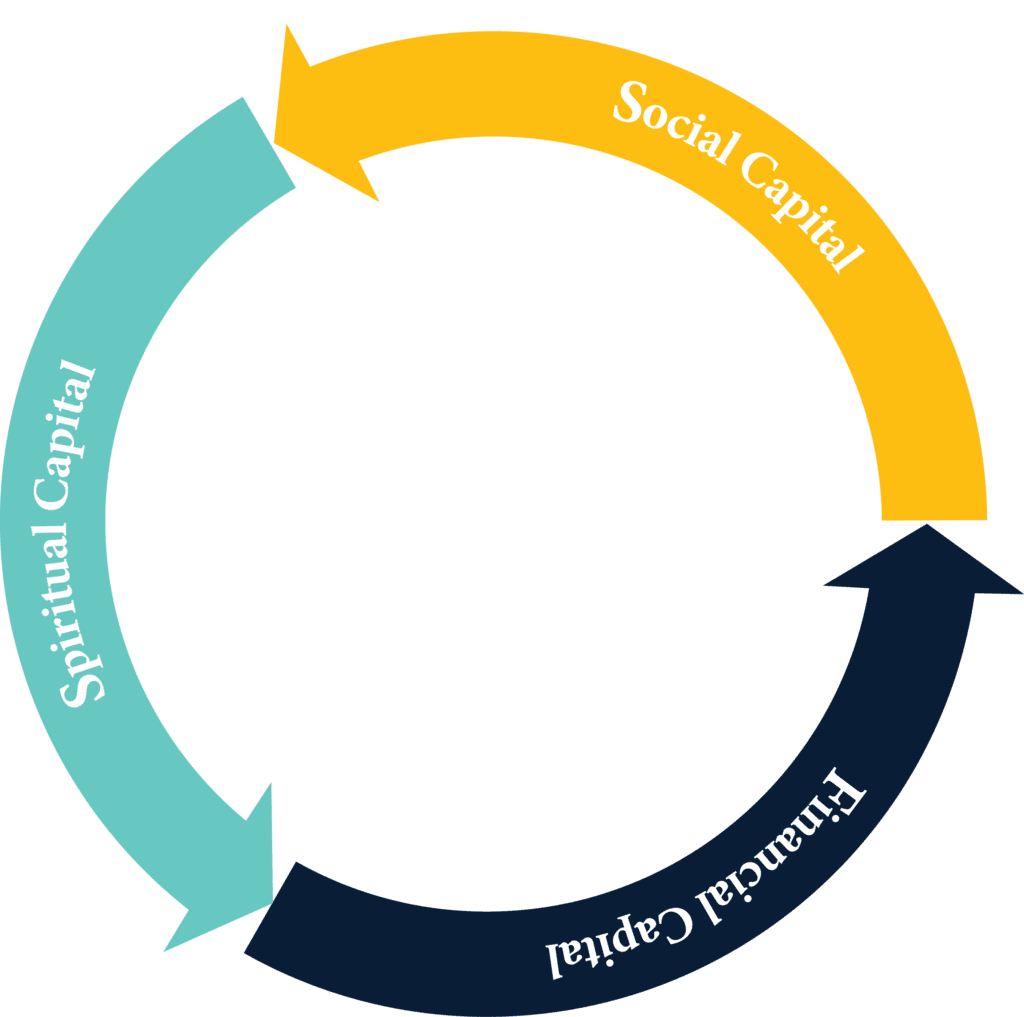

We make choices all the time. Some of them are smaller while some are larger. some of them are financial, some of them spiritual, and other are relational. As a financial advisor, I generally see people when they are thinking about financial decisions. In reality, there are a few different types of capital we need to think about spending, investing, and growing.

Here’s the thing about these small decisions that create this kind of eternal significance. Every moment in which we act, we take a step forward on one path or another. Even indecision, or inaction is a step forward in the timeline of our lives. We create futures with these steps, building them into a masterpiece, or we leave them weathered, worn and underdeveloped. We pursue our passions, or we let them fade.

The hard truth in this is that we make choices that don’t lead us to this kind of significance and success all the time. When our priorities are misaligned, we find ourselves on facebook instead of face-to-face with the people who are right there. At other times, we do things that insulate us, from communities and our own fears. We choose to be disengaged or to build up walls to protect us from our fears or even from self-understanding. Decisions like these are often ones of apathy because it can seem easier to continue on the path of a disengaged life.

