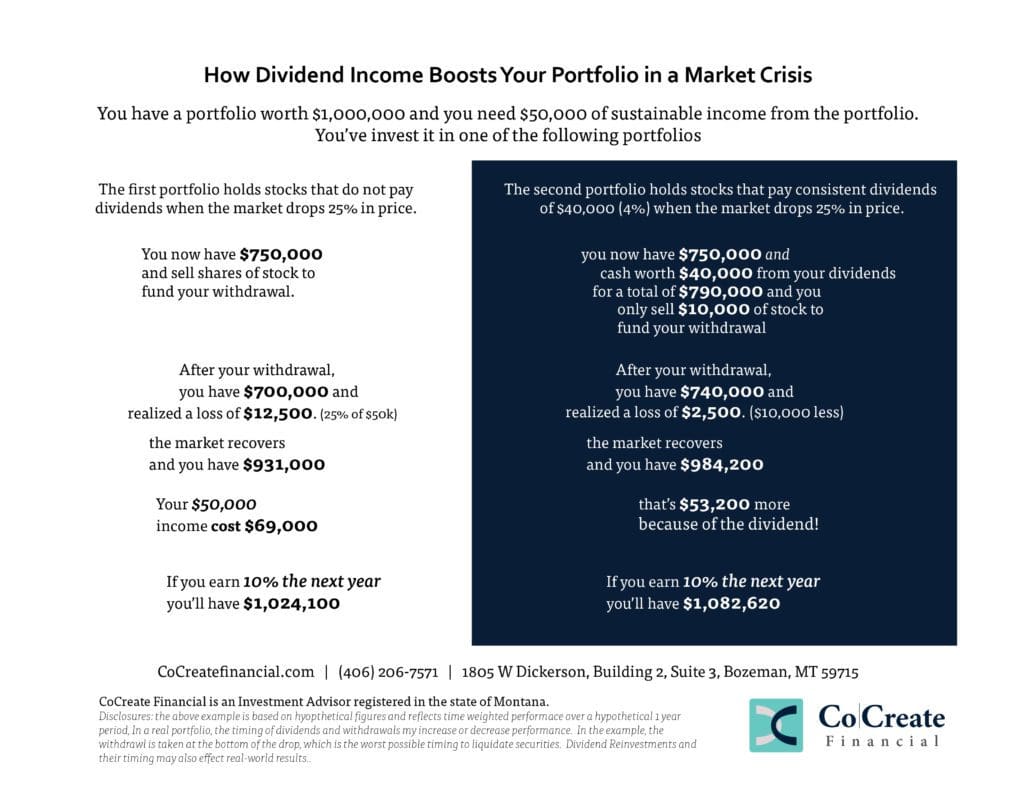

Dividend Income provides more stability to your portfolio and enhances your performance, especially during market crises. Today's general perspective on dividends is that they don't matter... clearly they do.

If you're like most people, who are in the left column, let us help you make sure you're in the best position possible to Pursue Your Passion!

2020 is in the running for one of the most bizarre years in American history. We’ve all spent most of the year just trying to decipher what’s happening. Some of us have been fortunate in the midst of it, and some of us have experienced great loss. At CoCreate Financial, we’ve been doing everything we can to support our local economy, from trying to help business owners make decisions on relief options to more than 100 contacts with legislators and officials. The way we see it, if our economy died and took our client’s livelihoods, it would be even more impactful than a market drop. There are quite a few things no one has ever seen before, including widespread economic shutdowns mandated in most states and massive stimulus packages that dwarf anything previously imagined. I’m tired of the term, but 2020 has truly been an unprecedented year—unlike any other. Our 2020 economic update is mostly an article about risks we are looking out for with hope and optimism.

We’ve also had our heads down, diving deep into a myriad of data and research trying to foresee various outcomes, both short-term and longer-term, that could affect the businesses our clients own in their portfolios. This has meant making meaningful, educated conclusions based on all of the available data in an environment when that data often means something different than it did before the shutdowns. That meant having to determine appropriate adjustments to the information, which was changing at a very rapid pace with very little consistency. This has made it difficult to put together relevant publications of any nature. By the time you finish a Google search on the topic of the day, the world has moved on to a new issue or data-point that appears to be contradictory to the first on the surface.

As we reach a point in time with a little more stability in data, we look forward to putting this year’s election season behind us. Overall, the businesses that are surviving the closures have shown their strength and have grown in their ability to adapt to new situations. There are substantial risks to mitigate in the near-term and long-term for investment portfolios, but we should see continued growth, albeit slower growth, for those who are invested selectively in high-quality businesses with a long-term perspective. We’ll address some of them below:

We’ll be brief on the topic of Covid-19 and its effects on the economy. They are extreme and very dramatic. They are also very temporary. There are three primary reasons the Virus and the gubernatorial closures will have a limited ongoing impact. The first is the amount we’ve learned about the virus and how to treat it. The initial wave of Covid in the US was dramatically different than the second, with deaths and hospitalizations decreasing by astonishing proportions after their March peak (even while cases rose to new levels. We made great strides in testing, intervention techniques, and therapeutics. Since the time we began to see such drastic improvements in our response, Covid statistics look much more like those of illnesses we’ve lived with every day and payed less attention to. Because of this, we believe the impacts of Covid-19 on the economy will not be permanent.

Secondly, most people seem to believe the Covid situation has been turned into a political issue and the election is immanent. We agree. We also think that much of the Covid propaganda (from all sides) will quiet in November and getting life back to normal will become the path to every politician’s next reelection.

Third, as we’ve watched the numbers, from unemployment to the number of people looking up directions on their phones each day, something significant began to stand out. First, people self-regulated before governors issued their various mandates and then after a period, people slowly began to reengage life. Unemployment is still high, but it is artificial because most of the businesses that have survived are already wanting to re-open and re-hire the workers they temporarily laid off. Americans have been making every sacrifice they can to keep from spreading the virus or contracting it, while continuing to live life to the best of their ability regardless of their governor’s orders. They have been putting conscience and necessity ahead of rule which will help us survive our politicians who care more about the outcome of the election than they do the people they supposedly serve.

The biggest long-term impact will be the extreme number of businesses that are not reopening their doors. In a quarterly economic report published by Yelp regarding the status of their listed businesses, some 55% of businesses that reported closing for Covid stated they would not re-open their doors. To date, there are more than 100,000 permanent closures that we know of. That number has undoubtedly grown as the year has progressed. To reach a full recovery, we will need to replace these businesses with new ones.

There is a positive side to the employment situation in that businesses have had the opportunity to creatively redesign their staffing structures and those with an entrepreneurial spirit have dreamed up new ideas. They will create exciting new businesses out of a combination of passion and necessity. While we don’t believe these silver linings make the shutdowns tolerable—especially considering their impact on things like domestic violence, child abuse, addiction, and suicide, but we do believe in our ability as Americans to make the most of it.

Pumping money into the economy in a crisis makes a big difference. In the midst of state governments shutting down commerce, it was perhaps necessary for survival. When we see it play out, stimulus packages look a lot like an athlete on steroids—it enhances immediate performance, the athlete gets credited with an exceptional feat of athleticism and experiences the long-term health consequences of steroid use. In terms of Stimulus, the Cares Act stimulus was far and away the most effective stimulus package in recorded history. Not only was the amount of federal dollars handed out off the charts, but it was done in a way that actually made it into the hands of businesses and consumers. We don’t have much to compare this to and can’t even look at the “Quantitative Easing” that was intended to stimulate the economy after the 2008-09 crisis because those funds never made it into circulation. This shouldn’t cause any kind of crash. Instead, it will slow the overall growth of the economy and should cause astute investors to select individual investments rather than trying to replicate the US economy broadly.

