In light of recent tariff and geopolitical events, we’ve decided to begin publishing a short piece every Monday to discuss what we think we will be doing to navigate the recent crash and eventual recovery. We have a history of being both supportive and critical of any politician or perspective, so the commentary below not intended to be a comprehensive statement or endorsement any politician, candidate or platform. Please be aware that we will need to avoid publishing certain details for compliance purposes but are happy to discuss any of the comments with you in the specific context of your account.

We manage the account on your behalf. That means that we are making adjustments, increasing/decreasing cash and cash investments, making portfolio decisions and carrying the stress of market turmoil on your behalf. We love to hear from you about your needs (and feedback), but please don’t feel the burden of managing your portfolio. Obviously, this note is for clients of CoCreate; if you’re not a client of our firm, consider reaching out to see if we can help you enhance the way your accounts are performing in this environment.

Also, publishing about the week ahead is a difficult task and some or all of the things we say may change or play out completely differently than we expect. Regardless of short-term market fluctuations, we will remain disciplined and committed to following our time-tested approach.

F.A.Q. (we’ll tackle one each week)

Are there tariffs or are they on pause?

Yes and No. On April 8, the President paused the “reciprocal” tariffs. These “reciprocal” tariffs weren’t related to tariffs imposed upon the U.S., but were based on the difference between imports and exports with each country.

The 10% broad-based tariff is in place. This is effectively a back-door sales tax on U.S. consumers (about $1300/year for every household according to the Tax Foundation). I’ve heard a number of news broadcasters express wrong information about whether or not the tariffs are in place. This is part of the Trump negotiating strategy, to create enough chaos and confusion that it is difficult for those he is negotiating with to fully understand what is happening. In is role as President, this has an affect upon the public’s understanding as well.

A Quick Infographic about U.S. Manufacturing

First Trust Economics: No America Didn't Stop Making Things

A few notes about last week’s events:

For anyone casually watching the stock market, the past two weeks have actually looked relatively good. The last eight days showed positive returns for the S&P 500, and if there weren’t significant outstanding issues, it would look like the markets might rebound. We’ve been watching the $5800 price point on the S&P 500 as a potential turning point. All the charts and graph wizardry that investors are known for has no reason to work, but sometimes it does. Right now, we’re sitting at a place where the market could go either direction. Andrew Adams from Saut Strategy put it this way:

Yet at the same time, the stock market has so far done everything that it's been asked to do since marking its lows in early April. Several resistance levels have been overcome, breadth has recovered to neutral from its washed-out lows, and the S&P 500 has now traded well into that 5500-5800 region that always felt like a logical target zone. Buying has indeed been strong. I wrote last Wednesday that breadth had been good but not as outstanding as it appeared, yet Friday's session was almost a 90% upside day and helped to improve those total breadth readings. The move off the low is certainly very reminiscent of others we've witnessed over the past few years that began larger rallies. It wouldn't exactly be shocking to see the market shake off the recent weakness, especially if all these trade deals they are supposedly working on start to get announced soon to keep waving a carrot in front of buyers.