The fantastic news is that each of these moments is new. You can live in a way that makes each moment significant, STARTING NOW. Every day, we encounter opportunities to engage life in such a way that we will make an eternal impact, creating a future for ourselves, our families, and our communities.

I encourage you to start engaging life on purpose. Though there is no set path to follow, I’ll be writing about a few simple ways get started in my next post “Engage Life – living on purpose.”

This three part series of articles was originally written by Christa Hudak in November of 2016.

Budgeting documents my financial growth. It is helpful to periodically evaluate where you are, where you have been and where you are going. If you don’t have a record, it is very hard to make this evaluation. It can be incredibly encouraging and motivating to recognize your progress. On the flip side, if your evaluation shows that you have not been making progress toward your goals it may help you realize it is time to start making some changes.

It is important to celebrate your wins and recognize what you have achieved. It fuels your motivation to keep pushing toward your goals and challenging yourself.

Budgeting allows me to live larger. When you are in control of where your money goes you can put incredible focus on the things that are important to you and accomplish more than you ever dreamed was possible. Truth be told, there a lot of areas in which I am very frugal, sometimes to a shocking degree. In other areas, we spend very freely. This practice is quite purposeful and it allows us to have a much greater impact in the things that are important to us than our income would generally allow. Are your finances a hurdle to overcome or are they propelling you toward your goals? Is money a stress and a worry, or is it a tool accomplish things of true significance? No matter your financial situation, you can begin the process of priorities-based budgeting and you will be amazed at what becomes possible.

This three part series of articles was originally written by Christa Hudak in November of 2017.

Budgeting relieves financial stress. A big source of stress is uncertainty. Simply not knowing where your money goes or what you will be able to afford is stressful. If you run a budget and track your expenses you know what is going on with your money and you have a good sense of what you can and cannot afford. This in turn will enable you to make appropriate choices in how you commit your money.

When was the last time you applied for a home loan? If you have at any point and you kept a budget at that time you were probably shocked at what the bank was willing to lend you. However, if you did not have a handle on your finances you may have said something like, “great, I didn’t know I could afford so much!” But what you can afford and what you qualify for are two very different questions.

Let me make one thing clear: It is not the bank’s job to determine how much you can reasonably afford in your situation. The bank’s job is to give you as many options as possible (as their customer) and not expose themselves to too much risk. Only you can make the determination of how much is reasonable for you to afford given your specific situation and priorities.

This is true of a lot more than mortgages. We live in a society bursting with payment plans, leases and longer and longer-term car loans. It is not wrong to utilize these tools in the appropriate circumstances, but you need to be able to evaluate them appropriately. Saying to yourself, I could probably scrounge together another $137 per month while you sign on the dotted line for your new car stereo is not really evaluating your budget. Making financial decisions in this manner will lead you down a path stress, worry and often financial hardship.

However, if you have a written budget in which you track your expenses you would easily be able to determine if there is surplus income or an area you are willing and able to cut back in so that you may buy the car stereo. If you determine that it is feasible and valuable enough you can move forward with the purchase stress free.

Budgeting shows me my priorities. You show me how you spend your money and I will tell you what your priorities are. I don’t mean your theoretical, sky high priorities, but your priorities in reality. Your functional priorities are the things on which you spend your time, energy and money. Looking at your budget can be a great opportunity to ensure that your functional and espoused priorities align as you want.

It is probably safe to say that we all prioritize a safe and stable home for ourselves and our family, which is why a large portion of most budgets are housing expenses. On the flip side, it is not accurate to say you value helping those less fortunate than yourself if you never expend any of your time or financial resources doing so.

Not only does budgeting help you see your functional priorities, it can be a tool to align your priorities with what you want them to be. If you recognize that you want to do something that you have not been, creating a place for it in your budget can make a big difference. For example, if you want to work on developing your relationships with your friends you can create a specific category for doing activities with, hosting and eating out with other people. Not only does the category give you the permission to do these things, if you are part way through the month and realize you haven’t spent that money you know it is time to pick up the phone and invest in your relationships.