When it comes to personal finance, we like to say “debt always mortgages the future.” This is true in Government Fiscal Policy as well. The more we borrow, the more we have to pay back at a future date. If we look at the US Economy in terms of GDP (essentially the dollar value of all of our commerce), there is a finite amount of money to go around. The government taxes individuals and businesses and also spends a piece of the pie (GDP). When they have more debt to pay, they need a bigger slice, which takes resources away from individuals and businesses who are the ones produce economic growth. Deficits don’t cause crashes, but create long-term obstacles for the growth of the economy. It is conceivable, however, that a rapid rise in US debt could result in the US government’s bond issues affecting the marketability of other fixed income securities (we’ve been avoiding these in our accounts because of their instability after Dodd Frank, QE, and potentially now this).

“The Fed,” meaning the Federal Reserve Bank and its board decide what rates they will pay to banks or other major financial institutions that want to borrow from them. They will lend and recall these loans to influence how much capital is floating around in the economy. This activity influences inflation, and the Federal Reserve has had a intermediate/long-term goal of 2.0% inflation. We’ve experienced inflation below 2.0% for some time, so they have recently announced they are willing to let inflation exceed 2.0% to bring balance around their target.

Inflation has to do with how many dollars are in circulation relative to the stuff being bought & sold. Simply put, if a dollar bill is hard to come by and a box of cereal is not, then you can buy a lot of cereal with your dollar. If one hundred-dollar bills rained from the sky and covered the ground, one dollar wouldn’t buy much of anything at all. We measure this in economics. “M1” is how much money exists, which is whatever the Government creates at its whimsy. The government can create tons of money that never enters into the economy (which is what happened in response to the Great Recession). It basically sits on the shelf and has no impact on the economy. When it actually goes into use, it becomes “M2.” To our knowledge, the amount of money in circulation (M2) has never “rained from the sky” like it did earlier this year. Investments and financial plans will need to accommodate for higher levels of inflation for the foreseeable future.

It’s important to remember that every politician’s approach to governing involves tradeoffs based on their political priorities. Our assessment of economic and tax policy is mathematical rather than philosophical and will be critical in projecting potential outcomes over the next 6 years(ish). in our assessment of this, we’re attempting to look at the economic/fiscal policies in isolation from everything else, which is not how any of us should consider our ballots. You should vote by making educated decisions on a number of issues that reflect your personal convictions. Also, the economic/tax situation doesn’t change on election day. Frankly, the President isn’t actually as important in these policies as we tend to think. Many of these issues will be addressed in Congress. We will have time to patiently adapt after the election, though “the markets” may quickly overreact and then level out.

Fun Fact: the federal government has never balanced a budget when their spending has exceeded 19% of GDP.

We’ll spend less time addressing the philosophies of our present administration because a second term will likely bring similar results. The extreme political fighting between parties in the media and on twitter acted like a smoke-screen as the President was more active in policy making than almost any other president in history (whether you feel its for better or worse). The President loosened regulation that various industries felt was overly burdensome in favor of free-markets and consumer choice, began to overhaul the tax system and negotiated new trade deals that removed hundreds tariffs that were disadvantageous to the United States. Admittedly, we didn’t believe the latter would work out, but it’s hard to argue with the economic results. That’s not to say these things don’t come with a cost, but the economy liked the policy enough that it remained resilient in the midst of a crisis the likes of which we haven’t seen since the Civil War. We’re getting back on track.

If there is a downside to the President’s fiscal policy, it’s that he is overeager to stimulate the economy and is too willing to borrow money to fund excessive government spending (more on that later).

Biden, the Challenger’s, proposed policy looks like what you would expect from someone running for office—its convoluted and lacks detail. If he wins, we’ll eventually see it with more clarity. What Biden and Harris have proposed isn’t great news for the overall economy, but economics isn’t really on their list of political priorities. Again, we’re not trying to endorse a candidate, we’re just looking critically at one issue in isolation.

If Biden’s administration is successful at implementing their proposed changes, they will add a number of different taxes to businesses, from raising tax rates on business income to adding a tax on US-based businesses assets that are not currently US-based and doubling the Global Intangible Low Tax Income. These changes will add about $2.6 billion to the government’s revenue, but will change profit margins substantially. The hit would be about 500,000 jobs and a decrease in the intrinsic market value of impacted businesses somewhere between 3%-10%. This will be a difficult challenge especially when paired with the reinstatement of regulations that were challenging to businesses. Again, this is one issue among many, and his intent would be to expand entitlements with the $2.6 billion to offset the difference. One of the biggest challenges with this policy is that it will reduce private retirement funding sources by that same 3%-10%, and the 2.6 billion likely won’t be enough to replace it.

The challenger’s proposed policies will impact individuals differently than corporations. For individuals earning over $400,000/year, the impact may be rather extreme. The marginal tax rate will increase to 39.6%, and it will limit itemized deductions to 28% of their incomes (most of which are charitable contributions). It’s important to make note that his promise not to raise the marginal tax rate for those earning less than $400,000/year does not necessarily mean the taxes they owe will not increase. The Tax Foundation reports in their extensive analysis, “The bottom 20 percent On a dynamic basis, the Tax Foundation’s General Equilibrium Model estimates that the plan would reduce after-tax incomes by about 2.5 percent across all income groups over the long run. The lower four income quintiles would see a decrease in after-tax incomes of at least 1.1 percent. Taxpayers in between the 95th and 99th percentiles would see their after-tax income drop by 2 percent, while taxpayers in the 99th percentile and up would have a more significant reduction in their after-tax income of about 7.6 percent.”[1]

Perhaps more significant to the individual at all income levels is how his policies will impact 401(k)s and retirement savings. After the impact of the corporate tax changes reduces intrinsic values of 401(k) investments, his proposed plan will make dramatic changes in the deductibility of retirement savings and the availability in employer plans.[2] The proposal intends to eliminate deductibility of 401(k) contributions (to be taxed at withdrawal), and replace them with a matching tax credit. We’re ok with this at first glance because it could mean lower taxes for savers in the immediate future, but it will actually end up causing substantial government budget issues over the long-term as it disrupts the tax deferral system on which retirement savings accounts rely. Biden’s plan will also reduce the total amount an individual can contribute each year to 20% of their income or $20,000 (from 50% & $53k) including their employer’s contribution. This will have a tremendous impact on individuals at all income levels and disincentivize employer benefit plans altogether.

Once more, this is not intended to be a pro-Trump or anti-Biden commentary. They have different priorities, and our focus is on projecting a range of potential economic outcomes and developing a corresponding playbook to help maintain our clients income and account values over the long term. We are preparing for each risk and opportunity as they seem to arise, and very unlikely that Biden’s policy will bear much resemblance to its current form after the House and Senate put it together.

Over the past decade, it’s been hard to keep pace with the growth of huge Facebook, Amazon, Google (now Alphabet Inc), and Apple stocks. There is even an acronym, FANG (N for Netflix). Together, Facebook, Amazon, Alphabet and Apple make up about 17% of the S&P500 (which is why index investing has appeared to be so attractive).

We are about to see the end of an era, and it’s been on the horizon for a very long time. Yesterday, the House of Representatives Subcommittee on Antitrust issued a 449 page report detailing their investigation on the ways in which these companies have violated antitrust rules, abused customer privacy, and used their monopolies to control/eliminate their competitors and the free press. It was a fascinating read; however long. The committee stated that the house should pursue vigorous enforcement of antitrust laws against these companies. This will change the fabric of the S&P 500 and the way many people think about how to invest.

I remember two times in my career in which the average stock was down about 33% but the S&P 500 was not largely because of these companies. There were two things that thrived in these “silent bear markets,” strategically selected, dividend-yielding stocks and the “FANG” stocks (including a few similar companies). These Big Tech companies have had a huge impact in broad-based market returns. Finally, the government has recognized these as monopolies in a bipartisan investigation and will likely split them into multiple entities. We are working on another article to explain the impact of this in more detail, but in short, it will make mirroring the S&P 500 quite unattractive as an investment.

