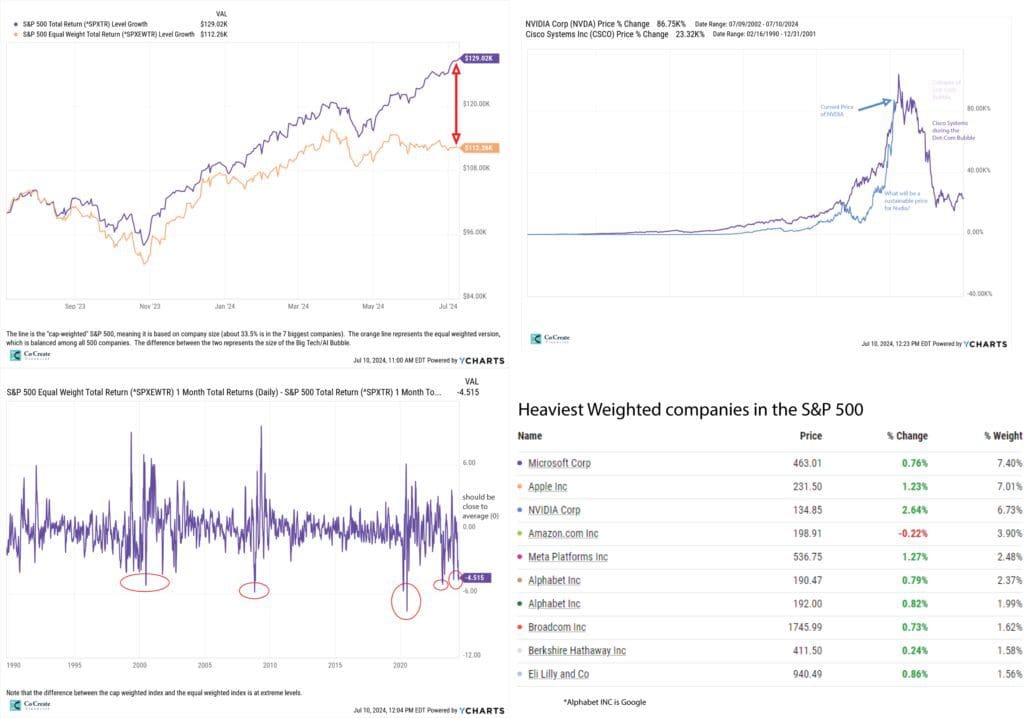

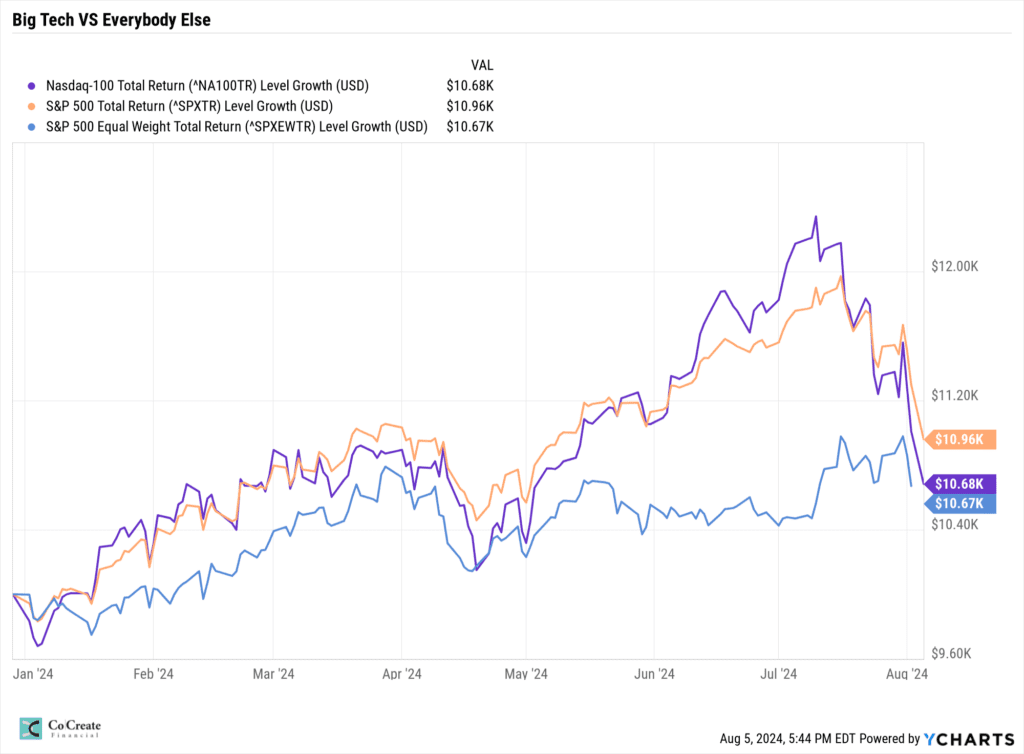

Here are two sets of charts that we feel do a great job of explaining what is happening in the stock markets over the past few weeks. The first is one that we created about a month ago that illustrates the tech bubble on July 10th. The second chart shows three different stock market averages, the Nasdaq 100 (about 60% technology), the S&P 500 (about 40% technology and heavily weighted in just a few companies), and the S&P 500 equal weight index, which gives an equal representation to each of the 500 largest companies in America. These three charts illustrate the tech bubble burst We believe the S&P 500 is a terrible representation of the overall stock market and when it is used in a portfolio as an investment (in a fund), it's actually a high-risk "momentum" investment. Because the Nasdaq 100 is even more heavily concentrated in Big Tech companies than the S&P 500 index, when we look at the two side by side it illustrates the impact the technology sector has on what most people call the stock market (the S&P 500).

People have been overly excited about the impact that publicly available AI will have on the economy and on profit margins. In short, the tech bubble is bursting, but the broad market is much healthier. The business-minded investor has a broader and longer view of the market, and resists the temptation to speculate. When you look at the S&P 500 Equal Weight, which is very closely aligned to the performance of our portfolios so far this year, you see a much different picture. For people in diversified portfolios (not an S&P 500 ETF) who are thoughtfully evaluating profit margins, business models, and dividend payouts, the story has been much more positive (blue line in second chart).

We've been skeptical of the Big Tech explosion for some time, and even made some adjustments in our client portfolios in July to account for the increased risks of the tech bubble. We believe that there will be some upside from here, but we aren't out of the woods yet. The election is coming soon and markets should be quite turbulent until then. In the mean-time, dividend-oriented businesses that fit or investment criteria are generally in a strong position and are continuing to increase dividends despite inflationary pressures and other economic challenges. These should be the strongest companies in a recovery, and have mitigated losses very well in the past weeks. We are excited to continue to collect cash from dividends to be reinvested ate better pricing.