Remember, your time and money are both limited resources, which means saying yes to one thing means saying no to something else. Take the time to consider if you are saying yes to the right things and you are comfortable with what you are saying no to as a result. Budgeting is not just about making sure that you spend less than you bring in, it is an opportunity to evaluate that your money is going to the things you want it to and accomplishing your goals.

This three part series of articles was originally written by Christa Hudak in November of 2017.

Truth be told, I am kind of an odd duck. I actually like to budget and I always have. There have been times when I did not like what I saw, but I have always liked to budget. However, I know this is not the case for most people. In fact, for a lot of people the idea of budgeting or reviewing your finances brings with it emotions of fear, anxiety, embarrassment and even sheer panic.

I understand that not everyone is wired to be a neurotic budgeter like myself, but I do believe it is critical for everyone align themselves with a basic budget. I want to share with you why I love budgeting.

I know that this seems backwards to so many who struggle to live by a budget or who never have, but I feel I have freedom in my finances because I budget. Sometimes I wonder if budget has become a dirty word and it may be helpful to think of it as a monthly financial plan. Frequently, people start to budget because they recognize they need to spend less and so the budget becomes about spending as little as possible in each category. Sometimes that is the reality of life, but it is a problem if you are never able to graduate from this perspective.

To help you understand how budgeting gives you freedom, I want to lay out a scenario for you. You and your spouse both work, you have decent incomes but there never seems to be enough money at the end of the month and you have fallen into the habit of carrying a balance on your credit card. Your major expenses seem reasonable but you know all the little things are adding up in a big way. Your vice (because it is a budgeting stereotype) is coffee. You grab at least one latte every day, sometimes a second if it has been a rough day or you feel like you need a pick me up. The problem is, as your finances have started to get out of control you have started to feel guilty about this habit.

If you able to actually develop a budget with your spouse you line out all your general expenses and make some categories that make sense for how you live and your priorities. All of your expenses will be allocated into one of your budget categories. One of the categories you decide is that you and your spouse each get a “Fun/Discretionary” category, which is for each of you to spend on whatever you want. After thinking about it, you decide this is where the money for your lattes comes from. By having this category, it gives you the freedom to enjoy the pleasures in life, but also a cap on what you have decided is reasonable. You may or may not be able to get a latte every day, or you might decide to skip the lattes for a week so you can go out to lunch instead. You are now able to be in control and make these choices guilt free.

First of all, let me direct your attention to the CFP Board of Standards, for the best generic summary of what to look for in a financial planner. [click here to read it]

Second. These articles about what you should look for in a financial advisor often leave much to be desired. Almost every one of them is written by someone with a significant conflict of interest. I have one too: I want you to do business with me. Right? I’m obviously going to say you should look for traits I possess so that when you call up to interview me, I’ll check all the boxes. (by the way, if you want to contact me about your financial needs, my direct line is 406-206-7571). For the record, if in any business transaction, someone tries to explain that they are “the one” who is solely looking out for your best interest… run away.

On to the Article…

I don’t want to rewrite the “what to look for” article for the 20,000th time. I have noticed, however, that there are some very important things that are missing from all of these I’ve read as well as a few factual errors that frequently show up as misdirects. I’m going to highlight these here.

Ask them: “Tell me about your finances?”

I believe that every person giving advice should be following their advice. I think Financial Advisors should have their financial lives in order. One of the great things about the investment industry is also to its detriment: the “Financial Advice” Industry was built as one of opportunity for the tenacious (think of the Will Smith movie Pursuit of Happiness). It’s great that people can change their circumstances and many who find success selling investment products actually master their own finances, but many don’t. It’s fine to do business with someone who is great at the stock market, but doesn’t have a clue how to manage expenses. You should know who you’re signing on with and how they do or do not fit your needs.

I could go on into a dozen examples, but I’ll simply note that success in retirement has more to do with how you manage your spending and your risks than it does the amount of money you earn the hot stocks.

You don’t need to get a detailed balance sheet from a prospective advisor. What you need to know is how they are on the right track themselves. If you were to ask me, I would tell you how my wife, Christa, and I learned to balance a budget when we were living on $9.50/hr and avoid the use of short-term debt. I would talk about how we worked to pay down our non-mortgage debt, and how we eventually paid it off. I would talk about how we’re saving for retirement, how we have capital for our present needs, and how we strive to grow in our generosity each year.