Consider this, if the average value of these 4 companies is 58 times their earnings (PE ratio) and the Government eliminates the competitive advantage attributable to their respective monopolies by dividing each company into 4 separate entities (the number 4 is arbitrary for illustration), the resulting companies may each be members of the S&P 500, but none of them will likely have significant influence on its return because of their reduced size. Furthermore, if their earnings multiples are close to a historical average for the other companies in the S&P 500 without the benefits of monopoly (about 15.8), then their cumulative values drop by 72.8% and the effect on the S&P 500 index is a 12.3% decline in value. From there, the S&P 500 will look much more like an average than an outlier. With the exception of Apple, who we expect to be just fine based on the specific findings, we had very little exposure to these companies because of the imminent and inherent risk that is just now materializing.

Not only are we at the beginning of a rising interest rate environment, which always causes the value of fixed income instruments to decline, but we’re approaching a season in which inflation will begin to accelerate (meaning that the fixed payment you receive today will buy less stuff tomorrow). The only way to increase your fixed income is to sell the investment at its reduced value (absorbing the loss), to buy new investments that pay more. To get the increased payments, you will likely be taking on more risk and paying a higher price for it.

Alternatively, dividend yielding stocks are an attractive alternative in this environment for producing income. When speaking of companies with good financial strength, we know that the dividend payments are extremely stable. Historically, these high-quality companies even tend to increase their dividend payments in times of extreme economic crisis. This gives you a rising income rather than a fixed income. More important to our inflation protection strategy, owning businesses (stocks), naturally adjusts to the strength of the dollar. Consider this example, as inflation occurs, the candy bar that cost 5¢ now costs 50¢. The Candy Co. has adjusted their prices to account for the strength of the dollar, their cost shifted from 3¢ to 30¢ which means their profit margin is the same. If they generally pay out 50% of their profit to the people who own the Candy Co, then the dividend has risen perfectly with inflation. In an ideal world, the Candy Co. would also find ways to increase their profit and grow their payout even more. Dividends are the ideal alternative to replace fixed income in a rising inflation environment.

We can expect the S&P 500 to lose its luster in favor of strategically identified investments. This is a highly complicated issue which we are tackling in an upcoming article, but it is significant for anyone engaged in “index investing.” Many investors have joined the fad of buying S&P 500 index funds started in the late 90s because of their low cost and competitive return. The biggest reason for the trend has been because of the obscene amount of marketing resources that were expended to promote these funds which back a now-studied and disproven theory that you can’t do better than the index.

There are a number of things that often don’t translate into the consumer’s thought process when it comes to the S&P 500. The most relevant of which is the concept of a “Cap-Weighted Index.” The S&P 500 is a cap weighted index, which means that each company participates in the overall performance of the index based on its total market value (called Market Capitalization). In today’s stock market, the top 10 or so companies account for the bulk of the index’s return. Over the past 5 years, the “FANG” stocks (Facebook, Amazon, Netflix, and Google) have been primary drivers in the S&P 500 index performing exceptionally well.

With the onset of bi-partisan work to “vigorously” pursue anti-trust enforcement against Amazon, Google, Facebook, and Apple, we’ll see a significant change to the structure and performance of the index. Investors will no longer be able to rely on the momentum of Amazon, Google and Facebook to make their index fund efficient.

The markets tend to overreact to headline news… even when it is as significant as election results. The best tool in our belt to manage the risks and opportunities we will see in the coming months is our cash allocation. As broad market risks grow, we can increase cash proportionally. Increasing cash allows us to mitigate losses and then reinvest at discounted prices. If the market explodes on a given headline, we can sell investments at a higher price to reinvest when the broader markets return to their normal levels. When dealing with the longer-term impacts, we need to remember that we are investing in individual businesses rather than the broader market. Each of the businesses in which you own an equity stake, will experience the impacts of these issues differently. As potential long-term risks grow for a particular company or their business model, we have a number of different choices depending on the probability and severity of whatever is on the table. We will want to be ready to hedge against certain risks (such as limiting losses with options contracts, though this comes with its own cost), limit our exposure to the company, or transition to a competing business that has a better opportunity to thrive in the environment.

[1] https://taxfoundation.org/joe-biden-tax-plan-2020/

[2] There is a great detailed article on the topic of 401(k)s at https://www.forbes.com/sites/ebauer/2020/08/25/joe-biden-promises-to-take-away-401k-style-retirement-savings-whats-that-mean/#6c4fc7164eb0

This article was written as a whitepaper we used prior to the extreme impact the Coronavirus lock-downs had on the employment situation across the US. Although unemployment rates skyrocketed and it it looks like a employer's labor market, hiring and finding the right employees is just as hard as it was before the virus, but as the country reopens, there will be more employers looking to fill open positions. Having an excellent employee retention strategy is more important than ever. We've published the resource below to help you start thinking about your retention strategy.

Nearly every employer, manager, and small business owner have been wrestling with the same question lately. Unemployment has been at a record low. The economy has recovered. Yet somehow some business can’t even stay open because their employees are moving on to new opportunities. HOW do you keep good employees for the long term?

CoCreate Financial’s most foundational conviction is that we “create the future… together.” We believe we do this for ourselves and, more importantly, those around us. As employers, we have one of the most profound ways to impact others—our businesses. By creating a positive employee culture and good employee benefit offerings, we can help our employees thrive and keep them around for the long term.

This article will dive into a few of the important pieces to an effective employee retention strategy and particular benefits you can use to create a magnetic business. Of Course, you can schedule an appointment with a CoCreate Financial Advisor to discuss your strategy.

Numerous studies have investigated the reasons employees leave their employers, and all have shown that compensation is rarely the primary reason an employee leaves their post. This has become a fairly well circulated fact, which, by now, is almost old news. Pay is often a job-change catalyst when an employee feels dissatisfied for other reasons. The biggest of these comes down to leadership within your business. After all, it’s about turning our employees into our business’ most avid fans.

For any of us, thinking critically about our own behavioral tendencies and professional philosophies, isn’t particularly fun. Often it can feel like the least effective use of our time. But a little self-reflection always goes a long way.

We’re all a product of context… Writing both as a Millennial and a business owner, I can fairly say that my generation was conditioned to approach their careers with a fend-for-yourself mentality. Big-Media, ENRON (et al), a Great Recession at the wrong time, and a highly politicized world of social media has conditioned many Millennials to be skeptical of business and “the elite” who are the owners. Also, if any business can go down in flames—or anybody can be laid off and struggle to get back on their feet, then pay-checks, retirement accounts, promises of the future, are all somewhat fleeting. (There were also a number of healthy perspectives that developed for Millennials too, like their emphasis on community.) I don’t think these skeptical presuppositions are remotely accurate. I’m not even sure how aware most in my generation are even conscious of their perspectives, but they insist that business owners and management must engage their employees differently.

There are a lot of resources on leading and developing your employees well (here are a two: research on generational differences; The Harvard Business Review), so I’ll only address two relevant ideas in this article.

You have to lead by example on the job, but you need to lead by example in commitment too. You have to commit to your cause (your business mission) and you need to show you’re willing to do whatever it takes to accomplish your mission (that means even the things that are “beneath you”). After all, your engaged employee is willing to do whatever you say it takes but if you aren’t willing to engage in a particular task, you either don’t really care about your cause or the task isn’t worth doing. This is old news.

You have to be “in-it” with them. There is another side to the paradigm. Being able to retain good employees means transcending the on-the-job management duties of leadership and becoming human with them. The need to see you connect with their experience of life and the world. This bridges the conceptual gap (however subconscious) for millennials between “elite” or “corporation” and “leader” or “professional family.” This doesn’t mean you have to agree with worldview or acquiesce in matters of business. Have conviction and give direction; just do so while demonstrating understanding and commitment.

Your employees need to know that they are your priority. Not the company’s priority—yours. This means you need to engage with them, ask for feedback AND RECEIVE IT (with humility and genuine interest), and you need to demonstrate your willingness (read enthusiasm) to invest in them. This is the foundation of your corporate culture. [you can’t just put something in a manual, a policy or memo… Culture is driven by you as a leader]

All of your employee benefits, compensation plans, and vacation packages have to be consistent with your culture and your heart as THE leader of your business. Any dissonance will engage the employee’s inner-skeptic.