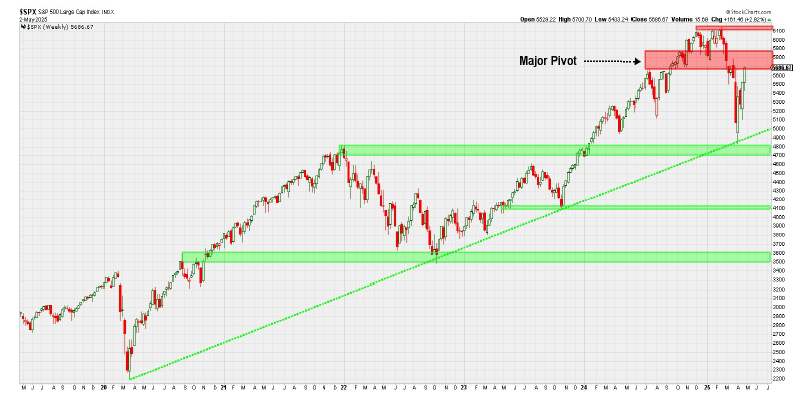

However, it can also be argued that the real test for the stock market is only now beginning. The S&P just entered on Friday what has been a major "pivot" point over the past 10 or so months. As the chart below shows, this region has been the site of both support and resistance in that time and is a primary reason why I've used ~5800 as a key area to watch. It's also why I've said that if stocks are going to roll back over, it is likely to happen around or below this zone where heavier resistance is found. Clearing that region will be a big win for the bull case and increase the odds further that a major bottom has been made.

Right now, we’re sitting at a point where the market could go either direction… except that there are significant topics that still need to play out and the positive growth ignored what should have been headwinds. First, many corporations announced their first quarter results. Some of them adjusted their forward looking projections to account for the potential impact of tariffs, some chose more of a wait-and-see approach remaining optimistic. It was interesting to watch, and while I’ve not measured any data to confirm this, it certainly felt like those companies who chose to be realistic about the threat had share-price declines and those who did not had price increases. If that’s the case, it should bode well for us this month to rebalance our holdings because that is the opposite of what I would want to see.

Of course, the first quarter’s results don’t include the tariffs, and included quite a bit of noise from the business trying to buy ahead of the tariffs. This boosted earnings significantly. The Second Quarter results, will begin to show the damage. For companies who are riding high on Q1 optimism, Q2 will be a big adjustment.

While the future of tariffs is still very much unknown, we’ve been working hard to prepare portfolios in as many ways as possible. We are looking at the probability and potential return versus risk of loss and we’ve even implemented Artificial Intelligence (AI) tools to mine for information that could specifically impact each investment’s sensitivity to tariffs (this would include company filings and exposure to various countries). This is our first foray into using AI for anything more serious than the photo for the weekly playbook series.

Q1 Real GDP came in at -0.3% (annualized), with business and consumer spending heavily enough (presumably to purchase ahead of tariffs) to increase Core Real GDP at 3%, which is the same as Q1 last year. Real GDP is regular GDP adjusted for inflation, Core Real GDP is consumer spending, business fixed investment, and home building, and excludes the most volatile categories like government purchases, inventories, and international trade. While it is difficult to estimate accurately, tariff frontrunning may have boosted Q1 GDP by as much as 2%. This won’t be part of Q2 GDP. The technical definition of a recession is complex, but most people use two consecutive quarters of contracting GDP as shorthand. I believe we have actually been in a recession since mid-2024 when people were out of COVID-19 money and began to really feel the impact of inflation. This means that we’re now seeing that reflected in GDP (among all the other things).

It’s important to remember that looking back on Q1 or the past week is just that, looking back. In some ways it is helpful to understand the investment and business landscape, but the role of an investor is to look forward with optimism for the long-term future.

While we look forward to the long-term future, I’ll once again quote Andrew Adams:

As impressive as the rally has been, it is also still within the limits of historical bear market rallies. This inconvenient truth is why simply assuming it's straight up from here remains a risky proposition. In 2000-2003, for example, the S&P 500 lost 50% overall but there were six separate rallies of 10% or more during that time, including three of more than 20%. In 2007-2009, the S&P fell 57% but there were four rallies of 10% or more, including two greater than 20% (this is yet another reason why I think it's silly to use 20% moves to mark bull and bear markets, but I digress). So even though this rally from the lows has been strong, it wouldn't be historically atypical for it to still roll back over.

While I genuinely hope the market losses and volatility have turned around, there isn’t quite enough evidence for me to fully commit to the paradigm at this point. We will still need to focus on collecting rising dividends from strong companies who are as insulated as possible from trade risks and balance the risks with appropriate levels of cash.