We have an articulated plan. We follow it. We talk about it. Whomever you are interviewing to help you be successful in your financial life should be do the same. They may be in an entirely different point in their financial life than I am (for being 30 I’ve learned a lot, sometimes the hard way, but I expect to grow and get better at living for at least another 60 years), but they should be able to talk about their financial story past, present and future.

Do you serve a diverse group of clients?

One of the questions most of these articles suggest is this “describe your typical client.” The reason for the question is because you should know your advisor can handle a situation like yours. I think it’s a good question, but I always hated when it was asked. After a number of years contemplating the question, I realized why. I may or may not have clients with the exact situation you do. You may be one of two clients with the same exact financial details. An advisor could primarily serve retirees who have an median asset value of $750,000. The advisor may have a number of clients with less, and clients with a lot more. If you’re in the $2,500,000+ club, you’re a fraction of a percent of the US population, so odds are, most advisors only have a couple of you.

I think there is a better way to gauge the advisor’s relevance. The one question should really be three.

How are you living in a way that recognizes the world is bigger than yourself?

Because generosity is an important financial discipline, your financial planner should have eyes for something other than his/her pocketbook. I know many advisors that are wonderful people who are working hard to make their communities better, to bless their neighbors, and make a difference around the globe. I can write out a long list of advisors who are doing things like foster care, global relief work, volunteering with at risk youth, helping people with disabilities, and more. In my travels I’ve talked to hundreds of other advisors with different perspectives and lifestyles when it comes to service, but I can say that I have yet to meet one who is passionate about serving and giving to others that has given me a reason to question their professional character or the quality of their advice.

The “fee-only” Myth

This one is flagrant. Fee-only is different… not better.

It seems like it’s plastered on every blog, “make sure your work with an advisor who is only compensated on a fee basis because commissions make advisors do too much trading and buy the investments that pay them bigger commissions,”. It’s asinine and a bold-faced lie told by a growing number of people in the financial industry. Asset-based fees and commissions are different, but none is universally superior. If an advisor doesn’t grasp this, they simply lack experience and are buying into a widely circulated misconception. (sorry to my fee-only friends, my intent is not to insult.)

The truth is, the best interest of a client is best served by the most cost-effective solution balanced with the most ideal result. Sometimes this is best accomplished on a fee basis, but it is sometimes most effective to charge a commission. (Please note that I am presently a fee-only advisor. I just don’t like dishonesty in marketing.) As a fee-only advisor, I have conflicts of interest too, even if I’m a charging the same fee across all products. Those things don’t force me to do what’s in your best interest, it just changes the way our relationship looks.

Sure, I’ve seen a lot of circumstances in which someone came to me after another advisor had charged them a commission for an unsuitable product or engaged in what were perhaps abuses of the commission-based system. But what about the advisor that charges a recurring fee that produces a high profit margin and does nothing for the client? There are a lot of responses someone might toss back at me, for example, most fee-only advisors are only “Investment Advisors” under the Investment Advisors Act of 1940 (or their representatives) and are thereby fiduciaries. First off, Fiduciary status isn’t the result of fee structure. There are commission-based advisors who are fiduciaries. Second, “Fiduciary” is usually a legal term, and it’s always a technical one, and it doesn’t always mean the same thing. When you hear the term Fiduciary, you need to know what kind of fiduciary, and what standards they need to follow. There are ERISA (retirement plan) Fiduciaries, Fiduciaries under the Investment Advisors Act, and fiduciary standards for various credentials like the CFP®. The short answer is this: everyone in business has a conflict, and no fee structure can eliminate that.

Sorry about the rant. Here’s the question you should ask:

“how do you evaluate your recommendations and compensation that minimizes your conflicts of interest and is fair for the products/services you are providing?” If they dazzle you with a bunch of technical information to avoid the question, give you a non-answer such as “that’s just the price for access to the markets,” then ask the question again. As financial professionals we should all have a satisfactory response to this question.

The most important part of choosing a Financial Advisor is finding someone you trust, who has the ability to help you with your financial needs for the long term. If you have questions about the process of finding the right advisor for you, reach out to Co|Create for help.