Again, each of us is a product of context. Our perspectives, no matter how right or wrong they may be, came from our experiences. Yours did, and so did mine. When we engage others, we need to honor the experiences that led to their perspectives and values systems (that’s not to say we need to agree or necessarily validate their perspectives at the expense of our own personal conviction). This is one way you can apply the “personal” to your leadership and create an effective filter for creating employee benefits. Let’s take a look at some things that have been said about Millennials as an example, bearing in mind that these stereotypes don’t actually represent the majority of us.

| You’ve heard it said… | What experience shaped their perspective? | When we honor the experience we can create an effective solution within the employee retention strategy. |

| Millennials will only work at your company for a year or two and then quit. | They are younger and are focused on achieving a variety of goals, and are also racing to reach a place of financial stability their parents never had (you never told us, but we all witnessed it…). They spent an unusually high amount of time in college (possibly multiple degrees) before entering the work-force, so they value learning and growing into new challenges. | At your business, you can create pathways for growth, exploration, and developing new ideas to help the company grow (all within defined limits). Also, by laying out a career trajectory, you can create a way for them to achieve from within. They know that you usually grow your professional capacity more when you change companies, but this doesn’t have to be true at your business. |

| Write your example here: |

Your business has a unique mix of demographics. Employees in different life stages have differing worldviews, life experiences, urgent needs, etc. When your beginning to plan your employee retention strategies, you should make an evaluation of what these are for your business. I would recommend making a short list of all of your employees (or if you have a large number of employees, creating profiles that represent common personalities) and answering three questions for each:

Now that you have [done the above], you’re ready to offer a diverse range of benefits to your staff, because each one of them matters to you.

For a long time, many small employers have prioritized cost-effectiveness of their benefit plans, but in today’s competitive market for employees, the winner is the employer who puts retention-effectiveness first.

You should also market the exceptional quality of your benefits to your employees and why you care about providing each individual benefit.

Here are a few benefits you will want to consider as you specifically tailor your benefit plan to your unique employee demographics. Of course, you can always enlist the help of a CoCreate Financial Advisor to design and implement the employee retention strategy that is right for you.

Retirement plan options can become very complex, but most small-midsized employers opt for Profit-sharing/401(k) plans or Simple IRA plans. Here are a couple of considerations in selecting the right plan.

Many of your employees are working hard to pay down their student loan debt. This group of age-diverse employees feel a sense of urgency to get out from under their over-priced education. Not only do they have the emotional complications of having a massive debt hanging over their heads, they also have the immediate cash flow impact of its payments. Helping to cover the cost of this debt makes an immediate impact for your employees.

To make this benefit even more significant, many people wait to begin start saving for retirement in a meaningful way until after they have paid off their loans. This means that the employees student loans are hurting your employees doubly (interest paid & interest not being earned) while diminishing the value of your retirement plan benefit. By implementing a student loan repayment benefit, you can significantly help your employees and demonstrate you care about their situation right now.

Employer Sponsored 529 plans are becoming increasingly popular as well as help with student loans. There are some great aspects to this benefit but also some considerations to be aware of. 529 plans are tax-incentivized accounts, but the tax incentives are not as great as retirement accounts, however they may be more flexible than you realize.

When an individual sets up a 529 account their contributions are not deductible on their Federal taxes; however, most states offer some sort of tax benefit for contributions. In Montana you can deduct the full amount of your 529 contribution from your state income taxes. While there are currently 7 states who have incentivized employers to contribute to 529 accounts with additional tax benefits, in Montana, like most states, the tax structure remains the same regardless of if an individual or employer is contributing to the account. Any employer 529 contributions are taxable income, but your employee does receive a deduction on their state taxes.

One very powerful benefit you can use to motivate and retain your employees is the non-qualified deferred compensation plan. These plans are highly customizable and can provide benefits to your employees that become vested & available to employees at specified dates or triggering events (i.e. retirement). The date could be a ten-year anniversary, a retirement age, or specific year. The benefits can also be designed to be awarded only if your employee or company meets certain performance objectives. You can fund the employees future benefits now, create a plan to informally fund their benefits, or simply pay the benefits out of your cash flow when they become eligible to receive it. Because of the flexibility these plans provide, and the significant legal complexities in Section 409(a), These plans should always be established in conjunction with an attorney with experience in this area of law.

While non-qualified deferred compensation plans are often referred to as “golden handcuffs,” and often used for key executives or high earning employees, they can be used effectively to provide incentives and longevity benefits for any dedicated employee who does significant work for your business.

Never underestimate the power of a thank-you gift. Plan to identify a success for each employee at least once a year and give them a thoughtful gift in recognition. Do it individually. Do it thoughtfully. Do it at random. If the gift needs to be included in their taxable income, be sure to cover the tax liability for them.

We believe it is our duty to help businesses in their time of need. During the COVID-19 outbreak, we are offering free consultation to businesses who need help navigating the relief programs.

The best way to choose your relief options is to start with your business's needs. This flowchart can guide your thought process.

COVID-19 is here. now how do you invest in the wake of the 2020 Crash?

I’ve looked at hundreds of investment portfolios, and I’ve gone through the materials most advisors have used to create them (speaking generally of course). Occasionally, I’ll see an account statement or a portfolio model that stands out, but most of the time, they all look about the same. While I take a different approach than most, I feel the need to share some important information that will help your portfolio recover. If you’re already a client of mine, this won’t apply, but if you’re in the 90% of people with the same general allocation… Go get your statements… Listen up.

One of the biggest mistakes financial advisors make is assuming that the quality of your investments doesn’t matter as long as the portfolio as a whole seems ok. We can get into how Modern Portfolio Theory and the Efficient Market Hypothesis became twisted around since their development in the 1950’s & 60’s, but that would take a book (if you have questions, We would be happy to talk with you). Financial Advisors have been taught that the only risk that matters is the volatility of your portfolio. There are other, more severe, risks to which you’ve probably been exposed—all in the name of diversification.[1]

Look at your statement: You’ll likely find several investments with the terms: “high yield,” or “high income.” (on occasion, they will label these as income “opportunities”). These are called “junk bonds,” officially. They are “below investment grade” loans made to governments, corporations, and municipalities with particularly poor credit. They pay a high interest rate because they have more significant default risks. In good times, it’s an unwise financial decision to lend money to someone who can’t pay it back. Why do we do this in our investment portfolios? (FYI, because their price moves differently that “stocks” is a dumb answer.) You don’t need these to be diversified, and the times of crisis, in which bonds might help stabilize your portfolio, will certainly increase the risks that your borrowers won’t make their loan payments. If they don’t, you lose 100% instead of the 10, 20, of 30% you were trying to avoid.

Highlight these on your statements, sell them, and NEVER buy them back.

By “walking tall,” I mean get rid of your “short” funds. These are investments that make money when the stock market declines. These are generally a gamble and are among the rare investments that have unlimited losses when the market goes up in value. It’s well established fact that the stock market increases over time, so these are poor long-term investments. If you have them, they served you well in the recent drop, but as we approach the end of the decline, you’ll want to trade them out.

The impact of the COVID-19 outbreak will hit developing nations much harder that it will the United States (and a few other countries with highly developed economies). Most people own “emerging markets” mutual funds, ETFs, or even index funds. These are higher “risk” investments (read: more volatile), and actually have much higher risks (political risks, stability of the business themselves, Currency & Trade risks, etc.). Advisors keep these in your portfolio to be open to the opportunity that could arise if one country experiences rapid economic growth. Most people, however have a few funds that just own other funds focused on every country around the globe. These have been hard hit in the midst of COVID-19, and they will continue to lose value longer then that United States, and won’t recover quickly.

I’ve always believed with conviction, that if you have a significantly high probability of losing money on a given investment, it’s best not to own it. Like Junk Bonds, these don’t add much of anything to your diversification and they certainly won’t help your portfolio in the coming months, perhaps years. It’s time to move to investments primarily based in the United States.