All in all, we aren't particularly concerned for the long-term investor who is in an appropriately managed investment portfolio. It may even prove to be an exciting time with great entry-points for new cash.

Things to avoid

- Selling investments in a panic before they recover when you don't need the cash in the near future. Every investment experiences temporary losses, the key in successful portfolio management is to lose less when the markets head south. One of the ways we grade our portfolio management is to measure the downside capture. If you lose less, then you don't have to gain as much to get back so we believe this is really important. If you think about it, when $100 becomes $50, you had a 50% loss and need 100% return to recover. If you instead have $100 that becomes $75, you had a 25% loss and only need a 33% return to recover. If you can lose significantly less and gain almost as much as markets recover, then you're ahead by a long way.

- Trying to call the bottom. While I don't think it turns around tomorrow, there is an argument that it could. If we try to get out and get back in at the bottom, history shows we'll probably miss out on the recovery. If we ride it out and still own the shares of stock we owned at the top, we've not actually lost anything. It may be wise to harvest a few tax losses and reinvest in other high quality companies.

- Don't look for the winning stocks. Focus on stable cash returns from diversified sources. These are dividends from high-quality companies with long track records, interest from fixed income investments, treasuries, and money markets (we currently like a duration of 6 months to 3 years and high credit ratings)

. - Don't flee to riskier alternatives that offer the illusion of better returns or more safety. There are a number of good investment strategies out there, but there are even more that are risky and speculative. When we face difficult times in the stock market, it's easy to look for the greener grass and there are many investment companies and private investments that are ready to take advantage of that feeling. The truth is, if it is too good to be true it probably is. Also, if it's to complicated to understand the basic premise of the investment, then it probably isn't the right thing. We believe you should think carefully about your feelings and biases in these times and be talking to a qualified advisor if you're concerned. It's a great idea to reach out to us if you have questions about your portfolio, even if you're not a client. We're happy to share about what we are doing and we approach mitigating risk and generating relatively consistent returns.