On to this week’s playbook

This week we will continue to watch for trade negotiations. I have yet to hear any actionable news other than that of a rare earth minerals deal with Ukraine. Canada’s new prime minister will meet with Trump on Tuesday and has expressed a willingness to be both demanding and patient.

The Federal Reserve will meet this week. We are not expecting a reduction in interest rates, and I believe this is good. On the one hand, a rate cut would stimulate capital investment a little and soften the blow of tariff price increases, It would simultaneously have the opposite affect because increased money in the system increases inflation. Managing the stock market is not part of the Fed’s duties, so they should opt to protect the purchasing power of the dollar. Powell’s position also puts pressure on the Administration to bring its tariff negotiations to a head quickly so that it is far in the past when we get to the mid-term elections.

On the policy front, we are continuing to watch for a tax bill and additional deregulation. Musk reported that DOGE eliminated at least $160 billion in spending, and though he is stepping down, the administration will continue to hold this as a priority. Aside from the spending itself, excessive and nonsense regulation has been the biggest headwind to economic growth for quite some time. The combination of the reversal of the Chevron Doctrine last year (The Chevron Doctrine established that Federal agencies could essentially replace Congress in rule-making) and efforts to reduce burdensome regulations is the only thing that has the potential to offset tariff risks.

Republicans are still working out what may or may not be in a tax bill, and there are quite a few different opinions. Here are a few key topics in debate:

- SALT Deduction – (SALT=State and Local Income Tax) currently you can deduct up to $10,000 of SALT from your Federal return. The SALT Deduction doesn’t make sense because is disadvantageous for people in lower tax states when the limit is high, and bad for people in higher tax states when it is low. It is also disadvantageous for people who are married because the deduction is per household. Some legislators are asking the cap to be lifted to $100k or even $200k. This would benefit voters for republican representatives in states like New York and California (giving them larger federal deductions), while shifting a larger relative portion of the federal tax burden to other (mostly red) states. The outcome here will mostly likely depend on political strategy for the next election.

- Social Security, Medicaid, Entitlement reform. While the Whitehouse has insisted on a tax bill without any benefit cuts, the House is weighing what options they have here. Entitlements are the largest component of government spending, and it will be difficult to reduce the budget deficit without addressing these topics in some fashion.

- Extending the expiring 2017 Tax Cuts and Jobs Act (TCJA) would decrease federal tax revenue by $4.5 trillion from 2025 through 2034. Long-run GDP would be 1.1 percent higher, offsetting $710 billion, or 16 percent, of the revenue losses. Long-run GNP (a measure of American incomes) would only rise by 0.4 percent, as some of the benefits of the tax cuts and larger economy go to foreigners in the form of higher interest payments on the debt. (copied from the tax foundation)

- In addition to extending the TCJA, Trump would like to eliminate taxes on tips, overtime pay, and Social Security.

The issues in discussion will demand compromise because there are not enough productivity-boosting components of the bill to allow Republicans to use the budget reconciliation process and include all their tax cuts. Essentially, they won’t be able to offset the proposed tax cuts with enough future revenue to pass a bill that includes all of it with just a simple majority in the Senate. Tariffs won’t make up this lost revenue either, which was undoubtedly one of the initial hopes of the Administration. We’ll be watching to see what happens here, as the house has set a goal of getting this through by Memorial Day weekend.

Any good news, or even just clarity on any of these fronts should be a positive for financial markets and for our client accounts. Expect markets to continue to fluctuate in the meantime with a reasonable likelihood of declining more before this is finished. When it is all said and done, American businesses will continue to have competitive advantages and will prosper. We’ll continue to own what we believe are the best of them.

I hope you have found this insightful. We will continue to publish the Weekly Playbook as long as it makes sense to do it. In order to keep from spamming you, we may not always send it by email, but will certainly post it on our website at https://cocreatefinancial.com/ and in your client portal’s newsfeed. We double down on commitment to stewarding your investments and financial plans with diligence and integrity when the economy and markets are turbulent. Thank you to all of you who have trusted us to do so on your behalf.