Most people have a number of “index” funds in their portfolio. An “index” is just a fancy way of making an average. Indexes include a defined set of investments, usually weighted by size. They became commonplace in the 1960s when William Sharpe decided that they would be an effective way to measure covariance (at the time, measuring covariance of individual investments would have been impossible to consistently do by hand). They were never intended to be an investment, but became a staple in the 1990s and early 2000s. As quickly as they became popular, it became clear that indexes were anything but efficient and simple adjustments could almost ensure superior results. There are dozens of approaches, but they all perform a similar function: eliminate the investments that are clearly below average. Owning the index creates reasonably good returns, especially when times are good, but exposes your portfolio to the below-average investments you would probably never choose to own. For example, the Russel 3000 contains approximately 90% of publicly traded US companies. Owning the Russel 3000, you’ll undoubtedly own a number of small, poorly-run companies that will struggle to recover from the impact of COVID-19.

Instead of owning indexes, focus your portfolio around high-quality investments that have been resilient for many years, and have done well though other difficult times. Most of these will be mature, dividend-paying companies with long track-records of increasing their payouts. I would encourage you to work with your advisor to determine appropriate investments.

While staying within the bounds of your investment policy, you should reallocate from your expensive investments to those that you can buy for a bargain. At present, interest rates are almost impossibly low, which means the price of fixed income investments has risen, or at least has declined less than stock investments during the recent crash.

Let’s say you are invested in a portfolio that is 60% equity (stock), and 40% fixed income. If stocks stand to gain 40% in their recovery and bonds stay about the same (or decline as a result of rising interest rates), it is the perfect time to capture more of the recovery by shifting some or all of you fixed income investments into equity. By doing so, you would add a significant amount to the total return of your portfolio.

In doing so, it is important that you maintain the diversification of your portfolio. This means identifying investments that don’t move in similar fashion to one another. We’ve generally, and wrongly, assumed that bonds diversify stocks. Often times, they do. They also frequently don’t. Consider the following example: You own 100 shares of stock in the fictitious company CRP. They also owe you money because you own CRP bonds. If CRP loses revenue, the stock value declines. CRP will also have a harder time paying its debt, so your bond will lose value as well. Owning a stock and a bond make sense when the two have low “covariance” (their price movements are unrelated). This is a question of how closely related their price movements are, not whether it is a stock or a bond.

At the time of my writing, it appears that the S&P 500 is near the end of its decline. Its price dropped about 35%, factoring in an economic decline for the quarter of apocalyptic proportions. We would have to see a 80% slowdown in corporate profits over the next 4 months to justify the drop. While the reaction to COVID-19 has been extreme, it will not cause this level of catastrophe. Investments could continue to lose value, but are already at historic bargains. Now is the perfect time to begin preparing yourself to take advantage of the recovery.

We strongly advise working with a qualified investment

professional when evaluating your investment decisions. A CoCreate Financial advisor is prepared to

help you make the right adjustments to your portfolio in times of crisis and

have solutions designed specifically to make the most out of the COVID-19

recovery.

[1] Note: Diversification should have never been translated into “owning everything.” Being diversified means owning enough investments whose prices fluctuate independently (low “covariance”) of one another in such a way that the short term price changes in a single security will have a minimal effect on the overall value of the portfolio.

Investing involves risk in any market conditions. Your investments cannot be guaranteed and may lose value. The recommendations made above should always be considered in consultation with a qualified professional and account for your individual circumstances. These recommendations are given generally and should not be interpreted as individual investment advice.

We will be updating this post with a lot of relevant information including other businesses, experts, and community leaders partnering with us in this endeavor.

Register now:

https://attendee.gotowebinar.com/register/6573095321343961355

I believe that our economy is strong. I believe it is remarkably flexible and resilient. A couple of weeks ago I shared our thoughts in verse about economics considering COVID-19 and the “Oil Price War.” You also got a glimpse of my love for Mexican food. As we have watched the story unfold, we have revised our assumptions. The discipline of economics often feels like a luxury when it is growing and healthy, but we can’t forget the close relationship the discipline has with public welfare and social justice. I believe our response at local levels has caused significant economic damage (threatening small businesses and putting the vulnerable out of work and at risk), and will fail to protect our communities from COVID-19. WE MUST FOLLOW CDC GUIDANCE, but in fear, we have not. The future is in our hands.

You can download our in-depth study of what has been going on. The data shows a very different reality from the rumors that are circulating. If you know anyone in local or state government, please consider passing the study along to them.

As far as the Economy is concerned, The S&P 500 has priced in somewhere around twice as much economic castastrophe as seems likely to occur here. Furthermore, I have consistently been amazed by the fortitude and adaptation American businesses have shown in times of crisis. We will see this even more this year. We care about our employees, their families, and the people in our communities. We are likely at the bottom and will begin to recover soon.

WHAT YOU CAN DO: Small Businesses built our great nation. Even the largest businesses were once a kitchen table conversation. Our small businesses have carried us through “the best of times, and the worst of times.” We will continue to do so if we band together and refuse to give up. If you own a business, you’re our lifeline. You are our strength. Stay strong, and be the courageous entrepreneur God created you to be. Let’s carry our community through this. Never give up. Never give in.

Over the last couple of weeks, we’ve watched Coronavirus stir panic across the United States. This past weekend, OPEC met to negotiate oil pricing for participating countries. When Russia wouldn’t agree to reduce production, Saudi Arabia slashed their prices in retribution (this isn’t atypical OPEC behavior). The American people saw this as even more reason to panic and the stock market continued to drop.

As a professional investment manager and financial planner, I want to tell you a few things I absolutely love about the situation in which we find ourselves this morning.

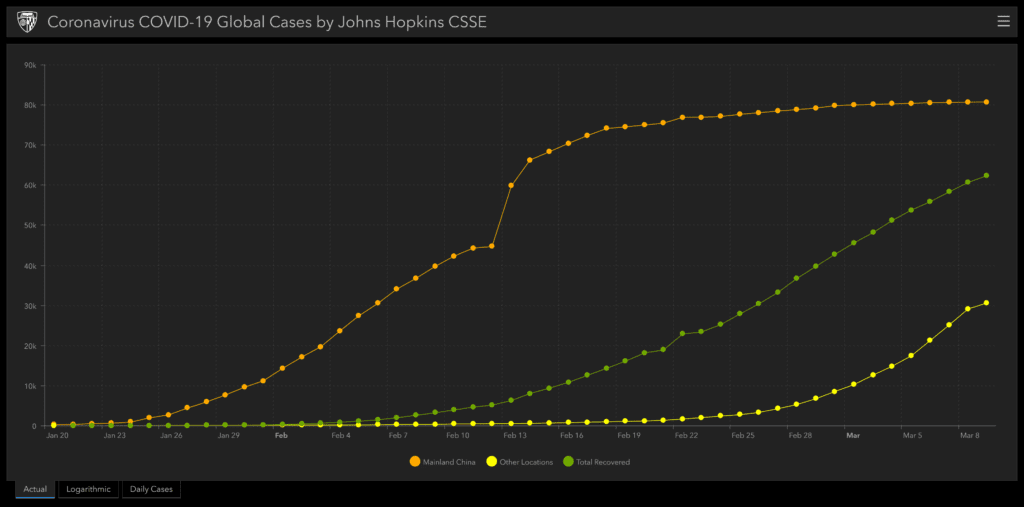

I wrote about the economic implications of CV last week… for those who missed the article, they are extremely minimal. As of this morning the spread of the virus through mainland China has slowed to a near halt and, while the virus is slowly making its way around the globe, the number of recoveries (62.4k) are massively outpacing the number of new cases (30.6k). The end result, the CV outbreak is subsiding. Sure, we’ll have a quarter or two of earnings reductions for a few companies, but we should play catch up throughout the remainder of the year.

| Q1 | Q2 | Q3 | Q4 | 2020 |

| 2.1% | 0.25% | 3.0% | 3.8% | 2.3% |

Projecting the year’s economic growth (by GDP Growth) with coronavirus we will still have GDP growth for the year of about 2.3%. While this is lower than I would hope to see, it is still growing at a reasonable pace.

What Coronavirus did accomplish for our financial system (the part I’m excited about), was create an opportunity to purchase stable sources of income at discounted prices and to strategically generate tax savings. Of course, this only works if you’re making business-minded investments (for stock traders and index fund investors, the recent volatility just hurts).

I find it fascinating that OPEC decisions like this one often lead to short-term declines in the stock market. The S&P 500, essentially an average for the 500 largest US companies that are traded on the stock exchanges, dropped in price substantially. What’s fascinating, is that the companies the average represents actually received a boost to their financials.

If I owned a taco truck

and parked it down the street,

I’d spend money on beans and beef

and pork and lots of things to eat.

If costs are high, when people buy

themselves a tasty treat,

I’d find that I have less at times

to keep for me and mine.

But when beans go on sale…

I have plenty room for profits to avail

and money to put food on my own table.

If I owned a taco truck

and could drive it down the street

I’d need more supply to feed new customers of mine

and another truck to park on their street.

So I’m no Robert Frost… But I can tell you that if I owned a taco truck, it might cost $2.00 to make my lunch special that I sell for $4.50. At the end of the day, I get to keep $2.50 of profit to support my family. IF beans and meat and cheese go down in price and I can make my lunch special for $1.50, I now have $3.00 in profit. That’s 50¢/taco that I can use however I want. I can pay down debt, pay for my kid’s education, buy a boat, or I can use it to grow my business. This results in more profit for me over time.

Lower oil prices are like discounted beans. Every business has energy costs, so lower oil (or other energy) prices mean more profits. If my taco truck makes more money, its value goes up proportionally. This is true for our stock market. The sudden drop in oil prices actually increase the value of every business in America that is not dependent on the sale of oil for their profit.

The “markets,” however, have never been rational. Instead of looking at a business’ value, people are selling out in mindless panic. SO there are bargains to be had in which you can buy the same dividend cashflows for less than you could a few weeks ago, and if a company’s profit is resilient, then their dividend payouts should be as well.

As I contemplate our situation, I recall a figure from my research a few years ago when oil prices declined: a $0.01 drop in gas price puts around $1 BILLION back into the pockets of the American Consumer. I can’t confirm this number is precise for today, but it gives you an idea of how much we stand to gain from cheap energy. EVEN MORE IMPORTANTLY, the United States became a net-exporter of oil to OPEC nations back in 2015, and we have, in each of the past 5 months, sold more oil to them than they have to us. Because the U.S. is energy independent, we have the freedom to choose how we are affected by a small, focused trade scuffle between Saudi Arabia and Russia.

The recent decline in oil price is good for our portfolios, and the unnecessary panic can help give us a nice discount.

There are many more reasons to believe that the economy is going to continue to accelerate. We are experiencing the dawn of a new age in manufacturing, data processing, machine learning, data storage, communication (5G), Genetic-based treatments for disease. It’s all coming together at the right time, and the technological revolution, which was in its infancy when we all purchased our first iPhone, is now entering adolescence and we will soon feel its impact more than ever.

| I remember when... | Now... |

| I looked up phone numbers from a book | I use voice control and the internet |

| We typed commands into a computer that took up the whole desk. | I don’t even have to type |

| We had to unplug the fax machine to connect to the internet… | I’m never disconnected and can download at 2 Gbps/second (soon to be 100) on my phone. |

| We managed & stored paper files | AI manages our storage & document security and we can access them around the globe. |

| When work was location based | we work from wherever it is most efficient. |

| I remember learning about the assembly line | Kids are learning to print parts and make robots in school |

| We watched worn out Video-Cassettes we rented from blockbuster. | “What’s Blockbuster?” You can watch anything anywhere as long as you have your phone… in HD. |

Technology has developed to the point that we have complete mobile systems that can produce with extreme efficiency and automation. They reduce costs while increasing output, customization to consumer, and flexibility of service/product delivery. Now that these systems exist, they are beginning to integrate seamlessly with one another. 3 years ago, remote employees were a viable option at select positions in the service sector, particularly for tech-savvy businesses. Now as all of these technologies mature into their adolescence, we are starting to see comprehensive solutions that make normal businesses location agnostic.

The growth we’ve seen in the last ten years is only the beginning. Sure, there will be ups and downs in the market, and we will certainly experience some growing pains. We’re at beginning of one of the greatest opportunities investors will have in our lifetimes.

Be patient with the markets, and take advantage of good opportunities. This is part of how we create a future… together.

Coronavirus has dominated headlines for most of the year so far, and it’s become the most frequently asked question we’ve received from clients in regard to the security of their portfolios. For most of the year, the markets mostly ignored CV and have been growing rapidly because the investing public finally accepted that recent economic strength was much more than an illusion. Over the past several days, however, the S&P 500 has declined about 7.8%. I expect that it will decline tomorrow again by about 3% and settle in the range of $3025 - $3040 (which is significantly undervalue by several valuation methods other than over-used PE ratio). I believe we’ll sit there for a week or two and then the markets will begin to recover. In this article, I’ll attempt to highlight a few points about the Coronavirus and its impact on the economy and address a few ways in which we’ve set our client portfolios up to be insulated from the impacts of the virus. I’ll also provide links to a few good outside resources.

First, it’s important to remember that if you’re a client of ours, your portfolio is NOT the S&P 500 and, regardless of the specific investments you have, we have designed your account to lose less than the market in moments like this one. A quick napkin-scratch calculation at the close of the market today showed that most accounts are presently down about 3.5%.[1] That’s a lot less than what you’re hearing about in the headlines. A “market index,” like the S&P 500 is just a form of average, so while it is blown by the wind, our portfolios have a specific focus on eliminating specific risks as much as is possible. One of the specific risks we had prepared for before the CV headlines, was trade risk with China as a result of tariffs. That means that, on an investment-by-investment basis, we evaluated the companies our clients own to make sure they would be resilient in a trade slowdown with China. Because we were prepared and designed the portfolios with stability and dividends top-of-mind, the portfolios have the ability to grow with the markets and have the potential to mitigate the types of losses we are seeing in today’s news.

Coronavirus infected humans, most famously in China, quite recently. Strangely enough, other forms of CV are very common, for example most housecats have a form of CV that doesn’t affect humans. The outbreak has affected a significant number of people and has been fatal for about 2% of those who have had the virus, though that number may be decreasing to 1% of those infected outside of China. Early on, the symptoms resemble those of the Flu, but become more severe as the virus progresses. The biggest challenge with CV, is that treatment and vaccination has not had time to develop. It has also been difficult to diagnose when specialized kits aren’t available to test.

While CV has been a tragedy, it has had a much smaller impact globally that the Flu has in the US alone, and immunologists and drug researchers are making significant headway in treating the illness. It is a relatively safe assumption that we will have ways to contain this virus and hopefully treat it effectively in the very near future.

Here is a link to a video on the virus from the World Health Organization: https://www.who.int/emergencies/diseases/novel-coronavirus-2019

Assuming that the disease continues on the path it has been on, not really. The Chinese government has been working to control the spread of CV and it has impacted production. While this could lead to a short-term slowing of imported goods from China, it won’t bring them to a complete halt. The aggressive response in China will ultimately yield a better long-term result than a hands-off “come to work sick” approach. Even if we do have a more rapid slow-down in China, the effects on the US economy will be minimal as net imports for China represent less than 1% of GDP. The virus will have significant impact on specific companies whose products are dependent on Chinese manufacturers who face temporary shut-downs. Even these effects will be short term.

Here is an article from Brian Wesbury, who I believe to be one of the most reliable economists I follow: https://www.ftportfolios.com/blogs/EconBlog/2020/2/25/time-to-fear-the-coronavirus

In summary, even though coronavirus is making a lot of noise in the headlines and the market indices are down as a result, but we don’t see any reason to be concerned about your CoCreate Financial Portfolio or the US Economy in general.

[1] Disclosures: Note that this performance is not the performance of a specific investment, portfolio, or account, but is instead the rate of change for all firm assets. This may or may not accurately reflect the performance of your portfolio. Furthermore, past performance does not guarantee future results. While CoCreate Financial portfolios are designed to mitigate risks, they may not reduce losses in every imaginable circumstance.

When I sit down with people who are preparing for retirement, one of the most significant topics we end up wading through is their potential healthcare cost. Many have significant concerns that they will bankrupt themselves paying for their medical expenses. Even curriculum required by groups like the Certified Financial Planner Board of Standards™ have been designed to prepare us for a world in which healthcare costs could be the largest expense in retirement.

Despite the above average inflation we’ve seen affect healthcare costs and the illustrations pre-programmed into your advisor’s financial planning software, you may find that visiting your doctor is more affordable than we like to think. Let’s take a look at some actual numbers.

In 2018, the Employee Benefits Research Association published a study exploring the out-of-pocket healthcare expenses for retirees (click here to access the study). The study uses actual data reported by participants, all of whom were over 70. Interestingly, most of the conclusions we’ve drawn has used a substantial amount of hypothetical modeling as opposed to real world data.

The results are actually quite shocking. The data results essentially make a bell-curve in terms of cost. Most people spend a relatively small amount on healthcare. From age 70 until death (post age 95), the median out-of-pocket cost was a mere $27,000. That’s only about $1,000 PER YEAR! What’s more, half of the population spends less than that.

This becomes challenging because half the population spends more than $27,000. If you’re in the top 10% of people with expensive medical care, you’ll spend more than $96,000 from age 70 until you pass away sometime after your 95th birthday. Based on these numbers, healthcare probably won’t be the challenge we anticipated since 89% of us spend less than $320/month on these expenses.

The study showed that for those who are the most expensive (the top 10%) nursing care can add more than $175,000 over the course of your lifetime. While women proved to be about 28% more than men, and were much more likely to enter into nursing care, most people spent very little or no money on these services. A surprising 54% of those who passed away after age 95 never used nursing care at all.

As with most statistical studies, we need to filter out some of the noise so that we can make practical sense of these numbers. Fortunately, the EBRA did some of the work for us. When you adjust for skewness in the data-set and accounted for the participants receiving Medicaid for their assisted living costs. The average person spends about $2,000 per year on healthcare (including nursing care). If you’re in that top 10%, you’ll be spending $11,000 or more each year.Financial planning for healthcare costs should be a “prepare for the worst, but plan on the average” type of scenario. Your financial plan should prepare you for the higher costs you could encounter by maintaining flexibility in both objective and quantity of capital, but shouldn’t excessively constrain you from pursuing your passion in life. If you’re preparing for retirement, reach out to Co|Create Financial. Let’s begin creating a future together today!

Major market indices (S&P 500, Dow Jones Industrial Index, et al) have declined today, and have done so in a way that will make headlines. What do we really need to know? How should we react?

The chart at the top of the page illustrates the price movements of the S&P 500 over the last 12 months. Most people are referencing this index when they are talking about "The Market." It's actually a geometric average of the 500 largest publicly traded, American companies weighted by the total size. This means that the biggest companies make up most of the S&P 500 (As of September 30, Microsoft, Apple & Amazon were just over 11% of the index). Given these weightings, we know that most of "The Market" returns come from just a few companies. The S&P 500 is really more of a focused portfolio than it is a representation of the stock market.

None the less, the headlines, and an overwhelming amount of public opinion stems from it's movement, so we would be remiss to ignore it entirely. The first headline you'll hear about will probably be looking what the chart is doing. Gleaning information from the charts is a discipline called "technical Analysis." It's focus is to look at patterns of buying and selling behavior to predict upcoming price movements. Technical analysis isn't particularly useful except for short-term speculation, but many people think it is the only way to invest. While we should rarely make investment decisions based on technical analysis, knowing how it works can give us some short-term insight.

In the chart, you'll see that the S&P 500 has dropped below the Orange line (the moving average of the last 50 days), and also a flat red line. According to Technical Analysis, this was a support level, and the act of dropping below it means that the market should be looking to find the next level of support. The pink line is the moving average of the last 200 days. It's a significant point of support. The red lines that sit close to it provide some reinforcement too. "The market" is almost at that point, and we can expect (according to technical analysis) people to stop selling and start buying again.

In good times and in turbulent ones, portfolio construction is important. Different risks impact different businesses differently, so investment in each of those companies needs to be made on a one-on-one basis. Concepts such as passive index investing have worked in the past decade in which almost all of the largest companies have seen steady or rapid growth in share price, but in a more turbulent environment, it can actually amplify declines in a portfolio. We need to go back to the foundations of our investment theory and consider each investment as an individual part of the whole and also look deeper than that mathematical shortcuts we begun to rely on (i.e. alpha, beta, CAPM) and evaluate our diversification on that same basis.

As I write this part, I'm realizing that I need to write an article translating that into plain English. I'll do that soon. What's important, is that your advisor is carefully constructing your portfolio so that your exposure to risk is as minimal as possible rather than exposing you to every risk knowing only some of them will hurt you.

If you're a current client of mine, your portfolio is already designed like this. It's created for situations like we're seeing today. If you're not a client yet, book an appointment on my website or give me a call.

More than anything, this is just a frustrating headline in terms of the stock markets. Whether or not Trump should be impeached is a question to be handled in a different forum, and is really quite distinct from our economic conditions.

Remember the Clinton Era? I remember learning about impeachment. It isn't removal from office. It's really just a black mark on the president's record. Sure, congress could decide to pursue a removal afterward, but that's a very unlikely scenario, largely due to the time left on Trump's term.

If Trump is impeached, he still has all of the same powers of office and he still has similar challenges in uniting Washington D.C. (and the country) behind him. The largest impact will be on the next election, which is the reason Democrats are pursuing impeachment with such vigor. That isn't to slight those on the left; if we're really honest with ourselves, election is what drives both sides in Washington.

The President is captaining our trade negotiations and has some impact on fiscal policy and legislation, but he isn't a primary driver of the US economy. Aside from massive actions, like engaging our troops in war (which requires congress after 90 days, by the way), the President is more of an economic cheerleader — a figurehead for the rest of the system. Impeachment of Trump has a net effect on the economy of very little, but it makes for a very loud headline.

I've been working to address this issue at length for a long time. The issue is really short and sweet. We've been in an economic cold war with China since before the end of the Cold War. China made some very aggressive moves during President Obama's administration. As an example, Consider their One Road One Belt initiative that was designed to open trade for China across Eurasia. The program, financed by China, is poised to create insurmountable indebtedness for these new trade partners. China's program is about more than opening trade routes. It gives them the economic leverage they need to command trade supremacy over half the globe.

For the Unites States, our risks in a trade conflict with China remain small. If we stop buying steel from China, or if it becomes overpriced due to tariffs, Another country will be excited to fill the gap. That country's economy will grow, and we can hope their political ties to the U.S. will do the same. The short term effect: a small slowing of GDP growth for the long term benefits of increased global economic and political stability. There are a number of ways we can misstep, but at this point, we should be losing any sleep.

Nestled quietly on page 5 of whatever newspaper you read, you'll read about the economic data released for September. You'll read about slow-downs in share buy-backs, and some other miscellaneous data-points. These are the most important things we should be watching to see if the continues to slow down.

This morning, the Federal Reserve stated their confidence in the US economy's strength. Frankly, I agree with the sentiment, and believe we can look at history to see that one or two months of lackluster economic data doesn't indicate we will begin a recession. It's certainly true that every recession starts with declining economic data (it's required by the definition of recession), but there are many months in which these numbers are less than ideal in the midst of robust economic growth. This morning, Brian Wesbury, Chief Economist of First Trust Advisors, wrote a fantastic article looking at the ISM Manufacturing data making this point [Read it].

The conversation about share buybacks could get a bit of attention as many will say that the companies themselves don't believe in their own value. I see it differently for now. In order to adapt to changing trade situations, large companies need their cash, and shouldn't be willing to part with it in exchange for company stock until some of the trade tensions play out. Additionally, companies have engaged in record-setting buybacks and mergers for a number of years now, using capital they set on the sidelines during and after the Great Recession. To me, this feels more like a return to normal than the beginning of crisis.

Like going to the doctor for your regular check-ups, it's important to keep your finger on the pulse of your financial plan. Usually this happens in conversations with your Financial Advisor, but occasionally you'll want to do a thorough review.

Refinancing your home or purchasing a new piece of property is the perfect time for an in-depth financial consultation.

July is the season when economists and investment advisors reflect upon the first half of the year and give ink to their thoughts about the year to come. These are some of my mid-year musings, which will guide portfolios, investment decisions, and conversations over the coming months.

Overall, it’s been a year in which the economy experienced moderately good performance, despite a few challenges stemming from Washington D.C. and from our social media accounts. This is truly a testament to the strength of the U.S. economy at this point in time. Find out what you need to know about the past six months and what the rest of the year has in store.

Understanding your mutual fund costs begins with understanding the underlying mechanics of your investment. In almost all circumstances, you own individual companies, loans (bonds) made to individuals, business and governments, and sometimes a few alternative securities types such as an option or commodity. These investments compensate you for your ownership (indirectly through the fund) and can increase or decrease in value over time. For discussion’s sake, let’s assume these investments increased 10% over the last year.

When you own a mutual fund, you don’t own these investments directly. Instead, you indirectly share in the ownership of these investments, mutually, with many other people. Your mutual fund manager decides when to buy and sell these investments and is responsible for ensuring there is enough liquidity available to provide cash to people who need to sell shares. The Fund also reports its taxable gains and losses to you as the fund’s owner (a potential impact of about 1.1% according to Morningstar[1]). Let’s take a deeper look.

Let’s say you own the fictitious Basic Blue-Chip Fund. The fund’s manager is responsible for the selection of the investments you own vicariously through the fund. The manager and staff need to feed their families, so they charge an annual fee to each person who owns the fund: the expense ratio. The expense ratio is an annual fee disclosed clearly in the prospectus and appears on most materials presenting the fund. Several academic studies have been published in recent years finding the average expense ratio is between 0.90% and 1.19%.[2] Let’s call it an even 1% for ease of conversation. The fund company also clearly discloses distribution fees, called 12b-1 fees, which generally range between 0.00% and 0.75%. If you’re paying a 0% 12b-1 fee, most of the time, you make up for the discounted cost in another method, such as a fee-based account, a retirement plan advisory fee, or in transaction fees if you DIY.

The manager must now run the business of investing the money you entrusted to the fund, the costs of which don’t show up in your expense ratio. The management team calls upon their colleagues around the industry for help. They ask the financial firm “Bond Co.” to research the government bonds they should use in the fund. In return, they pay Bond Co. a commission when they purchase the bonds. In many cases, they also ask Bond Co. to house the bonds for them at their firm using what is called an omnibus account, a service for which they will pay an additional fee. These are disclosed (generally in dollar values) in a document called the Statement of Additional Information which is available on request from the fund. Funds also experience a phenomenon called “price impact” when they engage in these transactions (which is a little more technical than we want to get in this article). These costs average approximately 1.44%.[3]

SO if you have the basket of investments that earned 10%, and you own them in the form of a mutual fund,

The assets earn 10% in the fund

The Fund pays its management team about 1%

The fund pays its distributors .75%

The Fund experiences 1.44% of internal costs relating to the acquisition and

disposition of the assets

So in total, you actually experience a cost of 3.19%. You don’t see this on a bill, but instead it shows up as a reduction in the Mutual Fund’s return so you would see a return on your statement of 6.81% instead of the original 10%.

We don’t believe that these fees and costs are necessarily a

bad thing; In fact, recent data published by George Mason University suggests

that, on average, a 0.02% increase in expense ratio provides an average

increase in performance of 0.13%.[4] But we do think it’s important to understand

your fee structure so you can make the most informed decisions possible.

[1] http://news.morningstar.com/articlenet/article.aspx?id=373782. More recent studies by Morningstar show that fees have declined on average since the 2011 study, showing an arithmetic average of 1.10%. The decline of geometric average is primarily attributed to the increased popularity of passive mutual funds which generally have expense ratios of about 20bps.

[2] Cf. Kinnel, Russel. "Mutual Fund Expense Ratios See Biggest Spike Since 2000." 19 April 2010. Morningstar Advisor. 31 January 2011.; Edelen, Rodger, Evans, Richard, Kadelec, Gregory. “Shedding Light on “Invisible” Costs: Trading Costs and Mutual Fund Performance” Financial Analysts Journal Vol 69 No. 1. ©2013.

[3] Edelen, Rodger, Evans, Richard, Kadelec, Gregory. “Shedding Light on “Invisible” Costs: Trading Costs and Mutual Fund Performance” Financial Analysts Journal Vol 69 No. 1. ©2013.

[4] Horan, Stephen M and D. Bruce Johnsen. "Does Soft Dollar Brokerage Benefit Portfolio Investors: Agency Problem or Solution?" George Mason University School of Law (2004): 4

I believe every one of us is searching for significance and satisfaction in life. My work as a financial advisor has put me in contact with a lot of different people at differing levels of wealth and poverty, and I’ve become convinced of a simple truth:

Success, satisfaction and significance aren’t born out of your account balance or income, but are achieved by the way you engage life in the present

In the first part of this series, we discussed talked conceptually about engaging life. This article is about practical ways to begin more effectively engaging each moment. I would encourage you to choose one or two habits to start practicing and then come back when you begin to see how these are changing your life.

People are really important. Though the statement should be somewhat ubiquitous, we live in a lightning-fast, “connected,” culture that demands immediate responsiveness and determines personal worth based upon output. To preserve our position in society, the pressure is on each of us to do more, stay in our lanes, and give into the constant barrage of push-notifications, texts, emails, and tweets, all-the-while staying in our own lane just to keep up with social and professional expectations.

While we can’t completely eschew cultural or professional standards, we can choose to embrace our inner-contrarian and foster relationships with others instead of our Facebook addictions (I realize the irony of posting this article on Facebook… and yes, I would love for you to share it). Here are three easy things you can put into practice here.

When you do these things, you’re fostering real relationship instead of fostering your technology and productivity addictions. You’ll also find that everyone around you will begin to see that they matter to you. Your relationships will deepen, your impact will grow, and you’ll become more satisfied in the way you’re engaging life.

It’s not always easy to see everything we’re called to do or be, but it’s usually easy to identify things that are counterproductive. If you identify something that gets in the way of engaging life the way you should be, make a change. Write down the activity or distraction you would like to eliminate from your life, create a plan for how you are going to avoid the old habit and replace it with something better. If you’re really ambitious, try doing making this a monthly practice.

You’ll need to take some time to be mindful in order to accomplish this. I like to take regular pauses during my day just 2 or 3 minutes every couple of hours to ponder. Others like to journal, or take ten or fifteen minutes to visualize their day and then time to reflect in the evening. Try some different things. You might want to set a reminder on your phone to remind you to be introspective.

I believe gratitude begins to grow as we begin to serve others. That’s another post for another day, but if you really want to grow your gratitude, there are three key things you need to do giving and serving being the most important. VOLUNTEER and DONATE!

There’s a third habit that is simply learning to express your gratitude over and above complaining. If you’re anything like me, you’ve probably found that complaining is the easiest form of communication. It’s taken me years of practicing gratitude only to find that I have a lot more to do. To be successful at being a grateful person, you need to respond to frustration with thanks. When you catch yourself wanting to grip about something ask yourself, “how might I be blessed and not realize it?” Enlist your spouse and your friends to help with this by encouraging them to respond to you when you complain with questions that will help you search for blessings in the midst of your frustration.